SA faces years of power prices double other states

SOUTH Australia faces wholesale electricity prices roughly double that of other states for more than two years, prompting grave warnings of new job losses — and thousands of homes being disconnected.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

- How power price surge during storm chaos hit SA employers

- Investigation into huge increases to SA power bills

- Energy Australia hikes electricity price by average of $261 a year

- What’s the weather going to do next?

SOUTH Australia is facing wholesale electricity prices that are roughly double that of other states for more than two years, prompting grave warnings the burden will spark new job losses and lead to thousands of homes being disconnected.

The Advertiser yesterday revealed Treasurer Tom Koutsantonis had been forced to ask the privately-owned gas-fired Pelican Point power station to increase output, in a bid to avoid temporary shutdowns at the state’s biggest businesses as they battled skyrocketing power prices.

Three SA manufacturing powerhouses have now spoken out about the immediate dangers posed by expensive electricity, including the administrators readying the Whyalla steelworks for possible sale.

The Australian Industry Group on Thursday night also declared it was “genuinely concerned about the impact of high power prices on the competitive position” of SA’s traditional manufacturing.

A spokesman from Arrium administrator KordaMentha said the company “absolutely” considered scaling back or temporarily shutting down its operations in the past week, and SA needed a new long-term energy strategy to avoid becoming “an unattractive place to operate”.

BHP Billiton has now also warned that high costs and unreliable power are a “significant concern” for the company and the “sustainability” of its Olympic Dam mine, which had been spruiked for a $50 billion expansion that was to underwrite the state’s economic future.

Adelaide Brighton Cement — one of the handful of high-energy manufacturers remaining in SA — says access to cheap and reliable power was “essential” to its future.

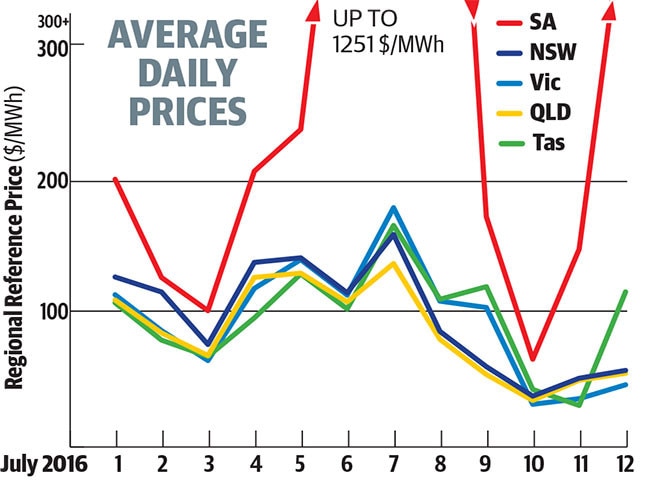

Australian Energy Regulator figures show the cost of wholesale power in SA will remain higher than all other states in the market for the foreseeable future, and about double that in Victoria.

Wholesale energy costs are the prices charged by power stations.

They add up to about half the standard business or households bill, which also includes costs for building poles and wires.

SA currently pays $70 per megawatt hour for its wholesale power, and the AER forecasts that charge will rise to peak of $94 by mid 2018, when the price in Victoria will be just $41.

Despite Mr Koutsantonis’ assurances that the incident was a one-off caused in part by recent storms, business groups and the social services sector have warned of more pain to come.

Analysts have blamed SA’s world-leading levels of wind and solar power for forcing the closure of baseload fossil fuel plants like that at Port Augusta, and leaving the state exposed to price shocks and unreliable supply at times when the wind isn’t blowing or sun isn’t shining.

The state was left unusually vulnerable this week because work on upgrading an interconnector to Victoria, which usually brings in coal-fired power to SA, was delayed due to bad weather.

Businesses which appealed for Mr Koutsantonis’ help this week are understood to include major employers BHP Billiton, Arrium, Nyrstar, Adelaide Brighton and suppliers to Holden.

Collectively, the group of up to 10 concerned businesses employ more than 10,000 people.

Uniting Communities advocacy manager Mark Henley said it was difficult to predict future movements in household bills, but further rises of up to 10 per cent could be coming.

“If prices do creep up 10 per cent higher, as a worst-case scenario, we’ve already got about 15,000 disconnections now and I’d guess that could rise to about 20,000 in SA,” he said.

“Already we’ve got literally thousands of SA households, maybe about 40 per cent, who are struggling to pay their bills at some stage during the year.

“With a sluggish economy, we’d expect to see more people struggling to pay, more hardship and giving up things like medical care or people eating very poorly to find the money to meet their bills.”

Mr Henley emphasised that the state’s large volume of renewable energy could become a long-term advantage, especially if battery storage technology could be mastered and exported.

However, he said there was a rocky road of several years ahead as the world watched SA as a green-energy guinea pig that was struggling to make the transition to a low-carbon future.

Australian Industry Group SA branch head Stephen Myatt said: “We do have genuine concern for some companies as they come out of contract”.

Those companies would either sign new fixed price contracts at much higher costs or battle in the volatile spot market, he said.

