Bundaberg holds its breath as Greensill Capital’s troubles worsen

The Queensland sugar city of Bundaberg could be in the firing line if the Greensill financial empire, founded by one of its favourite sons, goes under.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The global headquarters of troubled financial giant Greensill Capital is on a country road just outside the Queensland city of Bundaberg surrounded by fields of sweet potatoes and cane.

The address listed as 383 Windermere Road, Qunaba, is marked by a few sheds on the edge of a vast expanse of rich-red soil.

It may be thousands of kilometres away from the gilded towers of London’s Square Mile, but this is where the billion-dollar enterprise dreamed up by farmer’s son Lex Greensill began life.

The Greensill clan, along with their interest in UK-based Greensill Capital, now run one of the biggest commercial farms in Bundaberg, employing hundreds of workers and exporting thousands of tonnes of sweet potatoes, melons and sugar cane.

But with Greensill Capital teetering on the edge of insolvency after big international lenders suspended $US10bn of investment funds, there is growing concern any collapse will be felt in the city of almost 100,000 people.

Greensill Farming Group, run by Lex’s younger brother Peter, said on Friday that the horticulture business was separate from Greensill Capital and its operations remain unaffected.

The Greensills have been farming the volcanic soil near Bundaberg since 1945 when Lex’s grandfather bought a small cane property on the slopes of The Hummock - an extinct volcano that is the source of the region’s rich agricultural soil and is the city’s only hill.

The original 27 hectare property has expanded over the years as the Greensills systematically bought up a series of nearby properties.

Their holdings now cover 3000ha across four properties in the central Queensland region where even and temperate temperatures create almost perfect growing conditions. The family also run an earthmoving and development business.

The Greensills’ joint venture business with Holt Farming, Sweet Potatoes Australia, is one of the biggest producers of the vegetable in Australia. In 2019, the family announced a big expansion of their sweet potato packing sheds.

Bundaberg Canegrowers chairman Allan Dingle said the Greensill family were well-regarded and well-established farmers in the region. “There is concern the problems with Greensill Capital will have an impact locally because they are a big corporate operation that employs a lot of people,” said Mr Dingle. “We hope there is no foreclosure.”

Greensill Farming said Friday that the farming business was entirely independent of Greensill Capital and would continue to operate normally. “The current negotiations regarding the future of Greensill Capital will have no impact on Greensill Farming’s day-to-day operations and its ability to provide quality produce to customers,” it said.

Last June and July, Lex Greensill, 45, resigned as a director of four family companies - Greensill Farming, Greensill Farms, Greensill Sugar and Greensill Sweet Potatoes. A few weeks earlier a company called Greensill Farming Group was formed with Peter Greensill and his other brother Andrew named as directors.

Lex now lives in the UK with his wife, who is a doctor. Insiders say there is concern among some Greensill Farming employees about the stability of the group, but also confidence the family can survive the current funding issues.

In the close-knit city, four hours’ drive north of Brisbane, problems are often blamed on outsiders, in this case the global banking system.

Bundaberg Mayor Jack Dempsey said Friday he had spoken to Peter Greensill and personally received assurances that the farming operations remain unaffected by the global troubles of Greensill Capital. Peter Greensill was unavailable for further comment.

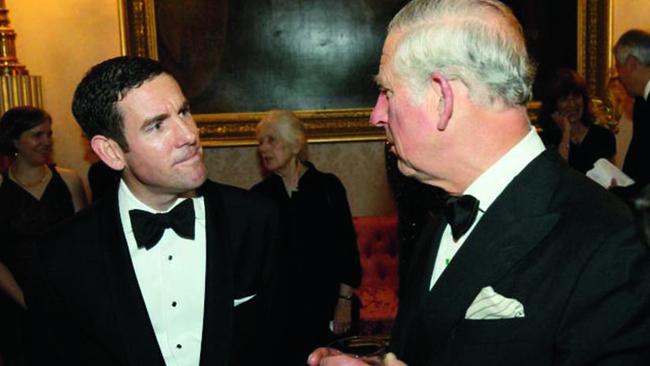

Lex Greensill, whose motivation to start Greensill Capital came from the fact his farming parents sometimes waited years to be paid for crops, is considered a local hero after rising from his hard-scrabble upbringing to in 2017 being awarded a Member of the British Empire by Prince Charles. He owns a $4.1m waterfront mansion in the nearby town of Bargara, where the Greensills are sponsors of the local golf club.

Two years ago, Lex’s proud father Lloyd received the city’s Hinkler Innovation Award on behalf of the family business. The award, named after Bundaberg’s famous pioneer aviator Bert Hinkler, recognised the family’s innovative approach to both farming and finance.

Mayor Dempsey at the time paid tribute to the fact the Greensills continued to maintain their base in Bundaberg despite the “huge international success their farming and finance ventures had enjoyed. “Having experienced first-hand how capital constraints can hold back farming enterprises, the family was determined to find a solution,” Mayor Dempsey said.

Isis Canegrowers chairman Mark Mammino said he was hopeful the Greensill’s farming business could survive even if Greensill Capital went under.

“They are pretty diversified in terms of crops,” said Mr Mammino. He said the family were well known in the region with the financial business growing out of the challenges small crop farmers used to have in getting payment.

Originally published as Bundaberg holds its breath as Greensill Capital’s troubles worsen