Reliance on the ‘Bank of Mum and Dad’ will only worsen Australia’s wealth divide | Emily Olle

Reliance on parents’ generosity has become a Millennial internet meme – but a leg up from mum and dad is not a long-term solution, writes Emily Olle.

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

There’s a certain pathos that comes with being right about something after desperately hoping it wouldn’t be true.

For me, that pathos comes after clicking into yet another article with a headline along the lines of, ‘How this 23-year-old bought 17 investment properties and you can too’.

You think, “Maybe this is the one where they saved with good ol’ fashion gumption and daily sacrifice of iced lattes!” – but it quickly becomes apparent that the caveat on “you can too” is, *”if your parents have lots and lots of money”.

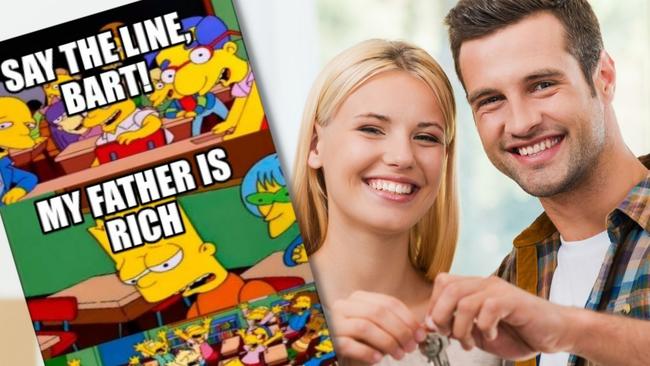

The “say the line” moment of intergenerational wealth reveal in these stories has become so common it’s reached meme-immortality online as 20 to 30-somethings are told all it takes is “hard work”.

A report by University of Sydney researchers found parental support has become the single biggest factor for young people to enter the property market, while research by Australian Unity found 64 per cent of parents are investing to give their children a financial kick start.

By 2050, Baby Boomers are expected to pass on an estimated $224bn in wealth each year in the form of either inheritances or gifts.

This is no slight on the hardworking parents who want their children to have a leg up in the hellscape we call the current housing market – but it does mean the wealth divide is only going to widen.

Your parents give you money. You buy a property. That property puts you at significant long-term financial advantage over your non-property owning generational counterparts.

You have a child or two. Because of the property you were able to purchase when you were 30 – plus, perhaps, some extra inheritance from your property-owning parents – you are able to help your children buy a property.

Your friends who never made it out of the rental market have children. They can’t even go guarantor for their child. Neither parent nor child owns a home. When they pass away, there are no tangible assets to pass on.

The reality is that no amount of man hours slinging McFlurry’s or boxing up fried chicken can compete with the ultimate mortgage broker: the bank of mum and dad.

This may come in the form of rent-free living until age 25, board paid into a secret account set aside for a home loan or a simple cash handout – but in each instance it creates an advantage for its recipient. For many parents, this simply isn’t a financial option.

Parental help has become an entrenched part of the conversation when it comes to housing affordability.

But the bank of mum and dad is not an independent assessor and cannot be the gatekeeper of our housing crisis – if it is, we are only going to see a deeper chasm between those who can buy and those who can’t.

First home owner grants and stamp duty concessions are positive steps, but many of these mechanisms still rely on being able to draw the funds in the first place.

While their efficacy remains to be seen, the federal government’s ‘Help to Buy’ program and downsizing incentives may be part of the solution.

To truly improve young Australians’ housing outlook, governments need to ensure policies are designed to help those least financially aided by generational wealth.