Sanjeev Gupta’s made big promises before. And so far he’s delivered

Before Sanjeev Gupta made big promises to save the city of Whyalla, he made similar pledges to a struggling steel town in Wales in the UK. This is what happened there.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

- ANALYSIS: Gupta gives cause for optimism

- Gupta promises to speed up payments to Whyalla suppliers

- Whyalla transformation: Gupta reveals steelworks rescue

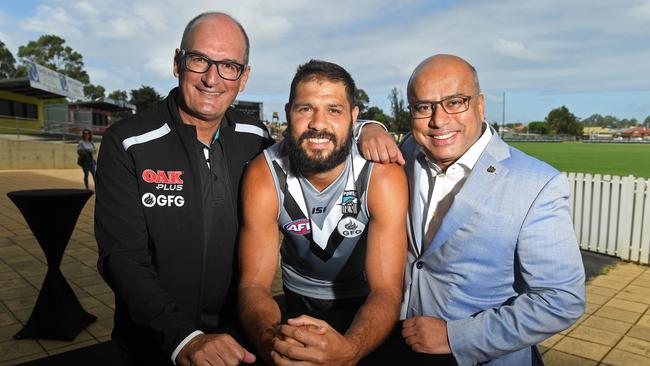

- Port Adelaide FC signs sponsorship deal with GFG

When Sanjeev Gupta bought a failing steel mill in Wales in 2013, the place was going bust, and 150 staff were set to lose their jobs.

The then-little known Gupta had been a mid-level commodities trader for more than 20 years, but was just getting started on a global acquisition spree, buying up distressed or underperforming steel mills around the world.

Gupta’s company Liberty House bought the mill at Newport in Wales from its Russian owners, placed it in mothballs — then made an offer the workers never expected.

In a bid to keep the workforce together, all 150 employees would remain on the books, and be paid 50 per cent of their wages, even though the mill was closed and there was no work for them until it was upgraded.

They could get another job to make ends meet in the meantime. Gupta also vowed to keep their superannuation payments up to date.

Two years later, the mill finally reopened — and 144 of the staff came back.

It was the kind of innovative — or crazy-brave — approach that has seen Gupta turn his business into a multibillion-dollar behemoth, buying or developing 200 sites around the world — including the Arrium steel mill at Whyalla in South Australia — and employing 15,000 people globally.

The Indian-born Gupta, who now lives mainly in Sydney with his English-born wife Nicola, has raised eyebrows in financial circles with the speed of his acquisitions and the debt he has taken on to fund them.

Liberty’s finances are opaque so it’s impossible to tell exactly how it’s performing, or how much debt it is carrying. Under the umbrella of GFC Alliance Gupta owns an array of privately-owned businesses including mining and steel mills purchased by Liberty House, such as the mills in Newport and Whyalla.

He also owns a bank in London, Wyelands, named for the historic property he bought with his wife Nicola near Newport.

The Financial Times in London revealed last year that a Swiss asset management company, GAM, was returning billions of dollars to clients after suspending one of its fund managers who invested heavily in GFC Alliance-linked bonds, allegedly without adequate due diligence. While there was no suggestion of wrongdoing by Gupta or his companies, it did reveal where a large amount of its financing had come from.

In 2016, when Liberty reopened the Dalzell mill in Scotland with the help of a $12.5 million loan from the Scottish Government, there was deep unhappiness in the first year among suppliers who were paid late, and even production halts as the company struggled to keep up with payments for supplies.

In South Australia, the company has apologised after Small Business Ombudsman Kate Carnell strongly criticised it for treating small businesses as “cheap banks’’ by making some wait more than 100 days for payment.

A company spokesman told News Corp this week that a combination of “legacy payments terms’’ inherited from Arrium, along with outdated processes and systems and a spike in market demand, had caused the problems with supplier payments, but that the company had tackled them as a matter of urgency.

Regardless of some of the payment issues, there’s no denying the success of his approach in Wales, which kept the mill, now named Liberty, alive, with a growing workforce.

Gupta has now purchased a power station next door, and is converting it to more eco-friendly

pelletised waste, so the power can be used to open a new scrap melting and casting facility at

Liberty.

Alun Davies is a national organiser for Community, the old steelworkers union, and said the union had initially been sceptical of the proposal to offer the workforce half-pay.

“One hundred and fifty people at 50 per cent is a large chunk of money,’’ he told News Corp

“We were dubious until he started. Then we started seeing people get paid.’’

Still, the union worried how long such a deal would continue. Around 20 people went straight back to work on essential maintenance, but there was no time frame for when the majority of the workers could return to their jobs.

“We started asking how long he (Gupta) would do it for. Then he kept doing it,’’ Davies said.

“We can’t fault the guy. Everything he said he was going to do, he’s done it.’’

Many of the workers took other jobs in haulage or at the local timber yard during the shutdown period to help them get by, but almost all of them came back when their jobs at Liberty became available again.

Davies said 96 per cent of the workforce came back to their old jobs when he mill reopened in 2015.

And the offer of half-pay was not confined to just those with specific skills — it applied right across the business, from all jobs on the factory floor through to administration and office jobs.

“It was the whole lot — he didn’t discriminate against anyone,’’ he said.

