Billion dollar dividend bonus for ‘skin in the game’ directors

Twiggy Forrest, Gerry Harvey and other top directors will pocket mountains of dividends in coming weeks and analysts say it’s good for all shareholders that they have “skin in the game”.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

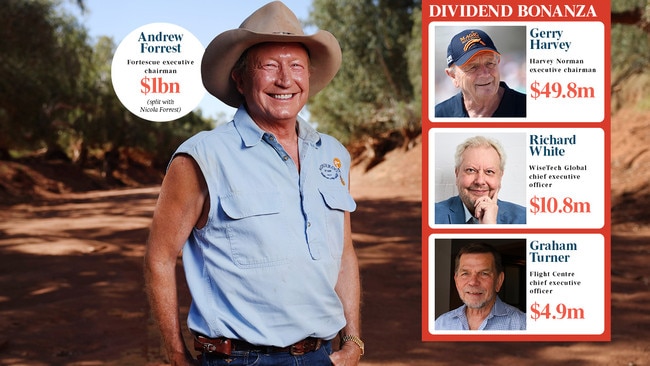

Top directors and company founders with ‘‘skin in the game’’ will be showered in dividends in coming weeks despite with Fortescue executive chairman Andrew Forrest and his family’s$1bn windfall streets ahead of anyone else

Mr Forrest and his wife Nicola, who announced their separation in July last year, will reap more than $1bn following the mining giant’s 87c a share final dividend.

Wilson Asset Management founder Geoff Wilson said directors with large holdings in their companies tended to be more focused on performance.

“My experience is that ownership does focus directors’ minds and studies often equate director stock ownership with improved financial performance and improved corporate governance,” Mr Wilson said.

He said he agreed with the late Charlie Munger, the vice-chairman of Berkshire Hathaway, who said ‘show me the incentive and I will show you the outcome’.

“Munger maintained that incentives are a catalyst for driving the behaviour and actions of all workers, including directors,” he said.

“We have been talking for a long time about establishing a founders’ fund (made up of firms where the founder still has a big equity stake).

“Guys like Gerry Harvey with big equity positions are very focused on performance.”

Mr Harvey, the executive chairman of furniture and electrical retail giant Harvey Norman, will pocket $49.8m from the final dividend payout. WiseTech Global chief executive Richard White will reap $10.8m, while Flight Centre managing director Graham ‘‘Skroo’’ Turner will earn $4.9m. Pub baron Bruce Mathieson Sr, who controls a big stake in Endeavour, will take home $20.2m while Reg Rowe, who founded the Super Retail Group in 1972 as a mail-order business, will earn $53.4m, after the firm declared a 30c final dividend plus a 50c special dividend. Seven Group founder Kerry Stokes meanwhile will take home $62.1m from his 50 per cent holding in the mining and media conglomerate.

Overall shareholders in Australian companies will receive more than $80bn in dividends from the year to the end of June, up 5 per cent on the previous year.

But weak economic conditions are expected to hold down total dividend payments in the current financial year, offsetting higher dividend payouts expected from defensive stocks such as utilities.

Australian Shareholders’ Association chief executive Rachel Waterhouse said her organisation always wanted directors to have some skin in the game. “We want them to feel like a retail investor,” said Ms Waterhouse. “In some cases, we have recommended a vote against directors who we believe do not have enough skin in the game.” Ms Waterhouse said there were exceptions, including a young female director with limited financial resources.

She said as a general rule non-executive directors should not receive options or performance rights but could be paid board fees in the form of shares, preferably purchased on market, in lieu of cash. After three years on a board, a director should own or have invested at least one year’s worth of base cash fees in the company’s ordinary shares.

“Where they do not, and it appears they will not, the ASA will vote open proxies against the director’s re-election,” she said. Key executives should be encouraged to have a “meaningful equity investment” in the company, as this promoted an alignment with shareholder interests.

Ms Waterhouse said the ASA recommended that a chief executive should have invested a minimum of 100 per cent of his or her fixed annual remuneration in the company’s shares after five years in the role.

Flight Centre co-founder Graham Turner sounded a note of caution about ‘skin in the game’, saying directors owning substantial shares had to be impartial.

“That is why a mix of founders with a substantial percentage of shares needs to be balanced with directors who probably have a small number of shares to the overall interest of the company,” Mr Turner said. “Most directors of public companies will have at least some shares but they will need to balance this against anyone who has a significant holding to make sure it is in the best long-term interest of the company as well as shareholders in how profit after tax is spent or invested.”

Mr Turner, who grew Flight Centre from a single shop in 1982 to a global company, said some professional investors would prefer money to be invested back in the company or even in stock buybacks. “My personal opinion is there will always need to be a balance,” said Mr Turner. “At Flight Centre over the years we have had a policy of distributing, usually as dividends, about 50-60 per cent of after-tax profits.”

More Coverage

Originally published as Billion dollar dividend bonus for ‘skin in the game’ directors