QYAC rejects ‘unauthorised’ audit which found issues with 2024 financial report

An Indigenous body has rejected a forensic audit into its financial records claiming the review was unauthorised by a recently departed CEO and done without access to full accounting details.

Members only

Don't miss out on the headlines from Members only. Followed categories will be added to My News.

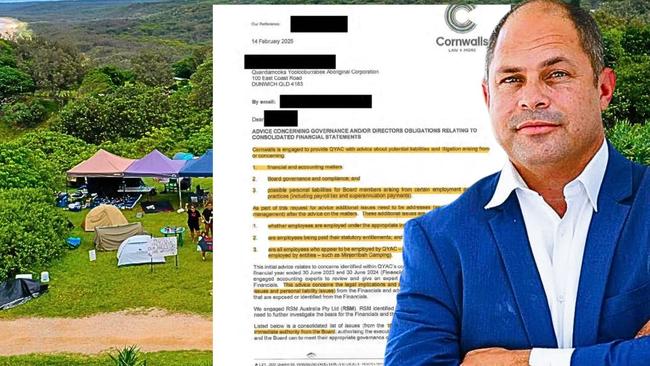

The main Indigenous governing body on North Stradbroke Island has rejected a scathing report into its financial management.

Quandamooka Yoolooburrabee Aboriginal Corporation claims an unauthorised review into its 2023-24 financials by legal firm and forensic auditors Cornwalls incorrectly claimed accounting discrepancies.

QYAC said the unauthorised “misleading” review contained significant calculation errors due to a lack of access to full corporate records, and was commissioned without board knowledge or approval by the former CEO Stephen Wright, before his sudden departure last month.

A QYAC statement issued on Sunday broadly disputed the accuracy of the unauthorised Cornwalls review but did not directly address specific claims and only stated the review’s authors were not fully briefed.

The Indigenous body said its true audited financials for 2023-2024 were reviewed and accepted by the regulator Office of the Registrar of Indigenous Corporations despite an operating loss.

Cornwalls said it could not comment on specific legal advice it has provided to individual clients.

“Cornwalls provides considered and accurate legal advice to its clients based on the instructions given to it by the client,” a Cornwalls spokesman said.

“Cornwalls does so in relation to any advice it has given QYAC.”

The corporation maintained that it had built sufficient cash reserves over time to absorb the loss and even reported an increase in cash holdings from the previous financial year.

QYAC elders were briefed on the unauthorised review’s findings at a meeting on the island on Saturday when they also voted to support a newly instated management team under the leadership of chairman Cameron Costello, who was the body’s CEO from 2013 to 2020.

The elders voted to support the body’s action to appoint an independent investigator to identify potential future risks and actions to ensure best practice financial management into the future.

They had been notified by email of the appointment of a forensic investigator to review the financial management including the report

QYAC said it had also engaged a highly-experienced Queensland forensic accountant and corporate governance and compliance professional, who found the organisation had a “healthy” 2023-2024 balance sheet with cash reserves.

“Despite the operating loss, QYAC has built sufficient cash reserves from its historical operations to absorb this loss,” a QYAC statement said.

“Cash reserves in fact, increased last financial year.

“It should also be noted that the audited financial statements state QYAC generates $2m in cash surplus from operations.

“The authors of this (unauthorised) review were not fully briefed and have not been provided with historical records which explain a number of the issues raised.

“It is not a public document and on its face is heavily qualified as to its use and accuracy,” the QYAC said in a statement.

The QYAC statement was in direct conflict with the 60-page Cornwalls report which found errors in QYAC’s consolidated financial statements to June 30, 2024 – which were not addressed in the QYAC statement.

The Cornwalls report referenced reviews by RSM and Herron Accountants on specific financial aspects such as bank controls, wage allocations, and profit/loss analysis and financial discrepancies and governance failures.

QYAC’s statement did not directly address these specific allegations.

The Cornwalls report recommended QYAC immediately correct its long service leave calculations after underestimating short-term employee obligations by $60,000 while over-estimating future liabilities by $107,000.

It also identified late superannuation payments estimated at more than $700,000, a claim which QYAC has not verified.

“A reasonable estimation of QYAC’s potential liability (superannuation) is around $772,000 (although this estimate is for a period beyond the two years on the financials,” the Cornwalls report said.

“That is a significant and material amount. Board members are personally liable to ensure payment if QYAC does not pay.

“There is a compelling obligation on members of the Board to pursue and identify with accounting assistance,” the report said.

QYAC did not mention superannuation liabilities in its official response.

Other issues highlighted in the Cornwalls report included payments totalling $400,000 not being correctly reconciled when financial statements were consolidated.

The unauthorised report also called for an urgent reassessment and verification of all fixed assets, including vehicles, after several assets were missing from financial records.

It also found that Minjerribah Camping had owed $363,376 to QYAC, but when QYAC combined the two financial statements only $196,607 of that debt was accounted for.

However, the QYAC statement did not mention Minjerribah Camping’s financial records.

The Cornwalls report said the difference suggested that some transactions between the two entities were not properly recorded or reconciled, raising concerns about accuracy.

Expenses related to utilities, such as electricity and gas, were found to be significantly lower than expected, suggesting that outstanding liabilities may not have been recorded.

Additionally, unpaid purchase orders amounting to nearly $150,000 were flagged as potential liabilities that had not been properly accounted for.

Operating expenses were alleged to have been paid using funds from grant accounts and other restricted accounts, contrary to financial best practices, according to the unauthorised report, a claim QYAC has not confirmed or responded to.

Cornwalls also recommended stricter controls over use of separate bank accounts to prevent further misallocations.

The unauthorised report also recommended a full reconciliation of fixed assets and liabilities to ensure accurate financial reporting along with stricter internal controls on prepayments, intercompany transactions, and accruals.

The Cornwalls report also called for a review of the corporation’s banking practices to ensure compliance with financial regulations.

QYAC director Cameron Costello said Sunday’s QYAC statement did not address specifics of issues raised in the unauthorised report because the authorised independent investigation was still underway.

“We are awaiting on that outcome of issues Cornwall raises,” Mr Costello said.

“The other important thing for us is that QYAC notified ORIC of its appointment of an independent investigator into the financial issues raised.”

More Coverage

Originally published as QYAC rejects ‘unauthorised’ audit which found issues with 2024 financial report