Insurance confusion causes Aussies to put too little value on their life

Is your car more valuable than your life and income? Research by a life insurance group suggests many Aussies think so.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Australians are almost three times more likely to insure their car than their life, new research suggests.

A study spanning more than 5000 workers and commissioned by the Council of Australian Life Insurers (CALI) has found nearly 80 per cent of people have car insurance but just one-third have life insurance.

“The research shows people focus on what is happening in their life now, rather than looking further in the future,” said CALI CEO Christine Cupitt.

“Their current focus on material possessions makes sense from this lens, particularly in a cost-of-living crisis,” she said.

Ms Cupitt said the research also found that the cost-of-living crisis was forcing people to make budget cuts, and they were almost three times more likely to cut life insurance than car or home insurance.

Australians approaching retirement age were eight times more likely to cut life insurance than home insurance, she said.

Life insurance is an umbrella term covering death cover (also called term life), total and permanent disability insurance, income protection insurance and trauma/critical illness insurance.

Ms Cupitt said a lack of affordable advice was contributing to people leaving themselves “unprotected when it comes to their future financial security”.

“Australia’s life insurers are restricted to providing their customers with advice that is general in nature only,” she said.

“That is why life insurers need legislative changes to be able to provide simple advice.”

CALI’s research found 38 per cent of people said they had death cover, and only 27 per cent said they had income protection or TPD.

This does not match with the reality that 64 per cent of Australia’s 22 million super accounts are in default MySuper products where death and disability cover are required by regulations to be provided to most people. It suggests that many people do not realise they have default cover.

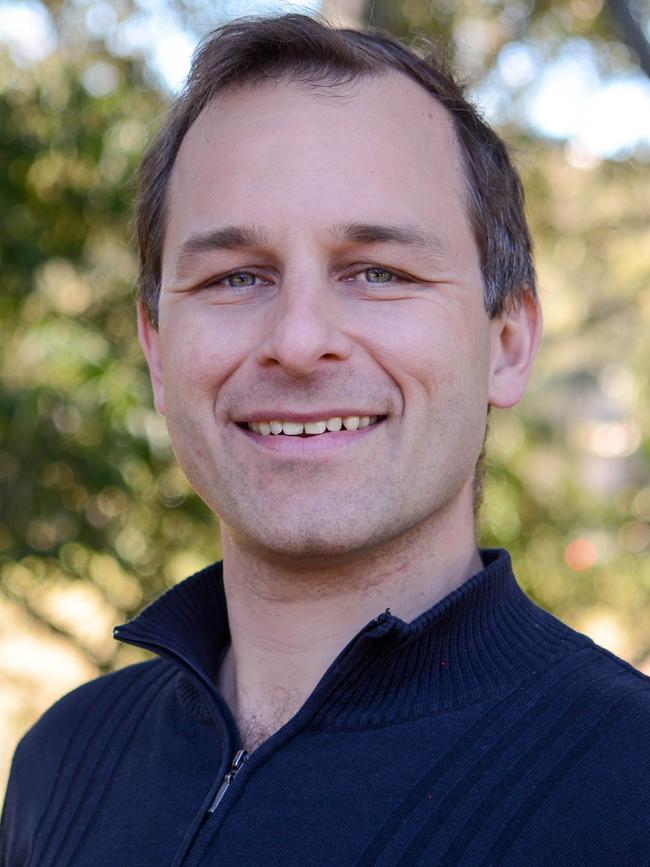

CreationWealth senior financial adviser Andrew Zbik said this was not surprising as many people did not understand the concept of personal insurance.

“It’s to protect you in the event of illness or injury that stops you from working in the short term or long term,” he said.

“People don’t know what they don’t know.

“If people can name all their super funds, that’s an achievement, and many have no idea what cover they have.”

Mr Zbik said the latest Zurich Cost of Care report showed the financial strain caused by several medical conditions was “quite staggering”.

The report says lifetime costs can be up to $12.9 million for spinal cord injury, $1.09m for childhood cancer and $201,000 for Motor Neurone Disease.

“You may have private health insurance but there’s gaps still,” Mr Zbik said.

Health insurance does not cover lost employment income or major modifications to homes and lifestyles.

Mr Zbik said young singles with no mortgage and no children might not need death cover, but “let’s talk about income protection and total and permanent disability”.

“It’s very misunderstood.”

CALI’s research found critical insurance cover – which pays out if people suffer specific conditions such as cancer, heart attack or stroke – was held by just 17 per cent of people.

“The advice accessibility crisis in this country is leaving far too many people underinsured,” Ms Cupitt said.

People needed financial safety nets for themselves and their loved ones, she said.

“Getting the right advice can set them up for the future. Getting no advice can leave them with nothing to fall back on when times get tough.

“We look forward to seeing draft legislation that enables life insurers to directly help their customers and provide simple advice on their own products, at no extra cost.”

More Coverage

Originally published as Insurance confusion causes Aussies to put too little value on their life