Property prices: how to ride the cycle and accelerate your wealth

Home values across Australia have been strong in the past year, but each state has a different cycle. Here’s how to handle it.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

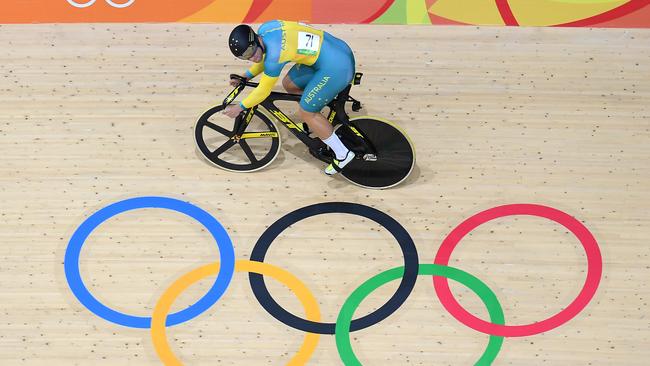

Olympic cycling – now there’s a sport Aussies like to watch, but have been denied it for five years and counting.

Talented athletes wearing fancy aerodynamic helmets hurl themselves around a velodrome, and spectators trying to keep track of what’s happening may find their heads spinning.

Real estate cycles can also cause head spins, but if you know how to deal with them you can propel your wealth ahead.

Each capital city property market has a different price cycle spanning several years where home values are trending up or down.

Try to understand where your own market sits in its cycle, because if you time your buying badly you could be sitting on flat or negative price movements for five to 10 years.

In recent months every Australian capital city market has been climbing at the same time – the first time we’ve seen that for many years because Perth and Darwin had been suffering long slumps.

THINK LONG TERM

The best way to handle any property cycle is to own your real estate for a decade or more.

You’ll experience weak periods along the way, but won’t get caught sitting on the sidelines during a surge.

Most people need just one property boom – with prices rising between 50 and 100 per cent – in their lifetime to set themselves up financially. The only way to guarantee experiencing that boom is to own real estate for the long term.

OWNER OCCUPIERS

Home buyers should generally buy when they can rather than wait for a potential slump, because history shows every capital city has climbed 400 per cent-plus in the past three decades despite short-term cyclical swings.

Record-low interest rates are tipped to stay this way for a few years, and there’s a wide range of government grants and other incentives available now to help homebuyers get started.

Free information and commentary online shows how an area is performing, comparable prices, whether a boom is peaking or whether a struggling market may be about to turn the corner. Nothing’s guaranteed, but real estate is certainly an area where knowledge is power.

Owner-occupiers looking to upgrade or move should remember that buying and selling in the same market, at the same time, should mean they won’t miss out on a snap property price boom.

INVESTORS

Property investors are perhaps better placed to ride property cycles well because they can look beyond their own backyard.

Investing interstate after a recent slump – rather than in a market that’s currently booming – can offer bigger potential gains.

Investors who diversify in different states reduce their overall risk, and can also dramatically lower their land tax bills.

Be wary of non-cyclical factors that may also affect property prices – such as COVID’s 2020 hit on student numbers and international migration that has hurt demand and prices in some city centres. Experts say these markets will eventually bounce back.

Riding the property cycle remains a great way to grow long-term wealth, and you won’t have to wear a weird Olympic cycling helmet.