What Adelaide house prices will do in 2024

An exclusive report has predicted the home value growth or loss across Australia’s capital cities in 2024 – with some tipped for profit and others a plunge. Find out what’s in store for Adelaide.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

There appears to be no relief in sight for househunters looking to enter the market, with a new report showing Adelaide is tipped for continued home value growth next year.

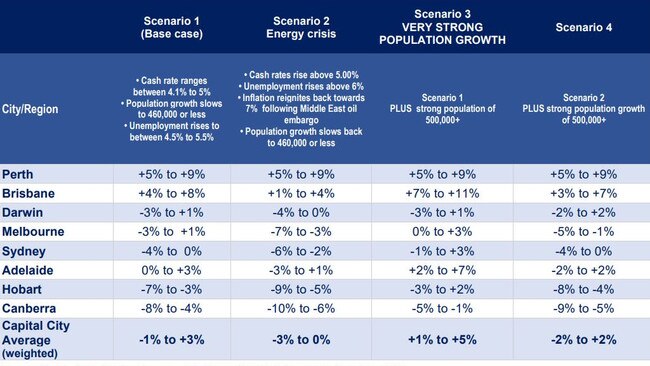

In SQM Research’s Housing Boom and Bust Report, provided exclusively to The Advertiser, Adelaide homes are on track to experience a value rise of between 0 per cent and 3 per cent – in line with the national capital average of -1 per cent to +3 per cent.

This is based on the report’s assumption of what it deems to be the most likely economic situation for 2024 – cash rate ranges between 4.1 per cent to 5 per cent, population growth slowing to 460,000 or less, and unemployment rising to between 4.5 per cent and 5.5 per cent.

Harcourts Packham managing director James Packham said Adelaide’s market was often overlooked but offered significant potential.

“Fuelled by a robust infrastructure, job creation, affordability, and the return of international activities, the city is poised for continued growth,” he said.

“While other markets retract, Adelaide remains buoyant, attracting savvy investors.”

According to the report, Perth is the real winner – with a forecast 5 to 9 per cent increase, closely followed by Brisbane with a forecast 4 per cent to 8 per cent lift, SQM Research managing director Louis Christopher said.

MORE NEWS:

See inside: House in ‘parent poisoning’ case hits the market

Shock SA mortgage stat as more rate pain looms

Want to rent a room? Even they’re hard to find

Oodie founder sells luxe beachside home for more than $3m

“Another year of anticipated strong population expansion (albeit slower than 2023) plus an ongoing shortage of new dwellings, will limit the fall in housing prices to single percentage digits and the price falls should just be limited to mainly Sydney, Melbourne, Canberra and Hobart,” he said.

“Nevertheless, with expected slowing employment growth and the corresponding rise in unemployment, tipped to be towards 5 per cent by the year end 2024, this negative will more than offset another year of strong migration.

“If I am wrong and the housing market has another strong year, it will be because employment growth has continued to be firm and/or migration has once again grown more quickly than expected and homeowners once again have managed to withstand the higher lending rate environment.”

Melbourne and Sydney are both tipped for value losses, with Melbourne at -3 per cent to +1 per cent, and Sydney -4 per cent to 1 per cent.

Canberra is forecast to experience the largest fall of between 4 per cent and 8 per cent, due to the combination of slower anticipated federal government spending plus an expected strong rise in dwelling completions.