The Advertiser explains what you need to know about vehicle rego changes from July 1

SA motorists can choose compulsory third party insurance while registering their vehicles from July 1. We rate the cheapest and the best insurers to help you decide.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

Insurer Allianz has won a customer-based rating contest ahead of SA motorists having the power to select their CTP provider from July 1.

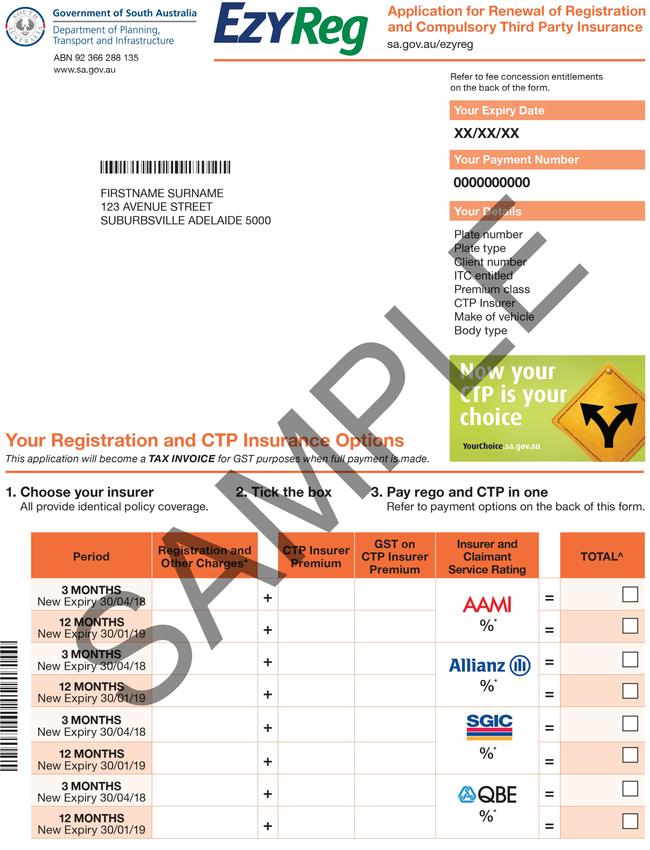

The State Government has revealed the ratings along with a how-to guide for motorists to be used when they renew registration from next month.

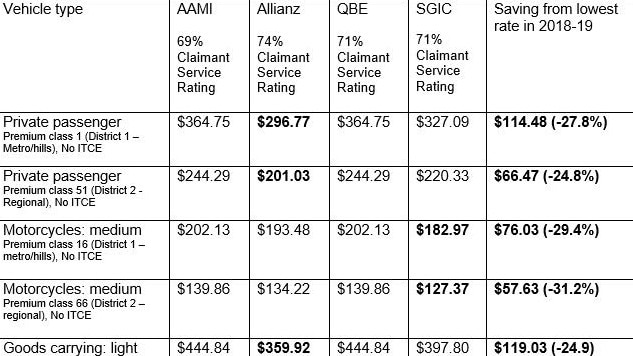

CTP for personal injury rehabilitation is compulsory, and the rating system is ongoing, but Allianz is currently leading the vote with a rating of 74 per cent from claimants, followed by QBE and SGIC on 71 per cent and AAMI on 69 per cent.

During a three-year transition period, four government-approved insurers have been offering the same product at the same price.

But from July 1 2019, while the same cover is on offer, prices and quality of service will vary to create competition in the system.

Allianz has also come out as the cheapest offering of the four for car owners, with their premium for a private passenger vehicle coming in at $296.77 a year.

SGIC’s premium is $327.09, while both AAMI and QBE have listed their premium at $364.75.

SGIC has the cheapest premiums for motorcyclists.

Allianz spokesman Nicholas Scofield said the company had used the three year period of fixed prices to refine a customer service strategy.

“Allianz’s CTP team has worked to identify the ‘moments that matter’ to our customers,’’ he said.

“The dedicated customer insights team seeks to eliminate customer ‘pain’ points, increase focus on customer service and improve experiences through easy to understand language.

“Through these focus areas, we aim to foster holistic recovery and return to health for our CTP customers.”

The CTP regulator has published details of how motorists can select their insurer, which is expected to cause delays at registration centres from July 1.

While the product will be the same, motorists will have to select the insurer based on the quote given to them for their type of car when they fill in their registration form, as well as the customer rating system which gives the best indication of the quality of the service provided.