‘Clear signal’: How major economic week, including new Trump tariffs, could shape election campaign

Voters will be watching Anthony Albanese and Peter Dutton closely this week, with another round of Trump tariffs set to shake up the campaign.

Federal Election

Don't miss out on the headlines from Federal Election. Followed categories will be added to My News.

Anthony Albanese and Peter Dutton will face key economic tests in the first days of the May 3 election campaign, with a second round of tariffs from US President Donald Trump to be announced within days.

Mr Trump loomed large in Sunday interviews, with the Prime Minister grilled on Australia’s relationship with the US ahead of what its President is calling “liberation day”.

Mr Albanese was forced to admit he did not yet know what would be in store for the nation come Wednesday in the US, telling Insiders only that his government had been “continuing to engage constructively with the US administration”.

“We are putting Australia’s case. Tariffs are an increase in price for the purchases of the goods and services, so they impose increased costs on American buyers,” he said.

“They don’t change the price structure here in Australia. We believe in free and fair trade. The US enjoys a trade surplus with Australia. We are pointing that out very clearly.”

Thr Prime Minister confirmed he was still yet to have a phone call with Mr Trump regarding the tariffs, telling Insiders communication was taking place only through officials.

When asked whether Australia could rely on Mr Trump, Mr Albanese replied “I believe we can”.

“I’ve had two constructive discussions with Donald Trump and I will continue to engage constructively,” he said.

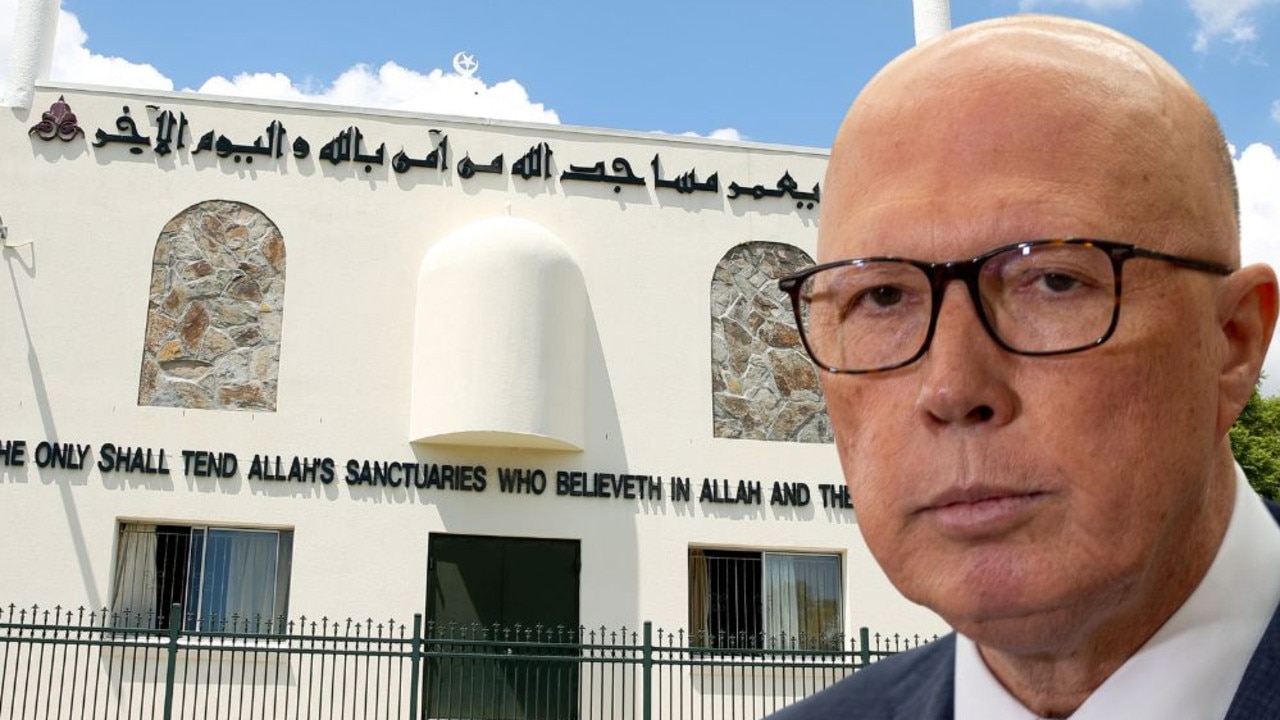

Mr Dutton has blasted the Prime Minister’s handling of the relationship with Donald Trump and negotiations over tariffs, after he failed to get a carve out for Australian steel and aluminium earlier in the year.

While the full details of the plan are yet to be known, Australia was hit in the first round of the Trump plan with a 25 per cent import tariffs on steel and aluminium.

There are fears the pharmaceutical industry and agriculture could face tariffs this time around.

When only steel and aluminium imports were likely to be impacted, AMP chief economist Shane Oliver said Australia should not respond to tariffs.

