Labor costings suggest it will deliver a bigger surplus than the Coalition

After weeks of intense speculation, Labor has revealed its full election costings, and there is one number at the centre of them.

Federal Election

Don't miss out on the headlines from Federal Election. Followed categories will be added to My News.

Labor says it will reform Australia’s “two-class tax system” and is promising to deliver a Budget surplus double that of the Coalition’s.

Labor has revealed today how it will pay for its election promises, including big increases to funding for health, schools and infrastructure.

HERE ARE THE MAIN POINTS:

• There will be $154 billion in extra revenue over 10 years, coming from five areas of tax reform — franking credits, negative gearing and capital gains tax, trusts, multinationals and accountant deductions, and superannuation concessions;

• Most of that money will go towards higher spending, particularly on health and education. The rest with strengthen the Budget bottom line;

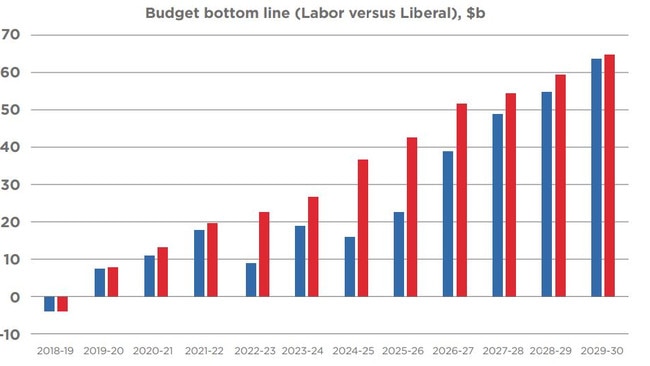

• Labor is promising to match the government’s surplus in the next financial year, followed by bigger projected surpluses in each subsequent year;

• It boasts a projected surplus of 1 per cent of GDP by 2022/23. That would mean a surplus of $22 billion, double that of the Coalition’s forecast surplus of $9.2 billion;

• The costings include an assumption that a Shorten government will provide further tax relief to Australians when the tax to GDP ratio hits 24.3 per cent, which is the level it was at under the Howard government.

COSTINGS ASSESSED BY EXPERTS

Shadow Treasurer Chris Bowen and Finance spokesman Jim Chalmers released the Budget costings today and revealed it had been assessed by a panel of three experts including Dr Michael Keating AC, the former secretary to the Department of the PM and Cabinet when Paul Keating was prime minister. He was joined by Professor Emeritus Bob Officer AM of the University of Melbourne and leading company director James MacKenzie, who is currently the chairman of law firm Slater and Gordon.

Mr MacKenzie addressed the media and said they were not asked to endorse the polices but just to assess and review them.

He said they believed the process had been thorough and comprehensive,” he said.

The trio signed off the costings as being developed using appropriate methodology and representing a reasonable basis for assessing the net impact of Labor’s policies on the Commonwealth budget.

LIBERAL PARTY MOCKS FIGURES

Prime Minister Scott Morrison has expressed scepticism about Labor’s numbers and reserved particular mockery for Labor’s promise of bigger surpluses.

“The four surpluses I announce tonight — that’s what Wayne Swan said. The four surpluses,” Mr Morrison said at a press conference, harking back to the Rudd and Gillard governments.

“Kevin Rudd said he would be a fiscal conservative, and he took around $20 billion surplus in a $27 billion deficit in the space of one year. And, of course, good old Paul Keating and the recession that we had to have. There’s always something very fishy when it comes to Labor’s claims about how to manage money.

“They talk about increasing Newstart. Was there any money in there for Newstart? No, there’s not. They talk about they’re going to pay extra money for childcare workers, but apparently only half of them. But what about the superannuation, what about the payroll tax?”

Finance Minister Mathias Cormann continued the attack at a later press conference with Treasurer Josh Frydenberg.

“Labor’s numbers just don’t add up,” Mr Cormann said.

He said Labor had not properly accounted for some key spending promises.

This included its promise to increase the foreign aid budget to 0.5 per cent of gross national income, which could cost between $60 billion and $82 billion over the next decade.

Labor’s costings include an extra $1.2 billion in foreign aid funding over the next four years to counter cuts made under the Coalition. It has not yet put a timetable on its target to double aid funding.

Mr Cormann said the document was also silent on Labor’s promise to increase the refugee intake to 32,000 per year, which would cost $6.2 billion; as well as increasing science spending at cost of about $36 billion over the medium term.

He said the cost of increasing Newstart of about $39 billion, and of lifting funding to hospitals at a cost of about $33.7 billion over the medium term were also not included.

