Telstra, Optus, Vodafone and others warned of ‘SIM-swap’ scam crackdown

Sydney man ‘David’ had nearly $50,000 stolen from his bank account by fraudsters using the fast-rising ‘SIM-swap’ scam. Now a government crackdown looms.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Mobile phone companies will face fines and tougher regulation unless they combat “SIM swap” scams being increasingly used by organised crime syndicates to infiltrate bank accounts.

The federal government has put the industry on notice after SIM swap fraud rose by more than 100 per cent in the first quarter of 2021, compared with a year earlier.

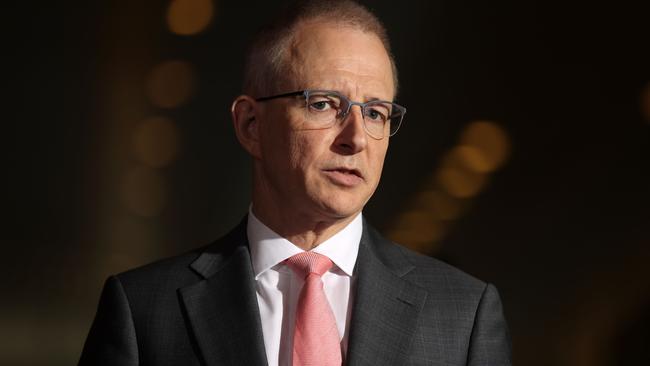

To slow or stop that growth, Communications Minister Paul Fletcher wants customer authentication processes enhanced.

Mr Fletcher’s spokesman told The Daily Telegraph: “If this does not occur in a timely way or if the measures are not applied industry-wide, the minister will consider directing the Australian Communications and Media Authority to make a standard in relation to SIM swap fraud.”

In April last year, an official standard was introduced to curb mobile porting scams. The Telegraph understands there has been a 95 per cent drop in porting since then.

The rise in SIM swap fraud has been an unintended negative consequence of the crackdown on porting, as cyber-crooks turn to the next best way to swindle Australians.

“Dealing with scammers is like playing the game ‘whack a mole’,” ACMA authority member Fiona Cameron said.

The con occurs when a fraudster misleads a mobile phone service provider into believing they are the true owner of a supposedly lost device. This can be done with as little as the victim’s name, date of birth and address.

Typically, the scammer will have already tricked the real owner into providing their banking password. Once the fraudster has a new SIM, they put it into another phone and get through the financial institution’s verification system, which usually involves a code being sent to the account holder’s mobile number.

Western Sydney businessman ‘David’ was a victim of SIM swapping last month. The scammer was able to steal nearly $50,000 after getting control of his Telstra mobile number, then his NAB bank account.

“I find it incredible,” said David, who is still reeling after his identity was stolen and asked that is actual name not be used.

A Telstra spokesman said “this case is unfortunately another example of cyber criminals becoming incredibly sophisticated, where they are employing a wide range of capabilities to obtain personal information from different sources for identity fraud to ultimately drain bank accounts and commit fraud.”

NAB told The Telegraph it would fully compensate David.

NAB’s head of investigations and fraud Chris Sheehan – formerly of the Australian Federal Police – said sophisticated transnational crime groups were behind SIM swapping.

Mr Sheehan said if you receive a phone call, text message or email claiming to be on behalf of your bank and suspect something isn’t right, don’t engage.

Instead, find a phone number for your bank yourself and ring to see if the communication was legitimate.

“Your bank is never going to ask you disclose your password or PIN,” Mr Sheehan said.

Been scammed? Maybe Public Defender columnist John Rolfe can help. Email him at publicdefender@dailytelegraph.com.au

More Coverage

Originally published as Telstra, Optus, Vodafone and others warned of ‘SIM-swap’ scam crackdown