ANZ predicts house prices to fall but never to pre-pandemic levels

ANZ has set a date for when we can expect property prices to “roll over” but there’s a major catch for aspiring homeowners.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

It’s here — the news we’ve all been waiting for. House prices are predicted to fall in Australia in 2023, according to a new ANZ report.

That might buoy the hopes of aspiring homeowners but there’s a major catch.

Property prices have been turbocharged by the Covid-19 pandemic and they aren’t expected to return to pre-pandemic levels.

This year, homes rose in value by more than 20 per cent and they’re tipped to rise by six per cent for 2022.

In 2023, homes in the capitals are expected to drop by around four per cent.

That’s according to ANZ economists Felicity Emmett and Adelaide Timbrell who co-authored the ‘Australia’s Housing Rolling Over’ report released late on Thursday.

However, that means that you would have been better off if you bought a home in 2019 than in 2023.

“If our forecasts pan out, housing will be 27 per cent more expensive at the end of 2023 than at the end of 2019,” Ms Timbrell warned.

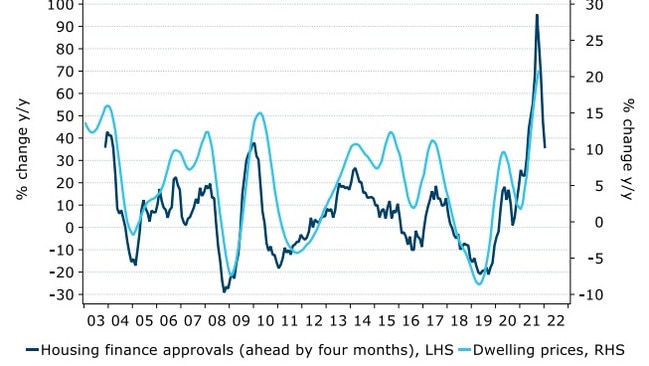

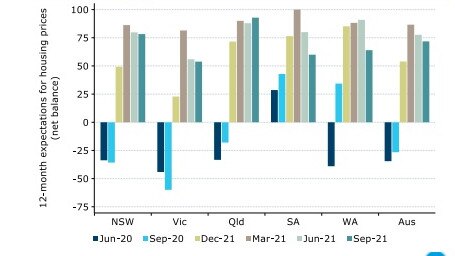

The new research was based around the idea that the market would soon be “rolling over” and said there are already signs of a looming “slowdown”.

It’s been an unprecedented year for the national housing market, with gains forecast to peak by November or December this year at 21 per cent – the strongest growth since the late-1980s boom.

However, the market can’t keep up for much longer.

“Affordability constraints are biting, new listings have lifted strongly, and macroprudential tightening and higher mortgage rates are set to constrain lending over the coming year,” the authors noted.

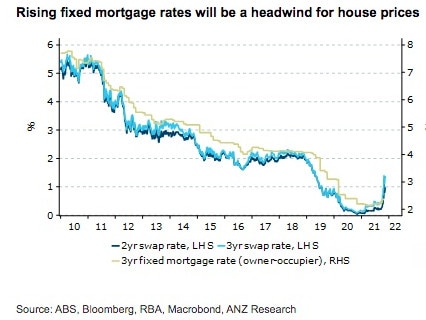

They said “interest rates will be key” in determining when exactly prices would fall away.

The interest rate is currently at 0.1 per cent and they expect they expect the RBA to “hold” this until the first half of 2023.

However, “fixed mortgage rates are already rising,” the economists pointed out.

“A faster-than-expected rise increases the risk that prices slow more than we currently expect. And vice versa.”

Cities where prices will keep growing

Although prices will become sluggish next year, with just a six per cent rise, some capital cities will grow above that threshold.

Brisbane is set to jump by nine per cent, Hobart will be up by 8 per cent, and Melbourne is expected to end the year at seven per cent higher.

Sydney is sitting exactly on the average mark at six per cent by the end of next year, according to the ANZ forecast.

The other capital cities are well below that number, with Canberra at four per cent, and Adelaide, Darwin and Perth all on more measured gains of just three per cent.

It’s not just housing prices set to fizzle out but the construction boom is also predicted to plunge.

“We expect housing construction to grow another 15 per cent by mid-2022, before activity brought forward by government incentives starts to dry up,” stated the ANZ outlook.

“A lift in apartment construction will cushion the fall.”

Originally published as ANZ predicts house prices to fall but never to pre-pandemic levels