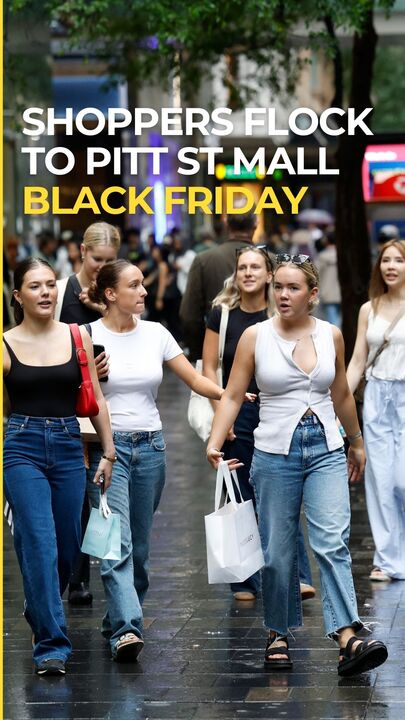

Retail trade grows ahead of Black Friday sales

The doom and gloom for Aussie retailers seems to have subsided – and that was even before an expected bumper Black Friday sales.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

Aussie retailers recorded a strong month ahead of a likely boom during the Black Friday sales, new figures show.

Bargain hunting Aussies and retailers looking to discount stock early have seen an uncharacteristic lift in October spending, according to the Australian Bureau of Statistics.

Australian retail turnover rose 0.6 per cent in October 2024, according to seasonally adjusted figures released on Monday by the Australian Bureau of Statistics (ABS).

In renewed confidence, the Ocobter figures follow growth of 0.1 per cent in September 2024 and 0.7 per cent in August 2024, meaning retail trade has grown for the last three months.

ABS head of business statistics Robert Ewing said retailers reported strong sales in the lead-up to Black Friday.

“The stronger than usual October month saw some retailers enticing buyers to spend early with discounting, particularly on discretionary items,” he said.

While figures overall looked stronger than expected, turnover for retail remained mixed among different sectors.

The non-food industries had significant rises for both other retailing (up 1.6 per cent) and household goods retailing (up 1.4 per cent).

“The rise in discretionary spending was driven by online discounting events, while people also spent more on electrical goods, particularly televisions and other audiovisual equipment,” Mr Ewing said.

Food-related industries also rose, with cafes, restaurants and takeaway food services up 0.3 per cent for the third straight month.

“The bounce back in food retailing is being driven by liquor retailers. This month, liquor rose by 1.7 per cent, which sees liquor turnover return to a similar level as July 2024,” Mr Ewing said.

On the downside, clothing, footwear and personal accessory retailing fell 0.6 per cent, and department stores were down 0.3 per cent.

Oxford Economics Australia head of macroeconomic forecasting Sean Langcake said there appeared to be a strengthening trend.

“Sale growth was driven by household goods in October, with retailers reporting a strong response to discounting activity. Online sales of AV equipment were particularly strong. In contrast, sales at department stores and apparel sales fell back in October,” he said.

“The trend in retail sales is gradually improving. Tax cuts and lower inflation appear to have been supportive for consumer spending, which should continue to gain momentum into 2025. “Retail sales data will become increasingly volatile heading into the Black Friday and Christmas period, but the underlying trend appears to be strengthening.”

Meanwhile, eToro market analyst Josh Gilbert said Aussie retailers anticipated even stronger sales figures during the Christmas period.

“While results this month for October will probably be more restrained, ING research indicates that this year’s Black Friday rush is expected to have injected $12.7bn into the retail economy. That means that figures released in December and January, which will reflect Black Friday and the Christmas rush respectively, will likely be a return to strength,” he said.

Mixed news on housing

The number of new homes being built continues to grow, although it was mixed news depending on the type of property Aussies are looking to live in.

The total number of dwellings approved rose 4.2 per cent in October to 15,498, following a surge of 5.8 per cent in September, according to the ABS.

“The overall rise this month was driven by an increase in apartment developments approved in NSW and Victoria, with private dwellings excluding houses, rising 24.8 per cent,” ABS head of construction statistics Daniel Rossi said.

“Meanwhile, private sector house approvals fell by 5.2 per cent in October after reaching a two-year high in September.”

Private sector house approvals fell to 9191 dwellings, following a 4.1 per cent rise in September. Despite the fall, private sector houses remain 2.4 per cent higher than a year ago.

South Australia was the only state in which approvals grew in October, with a 1.0 per cent rise. The 905 private sector houses approved was the highest result for South Australia since August 2021.

Total residential building value rose 3.2 per cent or $8.33bn, made up of a 4.4 per cent rise in the value of new residential building approved ($7.21bn) and a 4.2 per cent fall in alterations and additions ($1.12bn) in seasonally adjusted terms.

Mr Langcake said while Monday’s figures were relatively soft, the trend was likely to be short-lived.

“We expect mortgage rate cuts from mid next year will aid the release of pent-up housing demand, while traction on the housing policy front will become increasingly obvious. With the upturn spreading across all build forms and states, a sharper uplift is forecast for FY2026,” he said.

Policymakers at Australia’s central bank have long argued that rates have needed to stay higher for longer to control entrenched inflation within the economy, but October’s ABS figures showed the headline consumer price index rose just 2.1 per cent.

While this is in the target range, RBA governor Michele Bullock said it was more accurate to watch the trimmed mean inflation rate, as it stripped out volatile assets. This figure came in at 3.5 per cent in the month to October, above the RBA’s target.

“The word sustainability is important because it recognises that we look through temporary factors that influence headline inflation rates from time to time,” she said in a speech to CEDA.

Ms Bullock said while headline inflation was falling due to helpful policies such as electricity rebates, these were only temporary measures that the RBA was looking beyond.

Ms Bullock said she would need to be confident that inflation was falling within the target and she did not expect inflation to reach the midpoint of the 2 to 3 per cent target before 2026.

Originally published as Retail trade grows ahead of Black Friday sales