“Our response should be what we have been so far and take the [tariffs] on the chin because if we put tariffs on American products, Australians will feel it directly and we will have another flow to the cost of living, making the pain worse,” he said.

Dr Oliver said Australian goods to the US are around $24bn. While this will have an impact for those directly involved, is unlikely to have a major impact on the Australian economy overall.

“It’s better to complain loudly, protest by buying Australian goods, stop going on holidays in the US and that soft of thing,” Dr Oliver said.

Independent economist Saul Eslake agreed saying it would be “incredibly stupid for us” to place reciprocal tariffs on the US but supported Mr Albanese who called Trump’s first round of tariffs a “dog act”.

“We should remind the US that we are one of very few countries where the US runs a surplus, we have fought in every war alongside the US and we provide them with vital services such as critical military bases on our soil,” he said.

Blanket 25 per cent tariffs on the automotive industry have also been announced while individual countries are also facing tariffs, with China facing a 20 per cent tariff, while Mexico and Canada will both face 25 per cent tariffs on all imports.

“There is some talk that many countries will be exempted from the trade tariffs and it may only cover 15 countries,” Dr Oliver said.

“If we don’t face any tariffs the focus will shift to the indirect effect such as the damage done to China and Japan and other major trading partners.”

Tariffs are not the only hurdle facing our leaders in the coming week.

The first test will be on Tuesday when the Reserve Bank is expected to keep the official cash rate at 4.1 per cent, meaning mortgage holders are unlikely to get a rate cut until after the election.

Oxford Economics head of macroeconomic forecasting Sean Langcake said the RBA had been clear on what it was thinking.

“The RBA gave the market a clear signal in February that hopes for more rate cuts in the near future need to be tempered. We think that advice can be taken at face value.”

While the February rate cut started to ease the pain for mortgage holders, the RBA board remains highly unlikely to offer homeowners a back-to-back rate cut.

This is despite data from the Australian Bureau of Statistics suggesting a fall in employment and a drop in the inflation rate over in the month of February.

However, the Prime Minister is unlikely to get a rate cut throughout the election campaign.

Markets are factoring in a 70 per cent chance of a cut on May 19-20, but it will be three weeks after Australians have gone to the polls.

University of Melbourne associate professor in economics Matthew Greenwood-Nimmo said the RBA board indicated it would take a cautious approach to further rate cuts.

“Given that the economic data does not currently provide a strong case for further easing, it is likely that the cash rate will remain constant for now,” Mr Greenwood-Nimmo said.

On Thursday, the RBA will release the Financial Stability Review, which is set to show how households, business and commercial real estate are holding up.

With cost-of-living predicted to be the number one issue facing voters, the major parties are pitching themselves as the solution to the current issues.

The Labor government has promised modest tax relief of $5.15 per week as a “top up” from its revamped stage three tax cut.

The tax cuts double to $10.30 from 207-2028, with every Australian eligible for both rounds of tax relief.

Treasurer Jim Chalmers used the budget to say the government shares the pain of voters but noted the economy had reached a turning point.

“This budget builds on the progress we’ve made, together. It’s a plan to help with the cost of living, with two new tax cuts, and higher wages, more bulk billing, and more help with electricity bills, cheaper medicines, and less student debt,” he said on Tuesday night.

“And it’s a plan to build Australia’s future, with more homes, new investments in skills and education, competition reforms and a Future Made in Australia.”

They are also offering HEC cuts of 20 per cent to help reduce student loan debt, while the government will increase the HELP repayment threshold from $54,000 to $67,000.

Labor is also announcing cheaper GP visits, reducing the price of medicines on the PBS, fee-free TAFE and $10k apprenticeship bonuses.

Meanwhile the Opposition Leader said the cost-of-living was getting out of control.

“In my travels across the country, Australians tell me they’re working hard, but they’re not getting ahead,” he said on Thursday night during his budget reply speech.

“In Perth, a mum in a grocery store, in tears, told me how her, her husband and children couldn’t keep their heads above water with the bills stacking up.

“In Adelaide, I spoke with a food manufacturer whose electricity prices had gone up by about 300 per cent.”

Mr Dutton’s campaign is headlined by fuel excise cuts for 12 months which would cut the price of petrol by 25 cents.

They are also offering to allow Aussies to dip into their superannuation for housing to help bet them into the housing market sooner.

The Liberal Party has announced tax breaks for small businesses with turnover of less than $10m as they will be able to access $20,000 in tax deductions for meals and entertainment purposes.

They will increase spending for bulk billing and cheaper GP visits in line with the Labor Party but have offered an additional $500m to increase psychology sessions.

Voters have until May 3 to assess the economic credibility of both sides, but they will be closely watching how they respond to rates and Trump this week.

More Coverage

Originally published as ‘Clear signal’: How major economic week, including new Trump tariffs, could shape election campaign