Bright outlook as solar virtual power plants shine for electricity day traders

Forget day trading, tech savvy Australians are now trading electricity and selling their solar-powered energy at a profit.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Pascal Rodrigue doesn’t actively make trades on the stockmarket, but he still turns a profit. Instead he spends more time trading in another currency that, with little investment, earned him $1200 over the past year.

His earnings come from a “virtual power plant”, a network of batteries that sell stored solar energy back into the grid.

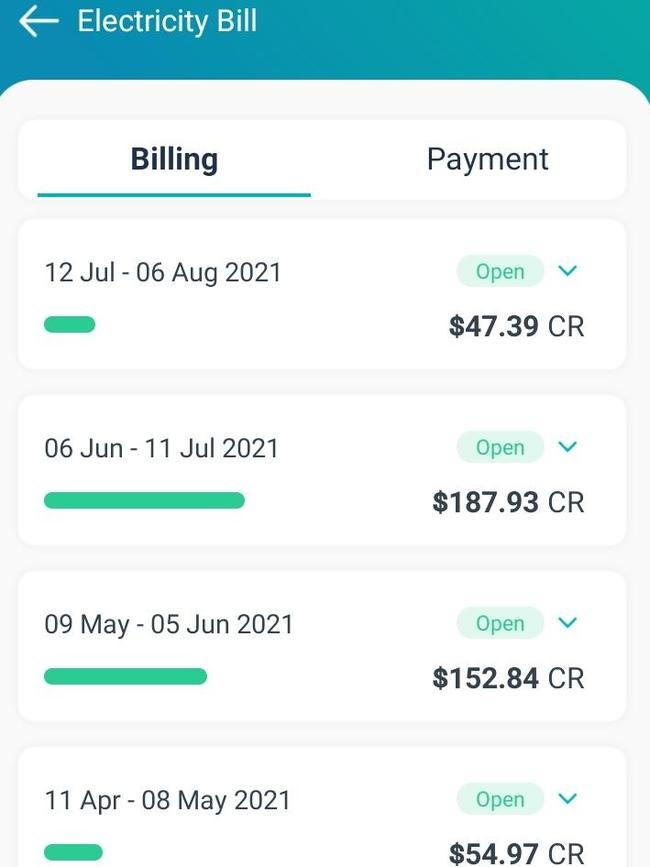

Each quarter, when the average Australian creases their brow at yet another energy bill, Mr Rodrigue smiles. He then banks an amount that’s the equivalent of what a two-person household in Victoria would pay for their power.

He hasn’t paid an energy bill in three years and even before then hasn’t paid more than $400 thanks to solar panels.

Discover Energy’s VPP, which uses an algorithm to take into account the weather, smart energy data and past energy consumption, is able to predict when energy is in demand and maximise profit when selling it back to the grid.

Mr Rodrigue is one of about 2000 Discover Energy customers, about 10 per cent of its total retail customer base, who are reaping the benefits.

The VPP system was the first to be rolled out to retail customers in Australia, group co-founder Jeff Yu said.

“In 2017, we knew we had to do something else other than sell solar panels,” Mr Yu said, referring to his other business, One Stop Warehouse Group.

“When we operated the wholesale warehouse we did see one particular problem … people are excited initially by solar panels but they usually forget after a week and they forget to maintain them.”

Two years later in 2019 they introduced Australia’s first retail VPP. Other energy retailers have since jumped on the VPP bandwagon, including AGL, which began a retail program in 2020, three years after implementing a $20m VPP project in South Australia in conjunction with Evergen and SA Power Network.

Mr Rodrigue joined the VPP in November 2020.

“I crunched the numbers recently and I got about $1200 in credits, about $2500 a year if you consider you’re not paying for electricity,” he said.

While the cost of a solar energy battery can mirror the cost of solar panels, Discover Energy executive general manager Chris Cormack believes VPPs aren’t limited to those who can afford panels.

“The very first people to get involved were your retired engineer types but now it’s more widespread … it’s probably a more energy-engaged set of consumers who are buying batteries,” he said.

Mr Rodrigue agrees. He said he paid about $18,000 excluding grants to purchase and install his solar panels and batteries.

“The payback is now between six and 10 years,” he said.

Aside from making a profit, Mr Rodrigue said he was able to learn more about the energy grid and his own use.

“It really brings some awareness as well,” he said.

“As for other benefits, I’ve been through a couple of blackouts with the lights staying on.”

Originally published as Bright outlook as solar virtual power plants shine for electricity day traders