Motorists have only one month to get to grips with a confusing new car insurance system, so here is how it works

Many people had lots of questions when the SA’s new CTP insurance insurance system was revealed this month. So we went and found the answers.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

Big brother currently decides which insurance company will look after you or your family if you are seriously injured or killed on the road by automatically allocating an insurer at the time of registration.

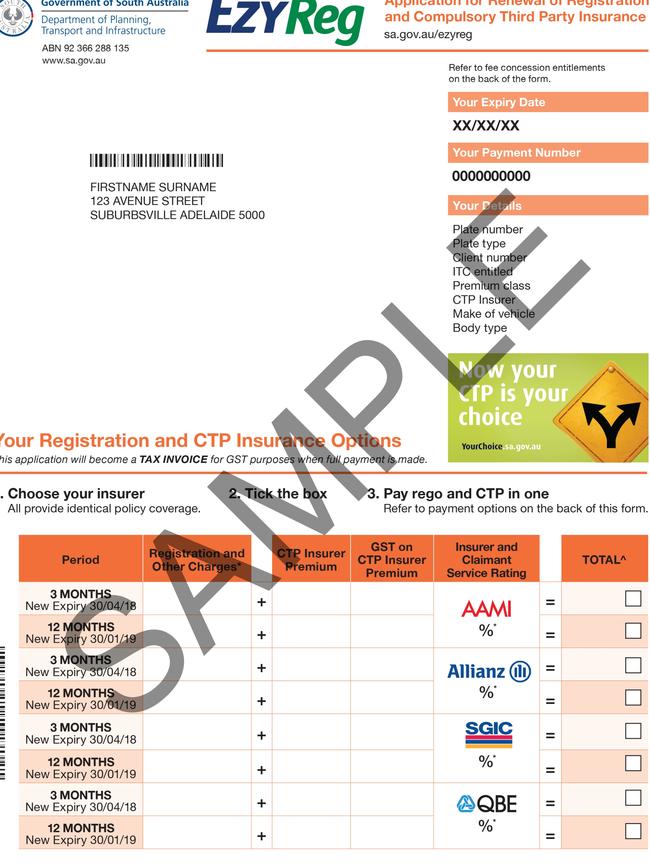

But that changes from July 1, when every motor vehicle owner must nominate one of four insurance companies based on price and quality of service.

The care provided and compensation doesn’t change, but based on current feedback from those who have had to claim, Allianz is the best provider.

Claimants have currently rated the organisation at 74 per cent compared to QBE and SGIC on 71 per cent and AAMI on 69 per cent.

That’s where things become complicated, because motorists will also have to decide on price.

Allianz has also currently come out as the cheapest offering of the four providers, with a premium for a private passenger vehicle coming in at $296.77 a year.

SGIC’s premium is $327.09, while both AAMI and QBE have listed their premium at $364.75.

When The Advertiser explained the new system last week dozens of readers expressed their confusion, and asked many questions.

We put these to the new Compulsory Third Party insurance regulator who has offered this how-to guide.

Q: What is this about? Do I have to worry about this if I have RAA comprehensive insurance? – STEVE

A: Yes you do. CTP is a compulsory insurance paid when you register your vehicle.

It covers you from being personally liable for the financial impact of injuring a road user.

Those injured in car accidents receive access to treatment and support to help them get back to work and life as quickly as possible following an accident and compensation as the law allows.

Comprehensive insurance is a different insurance for property damage.

It’s optional, and covers your (and other) property against events like fire, theft, and accident damage. It does not cover personal injuries.

Q: My registration is due before 1 July and I normally pay annually. How do I take advantage of the savings being talked about? – Anon

A: How you renew is your choice. You can select a shorter registration period for your current renewal if you want to choose a CTP Insurer as soon as possible after 1 July 2019.

Q: So, going on the ad for this, if each insurer’s policy coverage is the same, why bother with the extra complication of choosing one? If the system isn’t broken, don’t fix it! – PETER

A: By introducing competition, the Government is encouraging insurers to compete on service as well as price, to the benefit of motor vehicle owners and people injured in motor vehicle accidents.

The single step of choosing an insurer is included in the same one transaction when you register your vehicle.

Q: I have had comprehensive insurance with the RAA for years and they are one of the state’s biggest insurers, why are they not on the list? – TIM

A: Only AAMI, Allianz, QBE, and SGIC are currently approved by the Government to provide CTP insurance because they applied to do so and met the strict requirements of South Australia’s CTP Scheme. Other insurers can also apply if they wish.

Q: Third party insurance is compulsory. In other forms of insurance a company can assess you an unacceptable risk. Can the same happen here? Is so, what happens? – IAN

A: CTP Insurers cannot decline your business and cannot set a premium for individuals. Premiums are set for a premium class, which groups vehicles based on use and type.

Therefore everyone who registers their motor vehicles is automatically covered in the event they injure somebody while driving and an injury claim is made.

Q: As long as one is covered for 3rd party property damage how will the different policies work? Need to read the fine print as the excess between the policies may be different should an event occur. – KOSTAS

A: All four government-approved CTP insurers offer the same cover and cannot be altered. There is no excess, no fine print. The Policy of Insurance is available on our website.

Q: Quandary, buyer (owner of car) pays for policy that may pay a benefit to another driver. Not the purchaser. So if we all buy the cheapest policy, but worst cover, who wins? – TONY

A: The cover is identical for all four insurers. The CTP Policy of Insurance (cover) is set by the Government and cannot be altered by a CTP insurer.

The CTP Insurer you choose will be the insurer managing a claim for the person injured by anyone driving your vehicle. This includes passengers, which may be you or a family member.

Q: How is it supposed to save us money? I just renewed my rego under the old scheme, the cheapest listed on the example is $1 dearer than what I paid last week. – DARK

A: Without knowing your particular circumstances, generally speaking, motor vehicle owners who have a Class 1 private-use vehicle with no ITC entitlement in District 1 will be able to save up to $114 a year on their CTP insurance premiums from 1 July 2019.

Q: Doesn’t it work out cheaper to have everyone insured by the same company? This seems another way to slowly push up prices. – EMILY

A: The CTP insurers have to set their premiums within a range set by the Regulator. The cost of the CTP premiums is primarily driven by the number and cost of CTP claims.

Our scheme is community rated which means we take vehicle type and use and garaging address into account when setting the range, not individual driver history or driving patterns. This supports affordability for all SA vehicle owners.

Q: How will this alter the price of the overall rego, is there somewhere we can look at this? – KELLY

A: It depends on your individual circumstances. There are ‘Calculate renewal fee’ search functions in EzyReg where you can calculate the overall cost of registration including CTP insurance for your own vehicle from 1 July 2019.