1c shock: Solar surge drives prices to record low

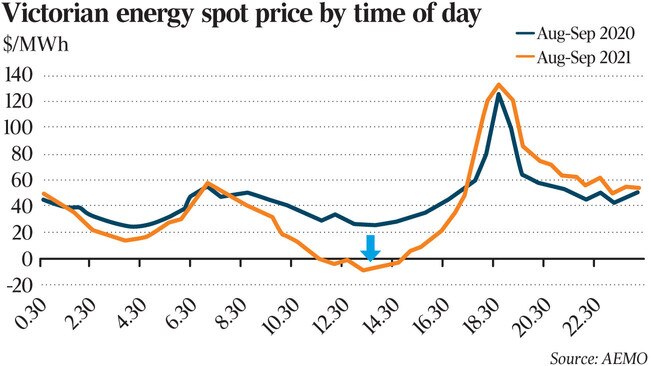

Solar drove average daytime prices in Victoria to just 1c per megawatt hour during August and September, as a move to renewables picked up pace.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Surging solar supplies cut Victoria’s daytime electricity spot prices to 1c per megawatt hour in August and September, underscoring the growing influence of renewables in Australia’s power grid.

While the national electricity market endured huge volatility in July that lifted prices, middle of the day prices plummeted towards zero in August and September as large scale and rooftop solar on homes played a bigger part in the energy mix, the Australian Energy Market Operator said.

The 1c per MWh average spot price recorded in Victoria between 10am and 3.30pm in the last two months of the September quarter compared with $30/MWh a year earlier and mirrored a broader national trend which saw wholesale power prices negative or zero for 16 per cent of the time, double the prior record of 7 per cent. Clean energy set several new records with renewables reaching 61 per cent instant penetration over a 30 minute period, putting it on track to ultimately provide 100 per cent of supplies for short periods by 2025 under a blueprint laid out by the market operator.

Renewables contributed just under a third, or 32 per cent, of overall supplies for the three-month period, also a new all-time high. Wholesale prices soared to $111/MWh in July and gas prices jumped to just under $16 per gigajoule due to an outage at ExxonMobil’s Longford gas plant in Victoria. That led to Resources Minister Keith Pitt being formally asked to consider capping gas exports by a major union and a leading industry group, with claims the nation’s manufacturing comeback was “in danger of being jeopardised by high gas prices”.

Still, more sedate conditions followed in August and September with Longford’s return to full production and milder weather resulting in September gas prices falling to $8/GJ.

Power prices averaged $66/ MWh over the September quarter, down a third from $95/MWh in the previous three months, but still substantially higher than $42/ MWh for the same period a year ago.

Despite warnings that Australia faces pressure on gas and power prices as a global crunch spreads to the nation’s energy sector, there has been little sign to date the squeeze has extended to customers on the nation’s east coast.

“International energy prices surged to record levels by the end of the quarter, with export coal prices reaching $269/tonne and Japan Korea Marker gas prices also hitting a new record of $41/GJ up from $17/GJ at the start of the quarter,” AEMO noted in its quarterly energy dynamics report. “However, the impact of these trends on Australia was not discernible during the quarter, with domestic energy prices moving in the opposite direction to international prices.”

Australia’s gas market, tied to Asia through Queensland’s LNG export industry, has yet to see any significant price inflation from the crisis.

Still, the Australian Competition & Consumer Commission’s LNG netback series – a local LNG price that takes out the cost of processing and shipping gas to Asian customers – is currently over $39/GJ for November, quadruple the price most local industry normally pays.

Federal Energy Minister Angus Taylor said the lack of price inflation showed the importance of having enough gas in the market for local industry.

“Australia’s competitive advantage has always been based on cheap energy. This report demonstrates the importance of ensuring that there is enough gas in the market to supply times of high demand and to provide security for our manufacturing sector,” Minister Taylor said.

AEMO, which runs the country’s electricity grid, said earlier in October it expects global price pressures to filter through despite Australia being the world’s biggest LNG exporter and not at risk of the same supply tensions in Europe and Asia.

Black coal-fired generation declined to its lowest third quarter average since the start of the national electricity market, predominantly driven by the NSW fleet as Queensland output was comparable to a year earlier.

Coal, which has historically provided 70 per cent of power in the national electricity market, is forecast to remain operating until 2048 but a growing number of experts predict it will be pushed out much earlier.

Power companies are under pressure to dramatically boost their plans to cut pollution amid pressure from investors and financiers even as the pathway for phasing out fossil fuels remains highly contested.

More Coverage

Originally published as 1c shock: Solar surge drives prices to record low