Brookfield and EIG consortium moves to sideline AustralianSuper with fresh Origin bid

The fresh offer - tabled just hours before the consortium’s $20bn bid was likely to be rejected - sidelines AustralianSuper and has been labelled ‘a bit of a mess’.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Brookfield and EIG Partners have submitted a revised near-$20bn offer for Origin Energy, as the duo move to undercut the influence of AustralianSuper and rescue the consortium’s signature transition investment, which was just hours away from defeat.

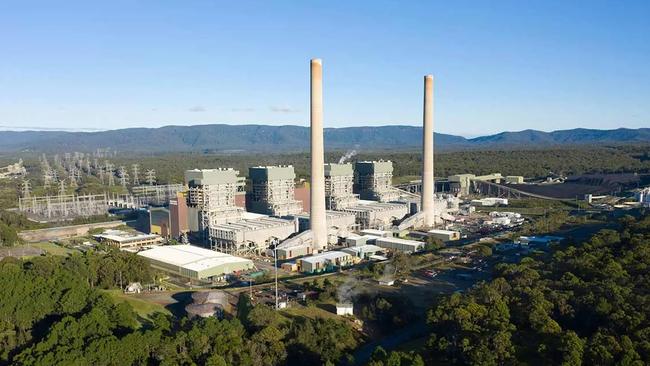

Shareholders in Origin were on Thursday set to vote on Brookfield and EIG’s $9.43 a share offer for the country’s largest electricity and gas retailer. But with AustralianSuper vowing to use its 17.5 per cent to oppose the deal, Brookfield and EIG were set to fall at the last hurdle.

In a bid to revive the bid, Brookfield and EIG late on Wednesday submitted a revised offer that will see shareholders offered $9.43 a share, but institutional investors will have the opportunity to invest with the Canadian private equity firm in the energy markets business of Origin.

If this bid is rejected by shareholders, Brookfield and EIG have proposed an alternative structure that sees shareholders offered $9.08 a share. Origin’s energy markets business and its 20 per cent stake in Octopus — a rapidly growing energy company based in the UK — would be sold to Brookfield for $12.3bn. Critically, this proposal requires support from just 50.1 per cent of Origin shareholders, undercutting the capacity of AustralianSuper to scupper the transaction.

Should EIG receive approval from more than 90 per cent of Origin’s shareholders for the so-called alternative plan then they would receive an additional 22 cents cash per share, making the offer worth $9.30 per share — though the threshold is extremely unlikely to be met.

However, in a blow to the plans, Origin chairman Scott Perkins said the company has reservations about the value, hinting the consortium will struggle to manoeuvre around AustralianSuper’s opposition.

“$9.08 against $9.43 — this isn’t a trivial difference,” Mr Perkins told reporters in Sydney.

“The only thing that motivates and drives us is to do the best thing for Origin and shareholders.”

Independent expert Grant Samuel last month said Origin was worth between $8.45 to $9.48 a share, and several shareholders had indicated it believed the $9.43 offer was too low.

Mr Perkins said Origin has yet to determine when it will make a recommendation on the revised offer. If the board determines the offer is not in the best interest of shareholders, votes will simply be collated on Brookfield’s and EIG’s existing offer of $9.43 a share without the alternative structure.

Brookfield’s attempt to re-work its $20bn takeover of Origin Energy “is a bit of a mess”, according to Morgans analyst Max Vickerson.

“This is a bit of a mess. Clearly the bidders are pulling out all the stops to try and resurrect the deal. It remains to be seen if the offer to remain invested in the Energy Markets business will satisfy Australian Super given that they have rebuffed similar approaches in the past,” Mr Vickerson told The Australian.

To push through the deal, Brookfield and EIG will look to convince Origin’s board of the merits of its bid.

Blair Thomas — chief executive of EIG — said the amended offer was driven by AustralianSuper’s outsized influence over the future of Origin.

“What it does is it liberates the majority from the control of a single minority shareholder. Right now you have 120,000 shareholders and you have one who has decided that theirs is the only voice that matters, and everyone else has to do whatever it is they want,” Mr Thomas told The Australian.

“What we’re saying is we’re going to give you an alternative, where we can liberate those shareholders from that situation.”

The thinly veiled barb at AustralianSuper will do little to temper ties between the two. Brookfield has previously accused AustralianSuper of holding Origin hostage, while environmentalists had accused the superannuation giant of being a climate wrecker.

AustralianSuper confirmed it intended to continue to oppose the transaction.

“This latest low-ball offer strengthens AustralianSuper’s view that the offer remains substantially below our estimate of Origin’s long-term value. AustralianSuper is resolute that the value and future value of Origin is better in the hands of AustralianSuper members and other shareholders than a private equity consortium planning to short-change them,” said an AustralianSuper spokesman.

The Origin board itself has identified that “the transaction appears inferior to the existing scheme” — which was scheduled on Thursday to be voted on and was “unlikely” to succeed.

While AustralianSuper will continue to influence the outcome of the vote to determine whether the $9.43 offer is accepted, the superannuation giant is at risk of losing its sway should Origin’s board recommend the alternative transaction vote.

Mr Perkins confirmed the company had held talks in the aftermath of the bid, adding the company would act solely in the interests of all shareholders.

With the recommendation of the board shaping as critical, there may yet be more twists and turns, and Brookfield and EIG could yet return with a hostile bid.

Origin shares fell nearly 1 per cent on Thursday after the vote, but outperformed the broader Australian energy market — which was rocked when the government said it would underwrite a rapid expansion in renewable energy and storage developments in a bid to accelerate the country’s transition away from coal.

The Federal Labor government said it would look to develop 32GW of renewable energy generation and storage assets by the end of the decade through a contract of difference mechanism that will implement a ceiling to the earnings of generators in exchange for the taxpayers guaranteeing a minimum return.

The expansion of the capacity investment scheme roiled the market, with AGL Energy shares falling as much as 5 per cent on Thursday before closing down 3.5 per cent.

Origin Energy chief executive Frank Calabria said the company was working through the implications of the plan, but said the absence of detail meant it could not provide clarity to its shareholders.

However, the threat to energy generators such as Origin could incentivise shareholders to accept Brookfield and EIG’s revised bid.

Federal Energy minister Chris Bowen said the scheme was needed to drive Australia’s energy transition, a reason cited by the country’s competition commission for approving Brookfield and EIG’s bid for Origin.

Brookfield has promised to develop 14GW of new renewable energy generation assets, extremely attractive for Australia as it struggles to achieve its ambitious target of having renewable sources generate more than 80 per cent of the nation’s electricity by 2030.

More Coverage

Originally published as Brookfield and EIG consortium moves to sideline AustralianSuper with fresh Origin bid