FIRE explained: Pros and cons of the finance hack millennials are using to retire early

Young Australians are chasing the benefits of a trending financial “lifestyle” that promotes an extreme approach to saving, with the ultimate promise of early retirement. But does it work?

Young Australians are boasting the benefits of a trending financial “lifestyle” that promises retirement as early as 30 – but critics have blasted it as an unachievable, naive take amid the cost of living crisis.

So, what’s it all about?

FIRE stands for Financial Independence, Retire Early.

It challenges the typical financial “treadmill” model of earning merely to spend and instead proposes a lifestyle change – cut overconsumption, maximise savings and invest until passive income outweighs living expenses.

For those aspiring to the FIRE lifestyle, the ultimate goal is to kick back and retire between 30 and 50.

Though many FIRE achievers don’t actually retire this young, it’s the idea of work being a choice that’s got young Aussies raving.

The model made its first appearance in the book Your Money Your Life, which created the idea that most people were “making a dying” instead of making a living. The book pushes financial independence and mindful spending.

FIRE has stolen the attention of entrepreneurial millennials hoping to hit back at skyrocketing real estate prices and to capitalise on assets while they’re fit and healthy enough to enjoy their income.

So is this just another get-rich-quick scheme, or is FIRE all it purports to be?

Where do I start? Your quick guide to FIRE:

Approaches to FIRE differ depending on one’s personal investment preferences and strategies, but there are a few core concepts that tie FIRErs together:

Extreme, no nonsense savings

FIRE followers suggest you need roughly 25 times your annual spendings to retire if following the four per cent rule, which is withdrawing just four per cent or less of your savings every year during retirement.

In order to accumulate such significant savings, millennials able to follow FIRE are stashing away between 50 and 70 per cent of their income.

Invest, invest, invest

The FIRE tact requires you to generate your annual expenses plus inflation through assets.

Popular investment assets include Exchange Traded Funds (EFTs), Listed Investment Companies (LICs) and real estate.

