Triple treat of stimulus is set to fire up South Australia’s property market

There’s a win-win ahead for SA first home buyers, property owners and investors alike and here are the reasons why, according to experts.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

- Suburb in profile: Spotlight on Daw Park

- Charm of yesteryear in Rose Park

- Inside North Adelaide’s most expensive apartment

- SA is home to Australia’s hottest housing market

A triple treat of stimulus is set to fire up South Australia’s property market as first-home buyer reforms, a looming interest rate cut and the rejection of negative gearing changes combine.

Experts say the state’s market will be significantly buoyed and have already recorded a spike in activity following the federal election.

Adelaide’s auction market will bounce back this weekend after several quiet weeks.

Real Estate Institute of South Australia president Brett Roenfeldt said the rejection of property tax changes, combined with first homebuyer incentives, would have a significant affect on the market.

“There will be very strong demand for that lower end of the market (and) there will be a bit of competition in that lower end of the market,” he said.

“I would envisage we will see a large amount of activity coming into the market place even though winter and the end of the financial year is traditionally a quiet time.

“We will definitely see a pick up — how far that will go I don’t know.”

Ouwens Casserly Real Estate managing director Alex Ouwens said his company received 11 unprompted appraisal requests on Tuesday morning.

“OC normally average one to two a day, so to get 11 through (on Tuesday) morning, it seems like it’s not a coincidence,” he said. “There’s confidence back in the market place.”

Klemich Real Estate director Matt Smith said he had personally opted out of staging many auctions in recent weeks because he could not assure vendors they would be competitive.

“We will be putting them back on the table,” he said.

CoreLogic is expecting 85 Adelaide auctions on Saturday and a total of 122 over the next week — the highest number recorded since the week before Easter. An additional boost is likely to come in the form of an interest-rate cut next month, with the Reserve Bank on Tuesday adding weight to expectations they would be reduced.

In Tuesday’s release of minutes from its latest board meeting, where it left the official interest rate on hold at 1.5 per cent, the RBA said “a decrease in the cash rate would likely be appropriate” if inflation stayed low and unemployment rose.

The jobless rate has been increasing slightly, inflation is low, and RBA governor Philip Lowe told a business lunch yesterday that a rate cut would be considered at its next meeting in two weeks.

“A lower cash rate would support employment growth and bring forward the time when inflation is consistent with the target,” Dr Lowe said.

Most economists expect one or two rate cuts this year.

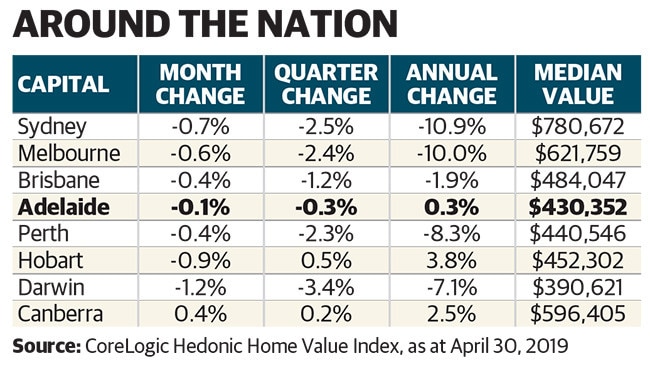

The South Australian market has defied heavy falls in property prices witnessed on the east coast and in Western Australia over the past year, leaving it well poised to capitalise on the stimulus measures.

Ahead of the federal election, both parties pledged to introduce a first homebuyer deposit scheme, allowing them to get into the market with a deposit as low as 5 per cent.

Harcourts SA chief executive Gregg Toyama said the first homebuyer scheme “will spur the market on from the bottom up.”