Legendary SA expat quits high-profile London ad company

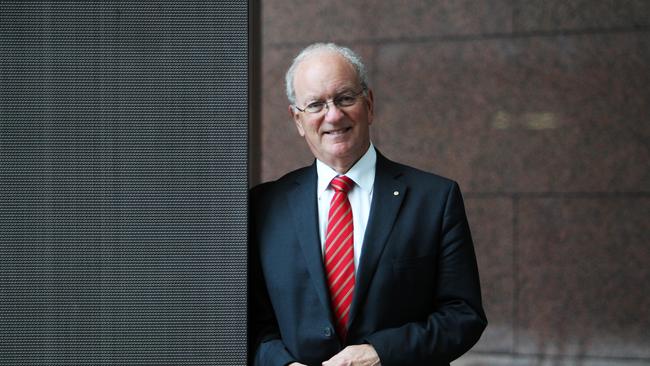

Legendary SA expat Bill Muirhead has quit his high-profile London ad company job and will spend more time back in Australia.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

South Australia could be seeing a bit more of one of its most successful expats after advertising legend Bill Muirhead announced he would quit as executive director of M&C Saatchi on March 31 next year.

Muirhead has also been South Australia’s Agent-General in London for past 14 years and is one of the best-connected Australians in the UK. Muirhead has been at the pointy end of the advertising industry for 50 years and has also helped run political campaigns for Tory Prime Ministers including Margaret Thatcher, John Major and David Cameron.

Muirhead announced last week he would be leaving Saatchi along with David Kershaw and Jeremy Sinclair, who formed the company together 25 years ago.

In an email to staff, the trio said: “The company has done work that changed the world – in politics, arts, society and of course, business. It has done start-ups in places and new areas which have become world leaders.’’

Still, all three leave under a cloud of what they described as the “horrible shadow cast over it with the accounting misstatements of 2018’’. The irregularities saw the company overstate its profits by around $21 million going back to 2014.

The revelation of that scandal last year saw another company founder, Maurice Saatchi and three independent directors leave the agency.

The company is currently suspended from trading after it missed a deadline last month to publish its annual accounts.

In an interview published in The Sydney Morning Herald, Muirhead said he was looking forward to spending more time in Australia and had been due to fly to Adelaide last Sunday, until new the eruption of coronavirus cases, which led to the lockdown of the state, stopped all international flights.

Firing up at AGM

The Beston Global Foods annual meeting this Thursday is shaping up to be an eventful outing, with the board facing the prospect of a possible spill vote, and a dissident shareholder looking to join the board.

The cheese and meat company rewrote the corporate governance book last year, when it failed to show shareholders any details of votes cast at that annual meeting. It was later revealed that almost 65 per cent of votes were cast against the remuneration report, with 25 per cent considered a “strike” under Australian corporations law.

Chairman Roger Sexton, who was then also the local head of the Australian Institute of Company Directors, told that meeting it was now considered “best practice” not to divulge votes during meetings- a notion thoroughly dismissed by the Australian Shareholders Association.

Two strikes triggers a spill vote, which can turf out the entire board.

One of the issues in play is the management of the company through Sexton’s company Beston Pacific Asset Management, which is paid about $2 million a year.

Senior execs are paid via BPAM, meaning their remuneration is not divulged, and BPAM’s fee is calculated on the value of assets under management, which is currently out of whack with the actual market value of the company.

The independent directors on the board looked at terminating the deal this year, but decided against it. Terminating the arrangement would have involved a shareholder vote and an undisclosed fee paid to BPAM.

Beston’s performance has been poor. While the past year has seen some positive steps towards profitability, it has lost money consistently since listing in late 2015, and at 8c, the company’s share price is 20 per cent down on last year’s level.

Yuan Ma from 10.6 per cent shareholder Kunteng Pte Ltd is seeking to join the board this year, while two other directors are up for re-election.

Kunteng – a wholly owned subsidiary of Chinese private company Dalian Hairunlai Group – dropped $28 million into Beston at 45c a share in 2016.