Why the Valuer-General’s quarterly figures don’t matter

Did your suburb median go backwards in the latest Valuer-General’s quarterly report? Here’s why that doesn’t matter and what you should really be looking at for long-term growth.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

I had a story in The Advertiser yesterday about the release of the latest Valuer-General’s figures. These show what South Australia’s state and metro median property values have done in the past quarter and year.

Incidentally, Adelaide just recorded its first median value drop since June 2022, prompting Real Estate Institute of South Australia chief executive Cain Cooke to say “the signs are there that the boom is coming to an end”.

The report also shows the 12-month growth or loss of every Adelaide suburb. Ideally I’d have timed this release with a column having a crack at our money-grabbing councils who use these figures to jack up our rates but I kind of bashed councils last week, so to return to that well so soon could have me perceived as unoriginal. It’s all about timing.

Timing has never been my strong point, if I’m honest. I’m often late to events, I tend to catch on to trends long after they’ve finished being in vogue and I have a six-month home renovation I’ve dragged out for more than six years now.

The uprising will soon be upon us. Do your own research. Wake up, sheeple.

A lot of people think timing is the be-all and end-all in real estate. They try to time the market – buying in at the bottom and selling at the top to maximise their profit and minimise any potential loss. Even the most skilled real estate professional will tell you it’s incredibly difficult to call those moments.

Trying to transact at the height of a peak or the depth of a trough is all well and good in theory, but it doesn’t take into consideration that all markets have their own property cycles.

The VG figures show some suburbs have recorded value growth in the past year while others have experienced losses. So if you’re selling in a suburb that’s going up and buying into a suburb that’s declining – awesome! But if you’re looking to buy now because you heard the Adelaide market was going backwards and are expecting to see that value loss across every single suburb or town, well, you could be incredibly disappointed indeed.

A lot of people place enormous stock in the Valuer-General’s figures but the reality is they’re not the best indicator of whether a property is a good investment or a great place to buy. They show what that suburb has done over the past 12 months, and that’s pretty much it. For most people, real estate is a long-term investment.

To be honest, I don’t even look for my suburb in the Valuer-General’s spreadsheet when it comes across my desk. It doesn’t really interest me. I’m planning on staying in my home for the next 10-20 years so what my suburb has done in the past year seems kind of inconsequential. If my suburb goes up, great, my council puts out its hand. If it goes down, well, it doesn’t matter because I’m not looking to sell for ages.

Worrying about whether you should sell now, wait a month or stressing about whether you’ve missed your market’s peak might seem like a big deal now but over the course of three, five, even 10 years, that money you might have missed out on will even itself out. That’s how Adelaide’s property cycle works. When we’re not in an abnormal property cycle like we are in now, it’s pretty much “slow and steady” here. And that’s what we’re expected to be returning to.

You see, it’s time in the market, not timing the market, that’s going to deliver results and lead to long-term gains. So don’t stress about trying to pick the exact right moment to do it. You could well be causing yourself needless worry about something that will all come out OK in the wash.

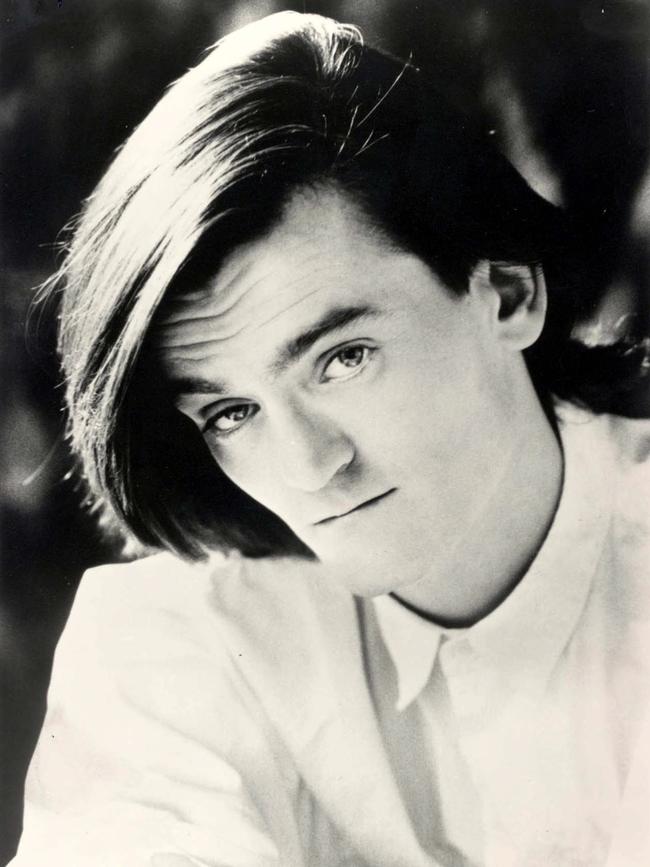

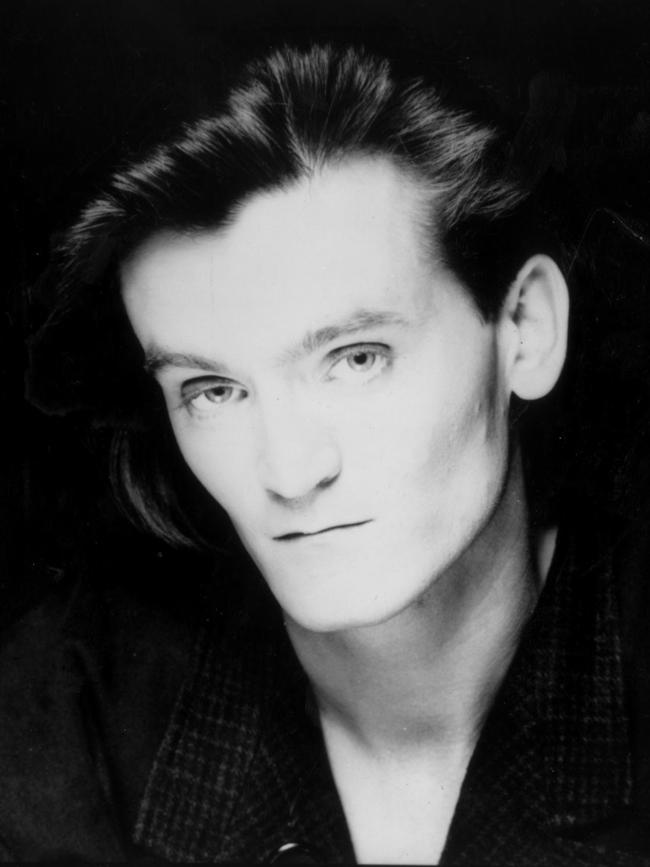

And now, if you’ll excuse me, I’m off to kick back in my new inflatable couch and listen to Feargal Sharkey.