Vailo founder Aaron Hickmann’s headaches mount: A masked robbery, a cannabis company collapse and potential ASIC bans

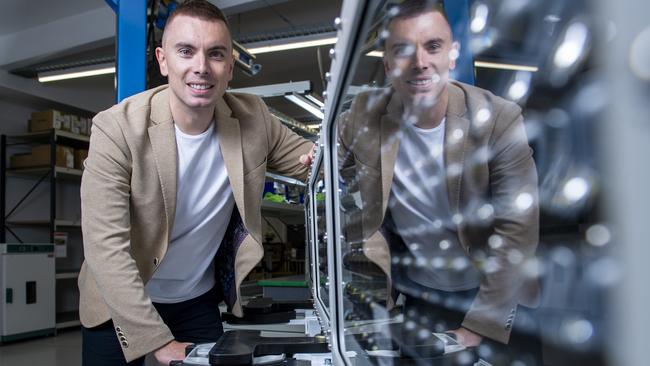

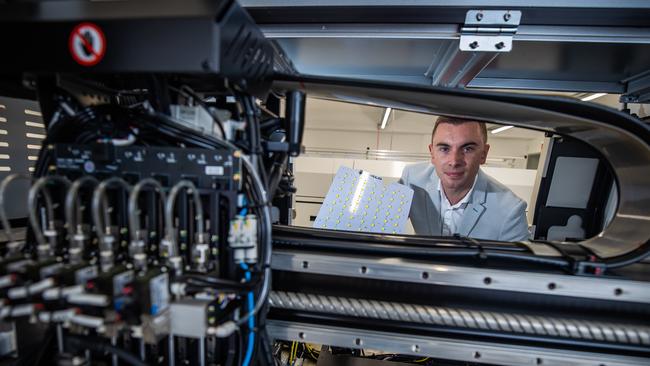

Millionaire businessman Aaron Hickmann says men in balaclavas invaded his family home last week – as he denied he could lose control of Vailo after the collapse of a medical cannabis firm.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

A millionaire Adelaide entrepreneur has insisted his directorship of a failed medicinal cannabis venture would not spark any future company bans, as he revealed his family was subjected to a terrifying home invasion last week.

Vailo founder Aaron James Hickmann, 34, denied to supporters he risked losing control of his high-profile brand, which is naming rights sponsor of the city’s returned Supercars motor race.

Adding to the intrigue is an early morning raid from three masked bandits on his Adelaide mansion while his family slept last week.

Mr Hickmann was majority shareholder of BBS Pharmaceuticals when in March last year he promised to inject almost $85m for construction, technology and manufacturing infrastructure.

But a corporate investigation by administrators has this week found the white knight’s vows to save the Murraylands project never eventuated and the business plunged into administration in January this year – three months after he resigned as a director.

“I am reaching out to share some news that has implications for Vailo,” Mr Hickmann wrote to supporters last night.

“The operations of our organisations are not at risk and we will continue to deliver on our commitments, unaffected by the situation surrounding BBS Pharmaceuticals.

“I want to assure you that the future of Vailo, Vircura, Ikara Estates and other associated ventures remains secure.”

He then goes on to detail the home invasion.

Mr Hickmann, who sponsors several major sport teams and events including the Adelaide 500 Supercars race, quit as a BBS director after just seven months, records show.

If creditors next week agree to wind up BBS, Mr Hickmann – director of at least 47 other companies – faces the possibility of being banned from managing a company as it would be his second involvement with a liquidated firm in seven years.

A ban would force Mr Hickmann to step down as director of his advanced stadium lighting manufacturing business, which underwent a “rebranding” last month, changing its name from its original VALO, which he founded in 2012.

Mr Hickmann, a father of one who denies wrongdoing, has now stationed security guards outside his $5.6m mansion in Adelaide’s inner south.

Police are investigating after three balaclava-clad intruders entered his yard at 4.15am on Tuesday last week but fled before entering his house.

It is unclear what sparked the incident, which occurred a week before the administrators’ report was made public.

In an email to supporters late on Thursday, Mr Hickmann described it as a “high security breach … attempted invasion and carjacking”.

“I’ve resorted to 24/7 security at our home, whilst working with police currently on a further attack,” he told supporters.

Early investigations into BBS’s affairs reveal a string of potential “offences”, or breaches of company laws, alleged against five current and former directors, according to the administrators’ report.

The allegations from administrators include potential insolvent trading and unreasonable and excessive payments to directors and related parties.

Administrators also allege unauthorised sales of company assets to related parties. There is no criminal investigation and no charges have been laid.

The administrators’ report, published this week, claims how “poor strategic management”, “high cash use”, a dispute between directors and years of losses led to its demise.

Nearly $3.5m in company payments before its collapse are identified as potentially uncommercial or unreasonable and could be recouped if liquidators are appointed.

The 82-page report, published after an almost $447,000 administration investigation, also alleges $202,000 in payments over two years to January 2023 “appear to be of a personal nature and include funds that were utilised for overseas travel”.

Almost 20 mum and dad investors and other shareholders have been left out of pocket after voting for a rescue plan put forward by Mr Hickmann’s Ikara Equities Pty Ltd in March last year, when he projected revenue would increase to $29.6m, and profit to $16m, by 2023-24 under his ownership.

Australian Securities and Investments Commission records show BBS co-founder Brandon Joseph Smith, 29, of the Gold Coast, was sole director when Hall Chadwick administrators David Trim and Brent Kijurina were appointed.

BBS, which is also the subject of District Court civil legal action, was licensed to produce medicinal cannabis products from its growing facility near Tailem Bend.

ASIC records show Mr Hickmann resigned as a director of Virtuous Research Pty Ltd, in August 2020, weeks before the company was wound up in December that year.

The corporate watchdog can apply for orders disqualifying a person from managing corporations for up to 20 years if they were an officer of two or more companies that failed within the last seven years and the way firms were managed contributed to failures.

Mr Trim, who recommended creditors vote to wind up BBS next week after four offers to buy the business failed, said it was up to ASIC to determine whether further action against Mr Hickmann would be taken.

“It is our duty as liquidators to report our findings to ASIC,” he said.

“It is then with ASIC to determine which, if any, further provisions of the Corporations Act they wish to enliven.

“But I am not in a position to comment on potential future actions to be taken by the regulator.”

Mr Hickmann’s lawyer, Greg Griffin, said his client was a BBS director for a “short period” and denied travelling overseas at the company’s expense.

Asked about a potential ban, Mr Griffin said: “Quixotic (unrealistic) ramblings of a person trying to build a position without any foundations. The Tower of Babel.”

Mr Griffin said losses were “restricted” from financial year 2020-21’s $1,023,362 “to just $139,322 over the next financial year when Mr Hickmann was a director”.

“Mr Hickmann resigned as a consequence of his concerns as to the integrity of the books and records of the company and in accordance with his duties as a director not to be party to an insolvent entity continuing to trade,” he said.

“Having regard to the short time that Mr Hickmann was a director of BBS and his resignation … there is no prospect of the administrators maintaining any insolvent trading claim against him.

“If instituted, any such claim would be vigorously defended.

“Mr Hickmann is more concerned that the administrators have in the four months since their appointment managed to bill … some $450,000, which he regards as outrageous.”

The other directors, who cannot be named for legal reasons, did not respond to inquiries.