Aussie report’s spotlight on slight buying conditions

A home loan expert has described Hobart’s property market as “extraordinary”, with the number of properties advertised for sale at an all time low. HIS TIPS TO SECURE A HOME >>

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

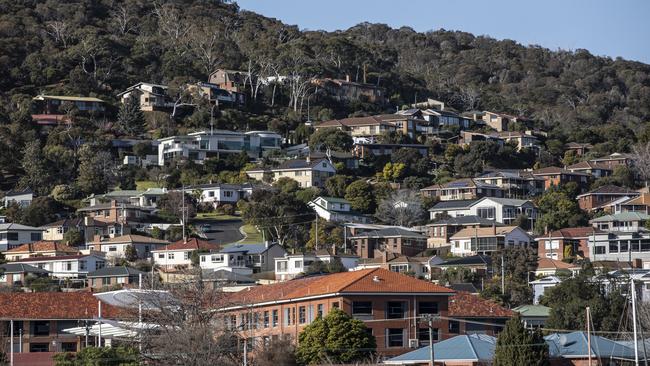

IT was almost impossible to buy a home in Rose Bay last year, a national report has revealed.

Research by Aussie Home Loans shows only 1.8 per cent of this Eastern Shore suburb’s housing stock hit the market in 2020.

That percentage landed Rose Bay in the Top 15 tightest markets nationwide — perfect conditions for a seller to cash-in on the exceptional level of demand found throughout the Greater Hobart marketplace but difficult for house hunters to secure a home.

Aussie’s Buyers’ Opportunity Report found Hobart’s tightest markets were generally within 7km of the CBD in suburbs like Moonah, Mount Nelson and South Hobart, alongside Gagebrook, with between 2.8 per cent and 3 per cent of housing stock hitting the market last year.

The were more opportunities for buyers — though still relatively few — to find homes in Hobart’s outer fringe areas like Oakdowns, Carlton and Sorell where the percentage of stock on the market ranged from 6.3 per cent to 6.9 per cent.

Midway Point and Richmond rounded out the best buying areas with 5.8 per cent and 6 per cent stock on market figures.

Nationally, 5.3 per cent of residential properties were advertised for sale last year. This was down from 6 per cent in 2019.

Aussie put Hobart’s median house price at $551,462, a 7.7 per cent rise from 2019 to 2020 while units were steady at $417,724.

Meanwhile, Hobart reached a new low in December with only 735 homes advertised for sale, the report found. This was 23.6 per cent lower than December 2019.

Aussie chief executive James Symond said the number of properties advertised for sale in Hobart was at “an all time low”.

“It is an extraordinary marketplace at the moment,” he said. “Only 4.3 per cent of the city’s housing stock was listed for sale last year, which makes it as tight a market as anywhere in the country; if not the tightest.

“Consumers need to do their homework to make sure they are buying well, buying right and thinking long-term.

“It’s vital to do your research and work out what compromisers you are willing to make, such as, would I be happy moving a few kilometres further out?

“Recognise your financial situation and seek a pre-approval from a lender or a mortgage broker so you can go to market armed with and understanding of what you can afford to buy.”

Real Estate Institute of Tasmania president Mandy Welling said the confidence in the Tasmanian real estate market and the shortage of stock come together to create “the perfect storm”.

“With the number of properties listed significantly lower from year to year, this will only increase the price growth and low days on market figures that we have witnessed over the past 12 months,” she said.

“So long as confidence remains high, interest rates historically low and stock levels low, this will be our “new normal” for some time yet.”

Mrs Welling said demand in the market had seen a “magnificent shift” toward regional areas.

“These areas are highly sought after by first homebuyers, and land sales are increasing,” she said.

“Affordability, level of services and value for money are the main drivers in this marketplace.”

Aussie’s data excluded suburbs with fewer than 500 dwellings.

HOBART’S BUYERS & SELLERS MARKETS 2020

Suburb, percentage of stock listed for sale in 2020, number of listings 2020 & 2019, median value

BUYERS

Oakdowns 6.9%, 8, 8, $437,190

Carlton 6.3%, 7, 11, $418,821

Sorell 6.3% 12, 24, $436,171

Midway Point 6%, 19, 15, $431,132

Richmond 5.8%, 8, 7, $506,624

SELLERS

Rose Bay 1.8%, 1, 1, $631,095

Gagebrook 2.8%, 3, 4, $352,297

Moonah 2.9%, 10, 17, 4473,838

Mount Nelson 2.9%, 3, 7, $700,468

South Hobart 3%, 16, 15, $670,870

Source: Aussie