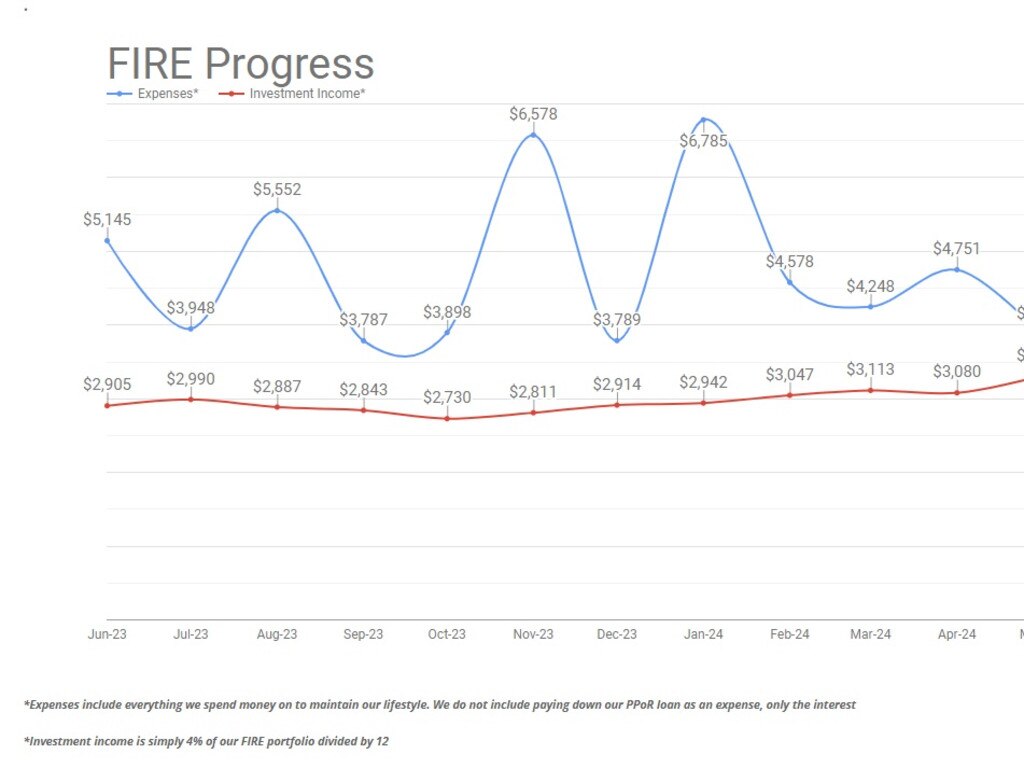

Australian millennial Matt, who goes by Aussie Firebug in his online blog, started his journey to achieve financial independence with his wife in his mid 20s.

Though he hasn’t hit his goal just yet, he and his wife now boast a $1.3m net worth with nearly $820,000 in shares alone.

“Our passive income has never been this close to covering our expenses,” he wrote on his blog.

“The life I’m living right now was something Matt could only dream of in 2015 when I first started blogging.”

Now a father, Matt said FIRE has given back his time when he “needed it the most”.

“Friends and family have been asking me when my paternity leave finishes, and I’m like: ‘I work for myself. I can have as long off as I want’,” he wrote.

“Life’s short, and I want to be as present as possible to watch our beautiful daughter grow up.”

Young starters

Sebastian Jensen’s mother convinced him to start investing in stocks five years ago.

“When she was a teenager my age she spent all of her money on clothes. She told me if she had just invested that money instead, she would literally be a millionaire today,” he said.

Mr Jensen first committed to $50 investments at a time and slowly increased his buyings with the ultimate goal of generating passive income.

“The idea of going to work is annoying,” he said.

“I’d love to be able to not go to work and still be able to live.”

At just 22, he was able to purchase a home with the combined income from his job as a Swiss Watch spare parts officer and his stock investments.

His technology ETF investment wielded $2000 in growth at its best.

“It’s definitely working for me. You just have to have a strategy,” he said.

“It might seem like you need thousands of dollars to get started but I think just putting that $50 in at the start was the first step,” he said.

Critics slam it as ‘demoralising’

While it seems all roses for some, other millennials aren’t so sure of the FIRE approach.

RMIT student Joshua Allen, who is in his 30s, called the FIRE pitch “demoralising” to those copping the flak of the cost of living crisis.

“I don’t think there is a very large percentage that can actually put (50 per cent savings) into practice. I would be gobsmacked if more than 20 per cent could to be honest,” he said.

“For a lot of millennials, about 40 to 50 per cent of our income generally, if we’re living in capital cities, is going toward rent.

“If you’re saving the other 50 per cent, you’re living off of crumbs.”

Mr Allen said financial influencers – “finfluencers” as they’re known online – who push investing in shares and Bitcoin were often out of touch with day-to-day pressures.

“I’m yet to see a financial influencer who hasn’t gotten a bloody good leg up or had a good bit of luck behind them,” he said.

“You’re kind of put in a position to feel guilty for not putting enough away. And it’s like, well, I can’t put enough away because I don’t earn enough.”

Even Mr Jensen, now with a mortgage to his name, said the FIRE dream wasn’t as attainable as he’d first thought.

“It is definitely achievable, but it’s obviously going to be difficult and require a lot of dedication,” he said.