“Any they have not properly factored in the cost of their proposal to have the taxpayer pay for wage increases for child care workers — it is not properly factored into their costings,” he said.

When asked whether he had been out-surplused, Mr Frydenberg answered: “Labor’s surpluses cannot be believed and the Australian people know that”.

‘BIGGER AND BETTER’ SURPLUSES

In releasing the figures, Mr Bowen told reporters “this is the earliest any Opposition has released its costings ever.”

“Of course in 2013, the last time the Liberal Party was in opposition, they released their costings 36 hours before the people went to the polls. Here we are before the last week starts, releasing our costings.”

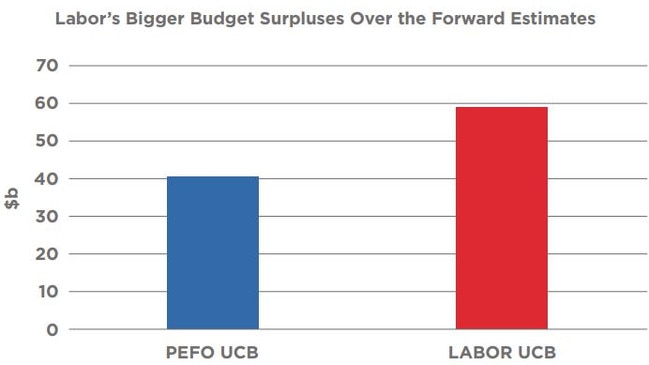

Mr Bowen said Labor would deliver a bigger Budget surplus “each and every year” and would bring the Budget “back in black” next year — at the same time Coalition said it will.

However, Labor is promising to deliver a surplus double that of the Coalition’s within three years.

“We will reach a surplus of 1 per cent GDP four years earlier than the government is forecasting,” Mr Bowen said at a press conference today.

He said the surplus in 2022/23 would be $21.7 billion, this compares to the Coalition's forecast of $9.2 billion, which it revealed in its Budget this year.

Mr Bowen said Budget surpluses under Labor would be bigger over the forward estimates and the decade cumulatively.

Labor will pay for these surpluses and its ambitious election promises by raising $154 billion over 10 years from five areas of tax reform: dividend imputation, negative gearing and capital gains tax, trusts, multinationals and accountant deductions and superannuation concessions.

Mr Bowen said Labor was taking a proactive approach to closing down and reforming tax loopholes that overwhelmingly benefit wealthy individuals.

“If your income comes from a certain place, you have good accounting advice, you get access to the first class tax system,” he said.

“If you are a normal taxpayer, it’s the very basic deductions, economy class for you.”

Mr Bowen said Labor is reforming the tax system and that the Liberals were running a “dishonest” campaign about who is impacted.

He said 96 per cent of Australians would be unaffected by the abolition of franking credit refunds, 99 per cent would be unaffected by the changes to tax deductions, and no one who currently negatively gears property would be affected by that policy, since it is grandfathered.

Mr Bowen said credited the hard work of the Labor team to identify and modernise Australia’s tax system to make it fairer and better.

“We have done our hard work,” Mr Bowen said.

“There are bigger investments in health and education, bigger surpluses, and we are ready for government.”

The Shadow Treasurer also flagged more tax relief for Australians but would only do this when the tax to GDP ratio hits 23.4 per cent, which is equivalent to that under the Howard government.

“When the budget returns to sustainable surplus, that is when tax relief can prudently and sensibly be delivered,” he said.

Mr Bowen said Australia would remain a low-taxing country compared to other similar OECD countries like the United Kingdom, New Zealand, Germany and Canada.

Money generated from cutting back on tax loopholes will go towards bigger surpluses as well as Labor’s election promises, including better funding for hospitals and schools, the Medicare cancer plan, cheaper child care, a pensioner dental plan, roads and rail projects and tax cuts for 10 million workers.

RELATED: Whoever becomes PM may ultimately be doomed

RELATED: James Weir recaps final leaders’ debate

MONEY SET ASIDE FOR PLEBISCITE

One interesting expense in Labor’s costings is $55 million set aside for a plebiscite on Australia becoming a republic.

Labor has committed to investigating public support for ditching the Monarch and making Australia independent.

Last year it pledged to hold a plebiscite to gauge public support.

In its costings released today, it has set aside $55 million in 2021/22 for a “national vote on the republic”.

However, the same-sex marriage plebiscite cost $80.5 million so this may not cover the full cost.

— with AAP

Originally published as Labor costings suggest it will deliver a bigger surplus than the Coalition