Reported scam losses down as criminal gangs blocked from funnelling money out of Australia

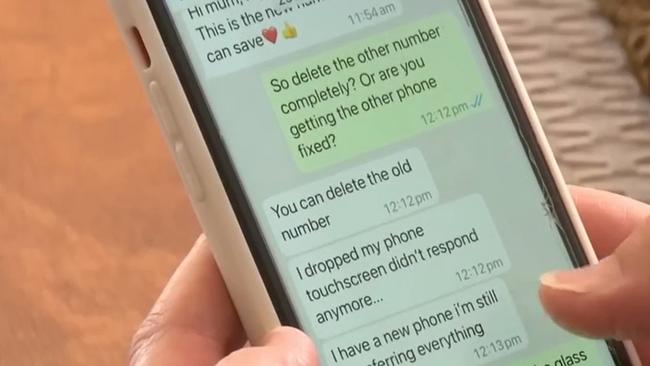

Criminal gangs scamming Australians out of hundreds of millions of dollars have had their business model smashed by a “full court press” targeting suspicious bank transfers, phishing text and call lines and fake investment websites.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Criminal gangs scamming Australians out of hundreds of millions of dollars have had their business model smashed by a “full court press” targeting suspicious bank transfers, phishing text and call lines and fake investment websites.

Financial losses dropped 29 per cent in the last six months of 2023 compared to the previous year, despite a 26 per cent increase in the number of scams disclosed to Scamwatch.

Australians reported being swindled out of $476m last year — almost $100m less than 2022 — and it can be revealed early data for January this year indicates a 40 per cent drop in losses compared to 12 months ago.

Investment scams remain the major money maker for criminals, with more than $291m reported stolen in 2023, though this was an improvement on the $377m taken the previous year.

Australians also lost $34m to romance scams, $27m from “false billing” and $25m from phishing scams.

Older people are most likely to fall victim to scams overall, with 72,000 reports from Australians over 65 years-old last year.

Assistant Treasurer Stephen Jones said he was “cautiously optimistic” about Australia’s apparent success in reducing scam losses.

“It’s clear that what we’re doing is working … but I’m not going to pop any champagne corks because we know whenever we do something, scammers adjust,” he said.

Mr Jones said the National Anti-Scam Centre was co-ordinating with telcos, banks and law enforcement to quickly intervene and block criminal activity.

“Data and intelligence sharing through the centre has been absolutely critical,” he said.

Mr Jones said call blocking and SMS filtering, stopping suspect bank transfers and developing codes of conduct for various industries were part of the “full court press” to stem the theft of Australians’ money.

Losses reported to Scamwatch in November 2023 decreased by 50.3 per cent compared to the same month the year before, and by 42 per cent in December.

Mr Jones said authorities were zeroing on a wide range of scams, including requiring social media companies to take down posts promoting scams.

In one recent scam, criminals have set up fake pay-per-view websites demanding payment for people to watch live streamed funerals of their loved ones.

“There’s no morality with some of these scams, these guys are vile scumbags,” he said.

Financial regulator ASIC took down 4,200 investment scam websites last year, while banks began blocking or limiting suspicious payments to cryptocurrency exchanges, resulting in a 74 per cent decrease in losses for Australian victims.

Criminal gangs use crypto exchanges to get stolen funds outside Australia’s banking system where it essentially becomes untraceable.

Australian Banking Association chief executive Anna Bligh said every dollar kept out of the hands of criminals operating scams was a “win,” but warned the community to remain vigilant about the threat.

“We know that when one scam disappears another will appear and that’s why it’s critical banks, government, telcos, social media platforms as well as consumers continue to work together to stay one step ahead of scammers,” she said.

More Coverage

Originally published as Reported scam losses down as criminal gangs blocked from funnelling money out of Australia