Die with Zero

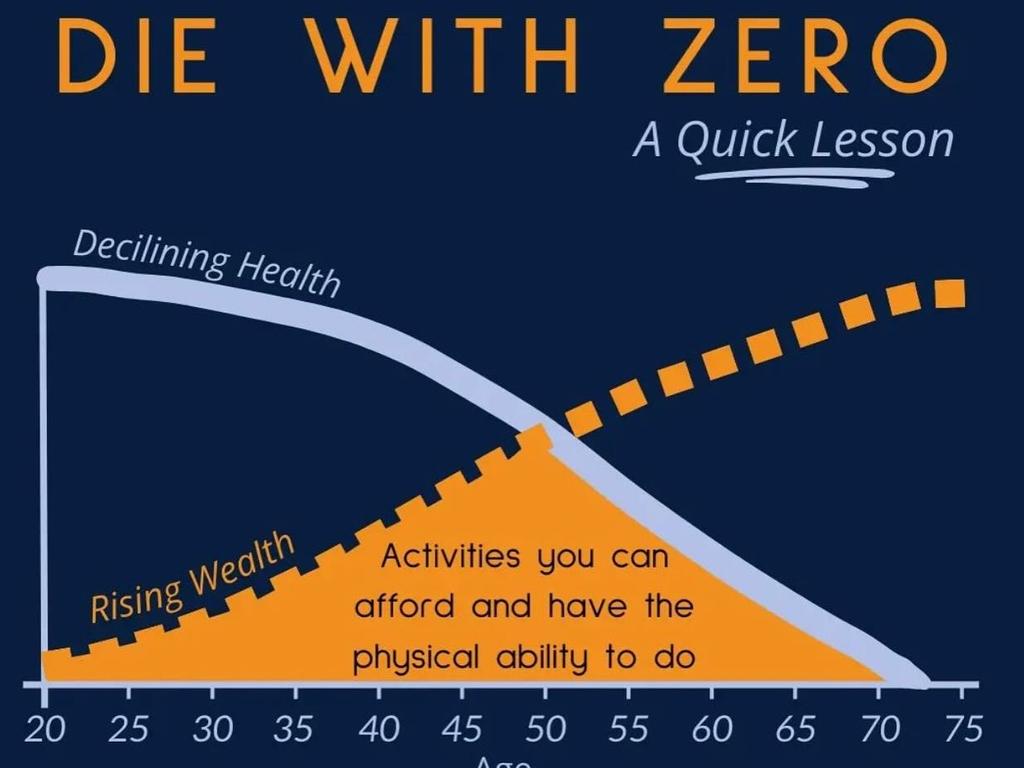

The FIRE tactic goes hand-in-hand with another popular ethos – “die with zero”.

Conceived by author Bill Perkins in his pandemic novel, “dying with zero” is pretty self-explanatory: try to get all you can out of your money and aim to have $0 in your bank account when you die.

The reason? Money should be spent at the point of greatest pay-off, such as travelling when you’re physically able or giving money to your children when it has the greatest impact rather than in their inheritance – all in an effort to “live rich instead of die rich”.

But Mr Allen raised concerns about the ethos gaining traction with the boomer generation, calling it a “kick in the teeth”.

“The boomer generation has basically benefited from the most favourable economic circumstances in Australian history” he said.

“For them to suddenly turn around and go ‘we’ve benefited from this system, this same system has entirely worked against you (millennials), and so we’re gonna take all the benefits from that, and we’re just gonna run with it, and we’re not gonna leave you anything’ is just a little bit of a bitter pill to swallow.”

But the blame ultimately remained with the government, Mr Allen said.

“Our taxation system is just fundamentally so flawed. It’s like Swiss cheese. There’s so many holes and loopholes,” he said.

“This current government has been a real disappointment. They’ve really not done anywhere near enough to address the kind of economic fires that are going on because they don’t want to dislodge the boomer voter base, mostly, who are still reaping the benefits of this taxation system.

“What happens when rents start getting to like 60-70 per cent of most people’s income? You’ve got a recession on your hands.”

FIRE wrapped up

Those following the Financial Independence, Retire Early approach are diligently saving and investing to generate enough income to outweigh their living expenses.

The ultimate goal is to be able to retire early or cut back on work hours. Many aim to save just enough to “die with zero” to their name to max out on life experiences.

FIRE is praised for its no-nonsense approach to spending, but it’s achievability is questionable in the cost of living crisis.

However, if it fails, it’s still got young Australians putting money away and thinking about their futures early enough to make a dent in the long-term.

Originally published as FIRE explained: Pros and cons of the finance hack millennials are using to retire early