“Return of the interconnector should provide greater pricing stability but there is still the ongoing issue of SA electricity prices being considerably higher than the other states,” Mr Myatt said.

Business SA chief executive Nigel McBride said local companies were already considering moving their operations interstate, while others considering an investment stayed away entirely.

“The one thing that we know for sure is that we are going to see increases in power prices across the board for the next three years,” he said.

“We’ve been raising the alarm for a long time now and there’s been an overemphasis on renewables and neglect of baseload energy.

“My concern is business confidence, and investment confidence in the next three years.”

Mr McBride said the exit of Holden, uncertainty in Whyalla and a further decline in defence jobs before the frigates and subs builds started posed major medium-term employment problems.

“A lot of big employers, where power is a pivotal issue, are saying that they’re really going to have to start considering where they base their operations,” Mr McBride said.

“A lot of my members who are near the border say they could just move across and get a much better deal.”

Treasurer Tom Koutsantonis said taxpayers had not been billed for the extra 239 MW of production at Pelican Point, which ramped up late Thursday and will continue to July 24.

Mr Koutsantonis took the historic measure of requesting the plant produce more baseload energy in a bid to stabilise volatile prices and provide certainty to SA’s major industrial businesses.

“They (power station owner Engie) did it because the State Government had to intervene, not because of renewable energy or our energy mix but because of a perfect storm,” he said.

“While you’re upgrading the interconnector between SA and Victoria, and that’s something that we believe and the market believes will lower power prices, that needs to be stabilised.

“Because of the high winds, some of that work has been delayed.

“On top of that, you had this unprecedented storm and this cold front run through SA and across the eastern seaboard.

“You’ve seen dramatic calls on gas prices across Australia.”

Mr Koutsantonis said he could not guarantee a similar price crisis wouldn’t occur again, blaming the privatisation of ESTA in 1999 for removing direct state control from the energy market.

“That’s been taken all out of our hands and we’re at the mercy of the free market,” he said.

“What’s doing harm to our economy is that there is not a proper national electricity market.”

The Government is funding a study to build new interconnectors with other states, which would allow SA to export excess green power on windy days and bring in baseload when needed.

It is also hopeful of a breakthrough in battery storage technology, which would allow for homes to store solar energy or the slow release of wind power into the grid as needed.

BHP Billiton’s Olympic Dam head of corporate affairs Simon Corrigan said the company was working closely with the Government and grateful that Mr Koutsantonis stepped in to help.

“Escalating costs, as well as the security and reliability of power, have been a significant concern for BHP Billiton and the sustainability of Olympic Dam,” he said.

“Throughout this challenging period, our team has done great work to safely reduce our energy use while continuing operations, with minimal impact to production.”

Adelaide Brighton Cement said that it was doing everything possible to reduce volatility in its energy costs and closely monitoring it use to maintain maximum efficiency.

“Adelaide Brighton Cement is one of the few energy intensive manufacturing industries still

operating in South Australia. As a competitor in a global market, it is essential for us to have

access to availability of uninterrupted economically competitive power,” the company said.

Conservation Council chief executive Craig Wilkins said renewable energy was being “unfairly made a scapegoat for failures in our power grid” and called for a statewide summit.

“We need a consensus from community, industry and government on how we can fix the mess in our power grid,” Mr Wilkins said.

“SA ... (has) an over-concentrated electricity market dominated by too few players. That’s a real market failure.”

Opposition Leader Steven Marshall said the “current energy price crisis in SA is completely the responsibility of failed energy planning by this Labor administration”.

“They gave planning approval to huge numbers of wind farms without consideration for the consequences of undermining the viability of baseload power in SA,” he said.

“They put no plans in place whatsoever to counter balance it.”

Mr Marshall said there was “no simple solution” but there needed to be an immediate examination of how to boost storage and interconnection as well as manage demand.

He said the state also needed to find ways to incentivise production of more baseload energy.

Shelling out this much is totally nuts

— Daniel Wills

RIVERLAND success story Almond Co is bracing for a $250,000 jump in its annual electricity bill — and has warned major change is needed to help the state’s growers remain competitive globally.

The 140-person operation is a poster child for the state’s push into the clean, green food market. But the company, which processes almonds at two plants in Lyrup and Renmark, now faces a worrying price hit as old, dirty energy leaves SA and wind takes over. Almond Co group operations manager Brenton Paige told The Advertiser that his company currently spends $1 million a year on electricity, a price that has been locked in with a long-term contract.

But he will soon be thrust back into the market to negotiate a new price and expects to suffer a 25 per cent jump in cost as SA’s wholesale energy prices march upward.

Mr Paige said Almond Co had been “protected” by a fixed price contract that runs until the end of the year. And he said there were “mammoth increases” ahead as that grace period ran out.

“I know some other businesses that have already come out of contract and are really up against it and experiencing those higher prices,” he said. “I’m in for a very rude shock.”

Frustratingly, it’s only a short drive across the border into Victoria where growers pay about 40 per cent less for the wholesale energy that is the lifeblood of their businesses.

He said: “It impacts on our ability to offer returns to our growers. With costs going up, they get less. Then, it makes us uncompetitive with other almond-producing countries such as Chile and others.”