State Government finally clinches land tax changes

The land tax deal has finally passed on its fifth rewrite. Here’s how it impacts you, the proposed new rates and all of the responses after a dramatic day in State Parliament.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

South Australia’s torturous land-tax saga is over, after Treasurer Rob Lucas clinched an unlikely last-minute deal, including concessions to the Greens that will see solar panels and batteries installed on Housing Trust properties.

In a dramatic day in Parliament that included tense negotiations to end a standoff that lasted 163 days since the June State Budget, Mr Lucas held together a coalition of the Greens and Independent MP John Darley to get a fifth rewrite of the package passed.

Additional sweeteners now given to the Greens are:

SOLAR panels for 75 per cent of all existing and new suitable Housing Trust stock. Batteries will have to go on 75 per cent of new public homes.

UPGRADES and maintenance on Trust homes, worth $7.5 million a year, starting in 2020-21.

MORE emergency accommodation for the homeless and family violence victims, at $2 million a year from 2020-21.

A TRIAL, to run for five years, which provides a land-tax exemption when private houses are rented at affordable rates and managed by a community housing provider.

That scheme will start in March and have eligibility controls attached, limited for up to 100 SA properties in total over the pilot period.

The cost of the scheme is about $400,000 per year. It will also be made clear that land used for certain heritage and conservation purposes is exempt from land tax.

On Wednesday, Mr Lucas had already announced details of a $400 million plan featuring support for the homeless and people struggling to get bank mortgages. On Monday, Mr Lucas gave Mr Darley extra tax cuts he had demanded to help smaller investors. It meant a plan which was originally intended to raise money for the Government by closing a tax-minimisation “loophole” now gives back more than it brings in.

The final plan passed the Lower House at 6.33pm.

Mr Lucas said cuts in land-tax rates across SA would deliver a fairer system that would drive new investment.

Responses to the land tax passing:

Greens MP Mark Parnell said he had secured a deal that was “certainly not perfect” but resulted in fairer tax and secured more than $10 million for the most needy.

“It still gives multi-millionaires tax breaks, and we’re not happy about it, but there is nothing we could do,” he said.

“What we risked was the once-in-a-generation opportunity to fix the aggregation measure (which currently allows land-tax minimisation through the use of complex legal ownership structures).”

Independent MP John Darley said: “I’m just glad it’s finally over”.

Opposition treasury spokesman Stephen Mullighan said the Government had made a string of embarrassing giveaways to pass a plan that would “hurt local jobs, small businesses and drive up rents”.

Master Builders Association chief executive Ian Markos said the group was glad this was finally done and dusted.

“If Master Builders didn’t lobby hard and push for a better deal, people would not be paying less tax on portfolios between $755,000 and $1.1 million,” Mr Markos said. “There would also not be $400 million allocated for affordable housing initiatives. We all want to see the industry firing – it is crucial for jobs and South Australia’s economy.”

Property Council SA Executive Director Daniel Gannon said the state’s anti-competitive land tax rates had discouraged investors and property owners for decades.

“We made a pragmatic decision to accept a fairer compromise from the Government late last month which ultimately led to the passage of this Bill,” Mr Gannon said.

“These reforms to rates and thresholds now pave a better pathway to future investment and a lower tax liability for the majority of property owners.”

A $25 million fund will help investors affected by the aggregation change transition over the next three years.

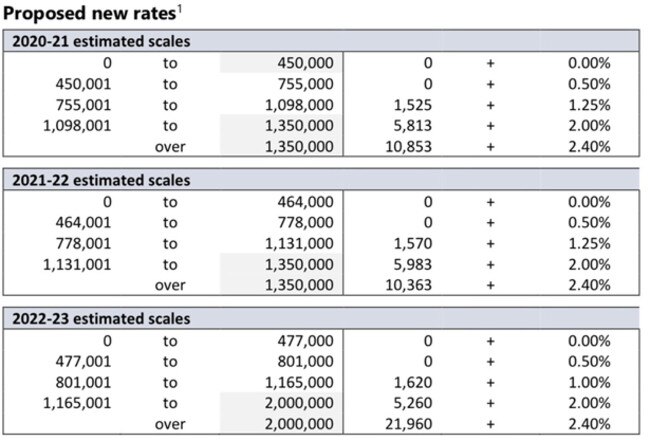

Properties valued under $450,000 will be exempt from land tax. Land tax for portfolios valued between about $755,000 and $1.1 million will have their rate fall from 1.65 per cent to 1.25 per cent in 2020-21 and then to 1 per cent in 2022-23. The point at which the new, lower 2.4 per cent top rate of land kicks in will be $2 million.