COVID-19 financial crunch brings out Christmas Grinch with national survey showing South Australians are planning to cut back

COVID-19 is hitting Christmas with a new survey showing many South Aussies will ditch gift-giving and festive cheer this year. Will you be one of them?

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

More than 10 per cent of Australians will forgo buying Christmas presents this year with many saying they’ll do away with a celebratory meal as well, according to a new national survey.

The research shows four in five households (78 per cent) are planning to spend less – or nothing at all – on festive gifts in 2020.

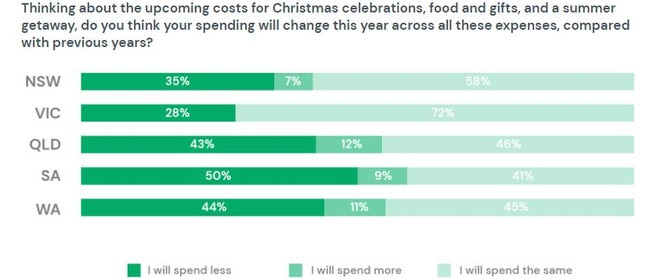

In South Australia, 50 per cent of respondents said they would spend less with just nine per cent planning on spending more than previous years.

Eleven per cent of South Australians surveyed said they wouldn’t be buying gifts while 28 per cent said they planned to spend less on festive cheer, such as Christmas lunch.

In New South Wales, 45 per cent said they would spend less on gifts with 26 per cent planning on tightening the belt on Christmas Day lunch expenses.

The survey commissioned by financial information platform Money.com.au found 39 per cent of people nationally intended to spend less on Christmas gifts this year, compared to last.

Money.com.au’s Helen Baker said if people were under financial pressure, it made good sense to cut out the excesses of the festive season.

“With many households experiencing financial hardship this year – and with an uncertain economic recovery – it may be wise to cut back spending on Christmas and holiday expenses,” she said.

“I encourage households to review their financial situation now to determine how much they can spend this summer.

“I also encourage people to be conservative in their spending, particularly if they are dipping into their savings.”

The survey revealed 32 per cent of Australians planned to use a form of credit to pay for expenses in December and January while 31 per cent said they would dip into their savings.

Ms Baker recommended against piling up the credit card with purchases, especially if job prospects in the new year remained uncertain.

However, she said there were tips to making a credit card work.

“If you are in a good position and use your credit cards for points, you may want develop a strategy for it,” she said.

“Rather than pay your credit card when it is due, do a balance transfer to buy yourself, say six months interest free (and) this will keep more of your money in your home loan offset account, for instance, guaranteeing a reduction in interest on your home loan while also saving interest on your credit card.”

In other findings:

A TOTAL of 28 per cent of households surveyed said they would spend less on Christmas celebrations, including lunch and dinner with 10 per cent saying they wouldn’t celebrate at all.

OVERALL, 44 per cent of households will spend less on Christmas celebrations, food, gifts, and a summer getaway this year, compared with previous years.

WHILE 38 per cent of respondents said they were ditching their summer holiday travel plans and 20 per cent were reducing their holiday budget.