Aussie markets flat despite Qantas high

The ASX 200 traded sideways on Wednesday, after $48bn was wiped off the sharemarket during Tuesday’s trading.

The ASX 200 traded sideways on Wednesday, after $48bn was wiped off the sharemarket during Tuesday’s trading.

TAB has slammed its “annoying” rival Sportsbet for giving the wagering industry a bad name as pressure mounts to ban betting advertisements.

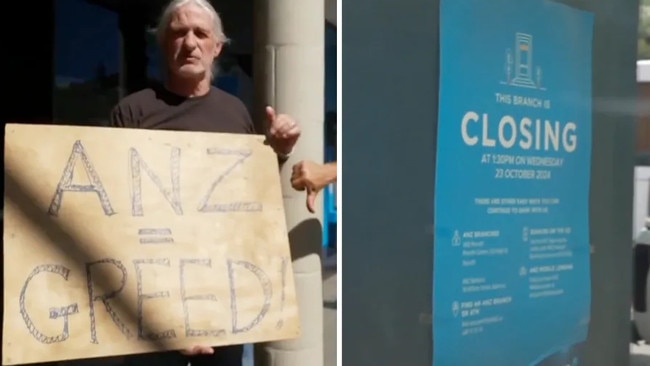

Customers have slammed a big four bank for its “outrageous disregard” after it closed a local branch, forcing them to drive 1.5 hours to do their banking.

The Australian economy is growing at its slowest pace since the early 1990s, and a key group claims the RBA is focusing on the wrong thing to fix it.

Becoming more aware of your bad spending habits is a crucial first step towards getting your finances back on track. Here’s what you’re probably doing wrong.

The ASX tumbled spectacularly after an ‘ugly late swoon’ on Wall Street, with few stocks spared from the sea of red.

Aussies rushed out of their homes to shop, dine and be entertained after emerging from Delta lockdowns in November but there was one industry to come out on top.

The ASX crept into the green as energy producers Woodside and Santos booked record numbers, while gold miners shone brightly.

Jobseekers are enjoying the best labour market in almost 14 years, with the unemployment rate falling further as employers scramble to secure workers.

The local bourse went south after US markets copped a battering amid concerns the Federal Reserve will aggressively hike interest rates as inflation surges.

Covid-19 staff shortages have already dented BHP’s iron ore and coal output in WA and Queensland, even before the west opens the border floodgates.

There’s been a bigger than usual post-Christmas slump in spending, as Omicron weighs heavily on shoppers’ minds. But there’s one thing Aussies are spending more on.

Original URL: https://www.couriermail.com.au/business/breaking-news/page/195