Payroll tax respite to feature in 2017 South Australian Budget to address state’s unemployment woes

HUNDREDS of South Australian businesses will receive payroll tax respite in this year’s State Budget as the Government intensifies efforts to address the state’s unemployment woes.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

- Funding announced for new Women’s Hospital at nRAH

- New terror laws introduced in South Australia

- State Budget 2017: Labor robocalling voters to spruik health reforms

HUNDREDS of South Australian businesses will receive payroll tax respite in this year’s State Budget as the Government intensifies efforts to address the state’s unemployment woes.

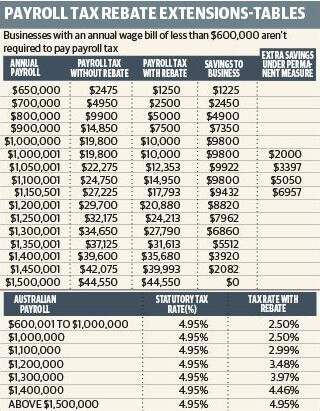

The Advertiser can reveal Treasurer Tom Koutsantonis will extend rebates to 1300 businesses with a payroll of $1.2 million to $1.5 million.

It’s the first economic measure of a Budget Mr Koutsantonis said would boost business confidence and help to grow important industries, with the closure of Holden’s Elizabeth plant just three months away.

STATE BUDGET 2017: FULL COVERAGE FROM 3PM THURSDAY

ALL THE BIG SPENDING ANNOUNCEMENTS

YOUR FIVE MINUTE GUIDE TO STATE BUDGET 2017

ANALYSIS BY STATE POLITICAL EDITOR DANIEL WILLS

The Government’s will now shift attention to job creation ahead of tomorrow’s Budget, after unveiling more than $1 billion in health spending in recent days.

Their push to turbocharge the economy comes as South Australia sits atop the unemployment table with a seasonally adjusted rate of 6.9 per cent.

The rate is exactly the same that faced Mr Koutsantonis last year when he announced a series of measures to boost jobs — including more than $100 million in Jobs Accelerator Grants and the temporary payroll rebate he’s now seeking to extend.

Mr Koutsantonis said this week that he wanted to double down on that strategy and the time was ripe for the Government to “step up”.

He said the rebate announced in last year’s Budget will be legislated and made permanent, but boosted, so businesses with payrolls between $1 million and $1.2 million will be thousands of dollars better off.

The extension — which will deliver the 1300 small businesses savings of between $2082 and $8820 — will apply from July 1, and is expected to cost the Budget $45 million over four years.

It will also lock in savings of up to $9800 for businesses with payrolls between $600,000 and $1 million, effectively halving the amount of tax paid.

Mr Koutsantonis said the added certainty would give small businesses the freedom and confidence to expand their operations and hire more employees.

“Our economy faces challenges as the closure of Holden approaches. This State Budget is about

creating new opportunities by supporting key growth industries, and giving our businesses the

confidence to invest and grow,” he said.

“With payroll tax relief and Job Accelerator Grants available for each new employee, now is a great time for businesses to consider growing and employing more staff.”

Business SA chief executive Nigel McBride applauded last year’s rebate announcement, which locked in rates until 2020, saying it would give businesses confidence to employ.

He’s expected to support the extension but push for a targeted suite of outcomes to reduce the state’s unemployment rate.

The Opposition has also lobbied for the rebate to be extended and made permanent.

Mr Koutsantonis has previously resisted calls to extend the rebate for more than four years because it would require a complete overhaul of the underlying payroll tax rates.