The key changes that could be made to negative gearing

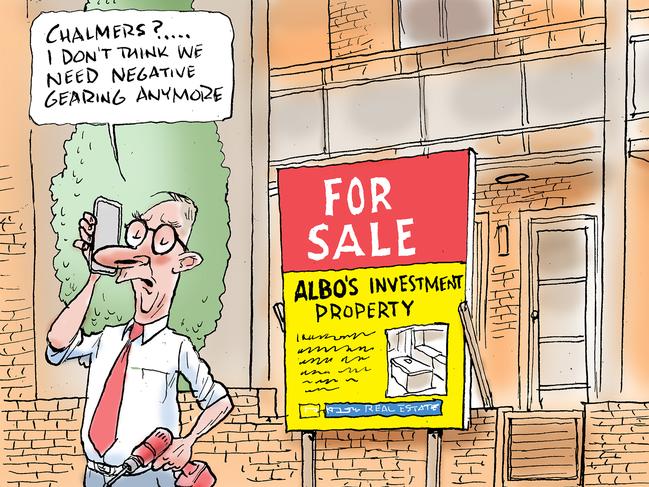

Negative gearing has again exploded into the political debate as Treasury models options to scale it back. Here’s how it could change.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

Owners of investment properties who spend more on the cost of their rental than they receive in rent are negatively geared.

This means the loss on their investment can be deducted from their taxable income when they do their tax return, lowering the overall amount of tax they pay.

Treasury is investigating changes to scale back negative gearing and the 50 per cent capital gains discount, which means people only pay tax on half of the net capital gains they make on assets owned for 12 months or more.

Here’s how it could change.

AXING BOTH TAX CONCESSIONS

The Greens are pushing for Labor to phase out negative gearing and capital gains tax in exchange for their support for Labor’s stalled Help to Buy legislation.

The minor party wants to immediately abolish the 50 per cent capital gains discount for assets held for more than 12 months.

It also wants to phase out the deductibility for all investment property interest expenses against personal income for people with more than one investment property purchased before July 1, 2023.

The phase out will occur over five years.

Those moves would impact more than 1.2 million Australians but the Greens claim it would boost the nation’s tax take by $165bn over the next decade.

Crossbench senators David Pocock and Jacqui Lambie received advice earlier this year about canning negative gearing and the capital gains tax discount for residential properties bought after July 1 this year, with homes purchased prior to be grandfathered under the existing arrangements.

But the Parliamentary Budget Office warned that removing the capital gains tax discount is estimated to reduce the overall rate of return on property investment by between 15 to 30 per cent.

LIMIT THE NUMBER OF PROPERTIES

Negative gearing would remain, but real estate investors would only be able to make use of it on a certain number of properties — perhaps just one.

The bulk of property investors, about 70 per cent, own just one property.

But for those with larger portfolios any change could severely crimp their investment strategy.

LIMIT THE TYPE OF PROPERTY

New builds would still be eligible for negative gearing arrangements and capital gains discounts, but existing houses would not.

That is, if you are a property investor funding the building of a new home — and hence increasing supply — you could negatively gear that investment.

But if you bought an existing home — an investment which doesn’t add to overall housing supply — you would not be able to make use of the concession.

CUT THE CAPITAL GAINS TAX DISCOUNT

The 50 per cent discount on gains made on the sale of assets could be cut.

A 2010 Treasury tax review recommended lowering the discount to 40 per cent, saying the tax system was encouraging households to take on too much debt and risk.

The Grattan Institute in 2016 called for the discount to be halved to 25 per cent.

CAP DEDUCTIONS

The Greens want to phase out the ability to deduct interest expenses on investment properties over five years.

Under that proposal, the percentage would reduce to 80 per cent in the first year, before reducing to 60 per cent in the second year, 40 per cent in the third year and 20 per cent in the fourth year.

Other proposals including stopping deductions for vacant properties, and stopping deductions for losses on investments from labour income.

REVERT TO PRE-1999 APPROACH

In 1985, the Hawke-Keating government introduced a capital gains tax policy that only taxed people on real gains.

This meant that any rise in inflation over the period that the asset was held was deducted from the capital gain, with the real gain then taxed as ordinary income.

The government also made changes to negative gearing that meant that investors could only offset interest expenses against rental income.

LABOR’S RECENT POSITIONS

In 2016, Labor pledged to limit negative gearing to new housing and halve the capital gains tax discount for assets held longer than 12 months.

The scheme would have been grandfathered so people that already negatively geared would not be affected.

It took the same policy to the 2019 election, which played a major part in its defeat in the “unlosable election” against Scott Morrison.

The Reserve Bank of Australia estimated that the overall effect on supply was likely to be “minimal” and it would risk eroding the equity of households if property prices fell.

Originally published as The key changes that could be made to negative gearing