AGL needs to think more like Macquarie as it undertakes mammoth green rebuild

The road to becoming a green energy giant will also require the 186-year-old company to undertake its own mammoth transformation.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Damien Nicks has painted a picture of what the new AGL is set to look like a decade from now as he attempts to put further distance between what has been an accident prone few years for the electricity major.

Even though Nicks has only recently been named as chief executive, it is likely he won’t be around to turn off the last of AGL’s massive coal-fired power plants by 2035. But Nicks is running flat out trying to build a platform to allow that to happen and keep the lights on.

After burning through a string of chief executives in recent years, a bitter board stoush and a period of being locked in energy wars with the Federal government, Nicks is seeking to give the 186-year-old company purpose again and this is all through its green transformation.

A big part of this is AGL’s own transformation as it moves from a volatile old-world electricity generator into a Macquarie Bank-style builder and financier of complex energy infrastructure.

This is also going to require a major rebuild inside AGL so by the time its green energy deadline approaches it will be a very different company.

Investors too will have to come to terms with a company that in coming years that pays out less in profit for dividends but promises smooth infrastructure-style returns. It’s going to require more Macquarie-like thinking to get green projects financed and off the ground and behaving less like a lumbering utility.

AGL has been rebooted largely thanks to tech billionaire and cornerstone shareholder Mike Cannon-Brookes who waged a grassroots battle against the board to derail its plan to split between a green and old coal-fired operator.

That plan was already deeply unpopular with shareholders, but the windfall profits AGL is now enjoying on surging wholesale power prices and more reliable performance show just how ill-conceived the idea of splitting the company into two smaller and weaker entities was in the first place.

High cost

The huge coal-fired cashflows AGL is currently generating will deliver much of the $10bn in core funding needed to build out new capacity over the next decade. This includes between $3bn to $4bn in new capital by 2030 to meet near time targets. However AGL needs another $10bn and is willing to open its balance sheet up to co-investment or joint ventures to fund projects as well as recycle capital from building and developing projects. That’s the Macquarie model in action.

“The transition won’t come for free,” Nicks says. “However coal will ultimately leave the market over the next 10 to 15 years. That means we have to replace those assets, they’re going to get to the end of their life no matter what happens,” he says.

Nicks is speaking to The Australian as AGL faces its own consumer backlash after delivering windfall profits given surging electricity prices. AGL on Friday upgraded this year’s full year earnings, and now expects to more-than-double next year’s earnings. This is going to be a hard sell while some households are applying for government relief on pricing.

Nicks points out while wholesale pricing has jumped on a tighter market, some of the rebound in earnings has been underpinned by improved reliability of AGL’s coal fired generators which means it is selling more energy into the market. Massive outages at Loy Yang last year wiped some $120m from full year earnings. At the same time AGL’s giant new batteries that are progressively coming on-stream are starting to generate new revenue.

To pay for AGL’s big green transformation Nicks has cut the power giant’s dividend payout ratio for coming years by putting a floor of 50 per cent of underlying profit to be paid to shareholders. Previously this floor was set at 75 per cent.

Investors knew this move was coming and instead focused on the near-term earnings windfall sending AGL shares up as much as 10 per cent on Friday to their highest level in two years. This share price jump now values Cannon-Brookes’ stake at $830m.

‘Big build’

There is little doubt Nick’s new AGL has a big build ahead as it commits to 12 gigawatts in brand new renewable generating and firming power by 2035 and in doing so wind down its two ageing coal fired plants.

These slated to go are Bayswater in NSW which is forecast to close between 2030 and 2033 and then the giant Loy Yang A plant – Victoria’s single biggest source of electricity – by June 2035.

If everything goes to plan the nation’s dirtiest carbon emitter will be transformed into a mostly clean green energy major, supplying nearly 20 per cent of the electricity market across base load and peak demand. AGL will have gas peaking plants but these too will be wound down over time.

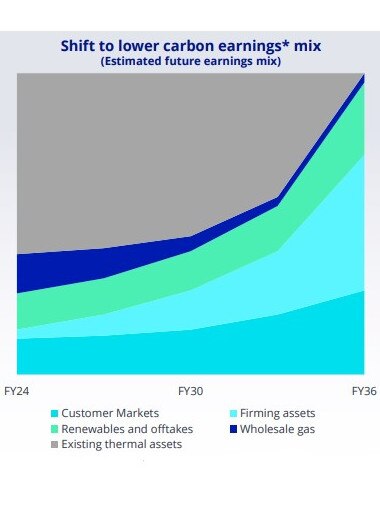

The chief executive believes green energy can replace huge cashflows of coal over time, with most of the earnings uplift coming after 2030.

Critically he calculates green renewables are likely to deliver superior return to today’s coal-fired generation.

Green generation such as solar and wind are forecast to return between 6 per cent and 8.5 per cent over time while firming (grid scale batteries and pumped hydro projects) will be more lucrative, generating returns in a range of 7 per cent to 11 per cent.

By comparison AGL’s return of capital averaged 7 per cent over the last three years, although that also includes gas and trading businesses.

‘Execution’

Nicks knows AGL’s talk is only as good as execution and the purpose of a major briefing with investors was another step in rebuilding confidence in the company that has long been big negative surprises.

Here he is breaking down the big 12 gigawatt ambition into digestible milestones. This includes the closure of the Liddell Power Station so far without incident. Elsewhere AGL is on track to hit 850 megawatt replacement from batteries by June next year and batteries are now operational in South Australia and Broken Hill. Significantly he has upped AGL’s near term development pipeline to 5.3 gigawatts, a sharp increase over what it was targeting from just a few months ago.

Speaking to The Australian Nicks says AGL is only going to be judge on what it delivers, but there is a new focus running through the organisation in delivering the 12GW in green power.

The 50-page update to investors Friday was all about “providing proof points of our positive momentum and the direction of where we’re taking AGL into the future”.

Still Nicks acknowledges the mammoth task ahead won’t be easy and in many ways it’s going to rely on more than AGL’s engineers to hit the 2035 targets.

Nicks also committed to keeping the coal power running to make sure the lights can stay on.

“There will need to be a significant build out over the next 10 to 12 years and therefore we need to get this progressively going as quickly as we can”.

“We will continue to ensure our current thermal coal assets are there for the market as this transition occurs. That is a very big part of this”.

“We all need to try and do it as efficiently and effectively as we can”.

johnstone@theaustralian.com.au

More Coverage

Originally published as AGL needs to think more like Macquarie as it undertakes mammoth green rebuild