Homestart shared equity scheme makes buying a home more affordable

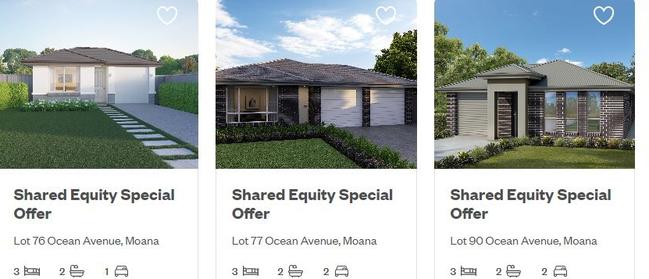

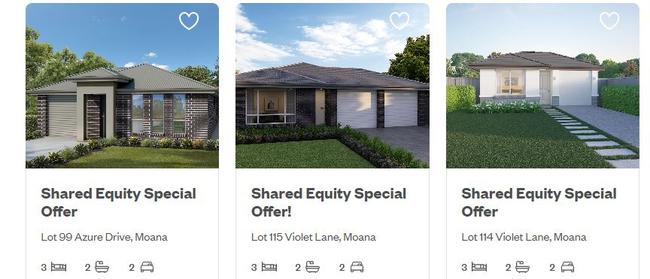

‘Shared equity’ housing schemes can make buying a home as affordable as renting. Here is how it works – and how you can find a property for $400,000.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

Public interest in shared equity housing loans has soared because of the rental crisis.

The state government’s housing finance company, HomeStart, said its shared equity loan portfolio had increased by 300 per cent in the past financial year.

Chief executive Andrew Mills said under shared equity, home buyers only made repayments on 75 per cent of a loan – with HomeStart paying the remainder.

“The advantage is that the homebuyer is only making regular repayments and paying interest on their part of the loan and not the shared equity portion,” he said.

“HomeStart is essentially a silent partner and instead will share in any gain or loss when the house is sold.”

“With Adelaide rents rising by 4.4 per cent over the past quarter, renters are faced with having to find additional money for rent, or if they can, enter the housing market when interest rates are rising sharply alongside house prices,” he said.

“However, a South Australian renting a home for the average median weekly rent of $492 could buy a home through HomeStart’s Shared Equity Option up to the value of around $510,000 for the same amount in mortgage repayments as rent.”

Mr Mills said shared equity had a significant impact on affordability because homebuyers only needed to afford repayments on 75 per cent of the price of a home.

“With HomeStart’s shared equity, they also don’t have to worry about monthly Reserve Bank interest rate rises because HomeStart only increases mortgage repayments annually with CPI,” he said.

This meant repayments only increased once a year by no more than inflation, instead of going up every time interest rates rise.

Mr Mills said HomeStart had been offering shared equity since 2007 “but it comes into its own in these current market conditions”.

“Rising rents, interest rates and house prices, coupled with growing cost of living pressures, mean that more South Australians are stuck in a cycle of paying much higher rents, while not being able to move into home ownership,” he said.

“The wider benefit of getting more South Australians into home ownership through schemes like shared equity along with other HomeStart loans can pull more South Australians out of renting into their own home, freeing up more rental properties which are in high demand.

“Shared equity through HomeStart is unlocking home ownership for many renters, often without paying any more in loan repayments than they were paying in rent.”

For more information about Homestart’s shared equity scheme, click here.

To search for shared equity properties available on HomeSeeker click here.