Australians reveal how they were duped, gave up life savings to global boiler room scam

A former company CEO on the NSW Central Coast and an SA businessman reveal how they — like many other Aussies — were duped by a global fraud syndicate’s investment scam.

Behind the Scenes

Don't miss out on the headlines from Behind the Scenes. Followed categories will be added to My News.

One was a former company CEO living on the NSW Central Coast, another a sophisticated businessman from Adelaide. But both of them fell hard for the investment scam being peddled by an international organised fraud syndicate.

And they are just two of potentially hundreds of Australians who have lost upwards of $60 million to the crime cartel run by British con artists with the backing of ruthless global money launderers.

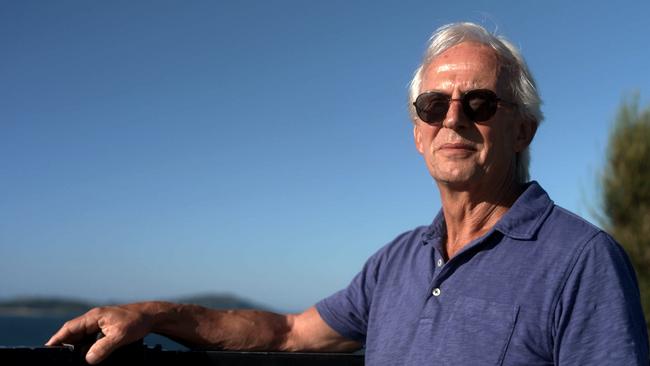

Jens, a retiree and former CEO originally from Germany was lured in after information was posted on his LinkedIn account.

Matt, had decided to make some investments for his young family’s future.

Like so many people would, Matt started doing his research by googling terms like “investment” and “IPO” and “shares”.

Thousands of kilometres away in a residential suburb of Brisbane, John a married businessman with two children was doing something similar. So too was Carol in Canberra.

All of them were looking for an investment with good returns, never suspecting their internet research would trigger pop-up advertisements that would ultimately lead them to losses so devastating, some haven’t even been able to tell their families what has happened.

Matt said after his search a pop-up advertisement appeared on his social media page spruiking investments through a broking firm.

The ad encouraged him to fill in a form and advised a broker would be in touch.

Soon after a man with an English accent rang and started a sales pitch saying he was the Vice President of Inter Berner Dubois, and he was able to sell some initial public offering shares in a new company.

Matt asked for the company’s history and some evidence that it was legitimate.

John did a similar thing. For John also a Brit, the English accent was reassuring. The broker was happy to comply. He suggested they check the credentials by looking up the company’s listing on S & P (Standard and Poors) and its press releases on the Yahoo Finance website.

LISTEN TO THE AUDIO OF THE BROKERS:

In all cases the small initial investment made a “profit” and they were convinced to reinvest buying more shares in an off market deal.

The sales pitch got more complicated and high pressured. The scammers said the opportunity invest was only available for a short time.

When the victims agreed they were told to send money to a “transfer agent” or an “escrow account” in Hong Kong.

When the money hit the bank account it was gone again within minutes.

Inquiries with the HK-based banks by victims were stonewalled.

“You would think the banks would be suspicious of tens of thousands of dollars going through their bank’s account and out again within hours,” said John.

They formed a support and information group to find and warn other potential victims. Soon hundreds of people were sharing horror stories.

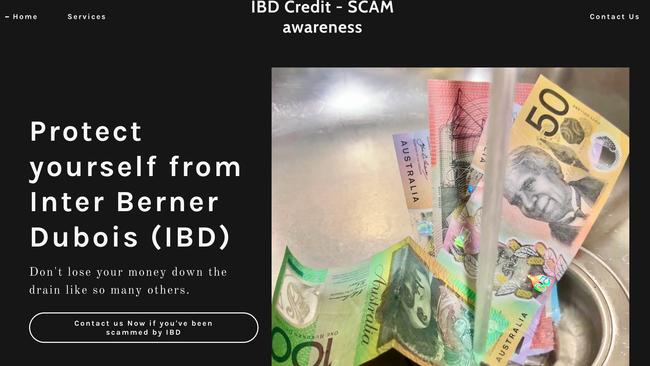

“There are four of us (based in Australia) have been ripped off by a company called Inter Berner Dubois. Lost a lot – already running to $3 million plus,” one victim wrote in a chat network.

“They have a very professional website and issue slick documentation …

“Anyway we fell for it….”

“ … Inter Berner Dubois also uses news stories on places such as Yahoo Finance and Bloomberg to endorse their legitimacy. They also use the S & P company register to “prove” they’re the real deal. They are not.”

A website called investment-scam-asia.com now lists phone numbers used by the scammers, the names of the companies, and the audio recordings of the scammers voices who have used multiples alias across a string of companies.

The website warns the investment fraud has reached “frightening proportions.”

“Unfortunately, the interest of public institutions – be it public prosecutors, police authorities or politicians – is low and characterised by a lack of competence …” the website said.

Jens, Matt, John and Carol all said they contacted local police for help to no avail. Jens said he reported the Chinese company that scammed him, to the Australian Federal Police but it continued trading.

Jens said when he finally realised he was being scammed the syndicate showed no remorse trying to convince him to make one final payment to get his money back. He had lost $900,000 – his life savings.

“I was just desperate and I’m telling them the situation they put me in because I was running out of money.”

“They don’t care …” Jens said.

Matt lost $270,000. He still clings to hope he may get back some of what he lost.

Another couple from Adelaide lost $2.6 million. A businessman in the finance industry lost $6 million.

Carol can’t bring herself to tell her father how much she had lost.

John doesn’t want his children to know. He and his wife have enough to deal with knowing they will have to work for years to make up the lost money.

SOME OF THE COMPANIES INVOLVED IN THE SCAM:

Monarch Broker

www.monarch-broker.com

AS Colins Continental

www.ascolinscontinental.com

Garner Tongyeong International

www.gtifinancial.com

Fujisawa Yoyama Group

www.ftgfinancial.com

Chiba Taiko Partners

www.ctpglobal.com

JK Marshall Mercantile

www.jkmarshallmercantile.com

S Venture Capital Advisors -

(Purported to be in Adelaide, Australia)

www.sventurecapital.com

Suncap Advisors (Sun Capital Advisors)

www.suncapadvisors.com

Inter Berner Dubois

www.ibd-credit.com

Aspen Asset Management AG

www.aspen-am.com

Julius Cohen Securities

www.jcstrading.com

Kingsman Investment Limited

www.kingsmanltd.com

Cullman Mutual Capital

www.cmadvisory.com

Tochigi Ontario Holdings

www.tohglobal.com

Charrington Pacific Group

www.cpgroupcorp.com

Lincoln Management Group

www.lincolnmanagementgroup.com

www.lincolnmanagementgrp.com

Agard Union Trading

www.autventures.com

White Oak Capital Asia

www.whiteoakcapital.asia

For more watch 7NEWS Spotlight 8.30pm on Channel 7

More Coverage

Originally published as Australians reveal how they were duped, gave up life savings to global boiler room scam