Businesses holding capital amid construction constraints and insolvencies

Capacity constraints within the construction sector amid a sharp rise in insolvencies and labour cost woes are driving a slowdown in the pipeline of projects.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Businesses are less willing to invest in expanding infrastructure and other projects amid a subdued outlook for the economy coupled with constrained capacity as thousands of builders go broke.

Uncertainty around the demand for products and services means many businesses will opt to shore up their balance sheets and wait for greater certainty before investing.

Analysis from Deloitte Access Economics shows that the total value of projects in the Investment Monitor database was largely unchanged in the September quarter, at $1.12 trillion. The result was offset by several projects that completed construction or were removed from the database.

Despite not expanding in recent months, the value of the Investment Monitor database remains almost 20 per cent higher over the year. The value of planned projects (under consideration or possible) rose to a record $617bn in the latest quarter.

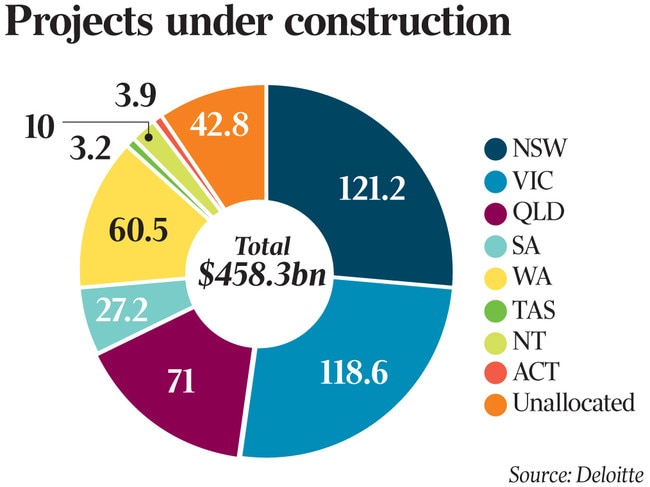

This was an increase of $107bn over the year. More than 90 per cent were new wind, solar, battery storage and hydrogen projects that will be critical to Australia’s transition to net zero. Projects under construction rose 17.5 per cent to $458.3bn, led by NSW with $121.2bn.

But constrained construction capacity limited the ability of businesses to invest. This directly affects engineering and non-residential construction, which collectively account for 40-60 per cent of total business investment each year. Deloitte Access Economics partner Stephen Smith said the weak outlook for the Australian economy was weighing on investment, compounded by higher input costs (particularly labour) and elevated interest rates.

“Constrained construction industry capacity is also limiting the ability of businesses to invest. This directly affects engineering and non-residential construction, which collectively account for between 40 and 60 per cent of total business investment each year,” Mr Smith said.

Infrastructure Australia says the country needs a further 212,000 workers to deliver the national infrastructure pipeline. Mr Smith said the shortages might get worse before they get better. He said projections of the workforce gap only accounted for known projects, so trailed off in future years.

“There are also limits on the pace at which new workers can be drawn into the industry. Despite additional funding for training places, it will take several years for these new workers to enter the industry. It is also increasingly difficult to bring qualified workers from overseas,” he said.

This comes as demands on the construction industry reach new heights. There is a record pipeline of infrastructure to be built, with the value of projects under way set to grow from $350bn in 2024 to $380bn in 2025.

Insolvencies in the sector have increased significantly. Data from the Australian Investments and Securities Commission show there were 898 insolvency appointments in the September quarter, a 14 per cent rise from the same period in 2023.

Equifax reports the number of credit-active businesses in the sector fell over the past year, with more than 15 per cent of construction businesses exiting in the year to June.

Construction entities were nearly twice as likely to have their credit quality downgraded as upgraded over the 12 months to March, with 13.2 per cent seeing a downgrade compared to 7.7 per cent receiving an upgrade.

Equifax head of product and rating services Brad Walter said the persistent challenges of a highly competitive market, high supply costs and a tight labour market have weighed heavily on profitability.

“This has been most notable for downgraded businesses, leading to a growing divide between this cohort and those with stable or upgraded ratings,” he said.

Ambitious targets have also been set for housing construction in the next five years with the Albanese government pledging to build 1.2 million homes.

Mr Smith said addressing the challenges facing the construction industry would be an important step in driving faster growth in the Australian economy.

“More investment today means a larger and more productive economy in the future. Although the near-term outlook for investment remains subdued, there are several longer-term opportunities for businesses,” he said.

“Significant investment will be required as Australia transitions toward net zero emissions. The value of electricity supply projects has increased fourfold compared to just five years earlier, while demand for critical minerals and commodities such as hydrogen is already supporting new mining and manufacturing investment.”

The share of definite project investment in NSW and Victoria has fallen from a peak of 66 per cent in mid 2020 to a low of 57 per cent in late 2024. NSW saw a decline of $6.4bn in the total value of construction investment since the June quarter.

There has been an increase in the share of definite activity in Queensland, South Australia and projects listed. This has been driven by increased investment related to the energy transition and the timing of large infrastructure projects.

Originally published as Businesses holding capital amid construction constraints and insolvencies