Davies said the company had approached the union and proposed the half-pay deal. At the time, the union had heard about Gupta but didn’t know a lot about him.

He said the company had said “the workers were here, we know they are skilled and we want to keep the workforce’’.

“It was 18 months, two years. We thought he’d pull out but his attitude was, as long as it takes.’’

Davies, who worked in the steel industry himself for 20 years, including for Liberty under a different owner, said while the company was occasionally late with its payments, it was literally only by a few hours and always ended up paying in full.

“There is loyalty there, they (the workers) wanted to come back,’’ he said.

Newport used to be a big manufacturing town, with more than 3000 people working at its three steel mills. Now it’s down to around 1200 people.

Davies said Liberty was looking at expanding, and “if Sanjeev’s vision comes off, Newport will boom.

“There’s 180, 200 people now (at the Liberty mill) and the workforce could go to 600,’’ he said.

A spokesman for Liberty said there were currently 183 workers at the mill, which rolled steel into coils and reinforcement.

“Our future plans are to install scrap melting and casting facilities at the site so that it can make its own liquid steel and cast its own slab,’’ the spokesman said.

He said scrap would be melted in an electric arc furnace.

“This will make the plant more competitive and provide the basis for substantial growth.

“The power plant next door which is also part of the GFG Alliance is being converted from its original coal-burning technology to burning pelletised waste, a lower carbon fuel made from materials that would otherwise go to landfill.’’

The spokesman said the new facility would create another 300 jobs at the site, and many more jobs indirectly through the local and regional supply chain.

Ray Phillips, 66, was one of those who took the half-pay offer and returned to work at Liberty.

An IT technician (and chairman of the Community union branch at the mill), Phillips has worked in the steel industry for 50 years, and at the Liberty mill since 2005.

He recalled the day workers were called in to be told the mill was being mothballed, but they would be offered half-pay.

“The director got up and made a statement, that he was just letting us know we were being laid off on gardening leave,’’ he told News Corp.

The workers questioned what that meant and were told they would not be required for work but would be kept on the books on half-pay with the intention of reopening the plant and getting it operational as soon as possible.

If they wished to leave, they could do so. Alternatively they were encouraged to seek other work during the period the plant was shut down.

“I signed up for other work,’’ Phillips said.

He worked in administration and logistics for a beverages company, and seven months later, went back full-time at Liberty.

Asked how important it was for the workers to be retained and able to re-join Liberty, he said: “Very important. I’ve been in engineering, steelworks, for 51 years. I came back after they maintained me on the books.

“What Mr Sanjeev Gupta has done is a miracle. It’s brilliant, he’s a lifesaver.

“The more of these factories we can keep going, and keep them producing, the better, and this is really good.’’

Phillips said Newport has once been built around its steel and coal mining industries, which had been the lifeblood of the town.

“It’s important for the whole area,’’ he said.

“Not only for me or the workforce but the whole area.’’

Phillips and his wife have lived in Newport since 1985 and raised four sons there. His father, uncle and oldest son all worked in the steel industry too.

“It’s in the blood,’’ he said.

He started in 1968 as a 16-year-old apprentice in an engineering workshop then moved to a steel mill near his home town of Brynmawr, in a valley 30 minutes away.

When the mill shut down, he moved to Newport.

“If we’d had someone like Sanjeev there then, it could have been different,’’ he said.

Steve Dash is the training and competency co-ordinator and the secretary of the Community branch at Liberty.

He’s met Gupta four times at the plant, and said he was a hands-on boss.

“I always have walk and talk meetings with him because that’s his style, he never stops,’’ he said.

“Liberty was his first acquisition and it holds a special place in his steel empire and he wants us to be a flagship.

“He has brought employment and hope.’’

Who is Sanjeev Gupta

■ Sanjeev Gupta’s father Parduman K Gupta (PKG), set up his first venture in Ludhiana, India, in 1995, making steel fasteners for the bicycle industry.

■ In 1992 Sanjeev set up Liberty House Group as a trading company focused on Africa and Asia while studying economics and management at Cambridge University.

■ By 2000 Liberty had grown into a commodity trade house focused on metals, opening offices in Dubai, Singapore and Hong Kong.

■ In 2013 GFG acquired the Newport steel mill in Wales, reopening it in 2015. The same year Liberty bought the second largest privately owned engineering business in the UK.

■ Other acquisitions include: two rolling mills in Scunthorpe, auto components supplier Amtek, saving 550 jobs in Essex and the West Midlands, two pipe mills from Tata Steel in Hartlepool.

■ In August 2017 GFG completes the acquisition of the Arrium mining and steelworks operation out of administration, renaming the company Liberty OneSteel and saving 5500 Australian jobs. Deal understood to be valued at $700 million.

■ In September 2017 GFG buys a majority stake in Adelaide renewables company ZEN Energy and commits to a $700 million investment program in solar, battery storage and pumped hydro.

■ He has also purchased the Tahmoor coal mine in New South Wales

■ In December 2018 at a “big reveal” in Whyalla, GFG announces it will examine building one of the world’s largest steel mills in the world in the city.

■ In February this year the company promises to do better, after being criticised for paying suppliers as late as 100 days overdue.

■ Gupta currently lives mainly in Sydney with wife Nicola and his three children