Federal Budget 2020: Debt ceiling to be lifted to $1.1 trillion

Australians are being warned the figures in Tuesday’s Federal budget will be “bad” as the response to coronavirus comes at a cost. This is what we can also expect.

Federal Budget

Don't miss out on the headlines from Federal Budget. Followed categories will be added to My News.

Watch the budget live on Tuesday at 7.30pm AEDT at your News Corp website

Finance Minister Mathias Cormann has warned the figures contained in Tuesday’s Federal Budget will be “bad”.

Gross debt is set to soar past $1.1 trillion, while the deficit will peak around $210 billion, according to a report in The Australian.

The Morrison Government’s response to the coronavirus pandemic that plunged the nation into a health and economic crisis is expected to increase gross debt about 55 per cent of GDP.

Senator Cormann on Monday said the response to the job losses and the health measures came at a cost.

“The numbers will be bad objectively, but we know why we are here,” he told ABC RN.

“We were hit by an unexpected coronavirus pandemic which has had a very severe impact on our economy.”

Senator Cormann said Australia entered the crisis in a stronger fiscal position than other nations.

“Having cushioned the blow, having saved as many jobs as we could, we are focused on the recovery,” he said.

Estimates contained in the budget will be based on the assumption of a coronavirus vaccine, which Senator Cormann said was based on the “best available advice”.

He remained tight-lipped on how many jobs measures the budget would create and would not weigh in on whether the its apprentice wage subsidy model could be applied to other sectors.

On income tax cuts, Senator Cormann said the Labor Party would have to decide its position.

“Whether they want to stand in the way of more money in workers’ pockets, if that is what the budget delivers, then that’s going to be a matter for the Labor Party,” he said.

“If there is a measure to bring forward some income tax cuts and they are supported by both sides of politics, they are legislated … then the Australian Taxation Office would be able to pass that on very quickly.”

BUDGET BASED ON ASSUMPTION OF COVID VACCINE

It comes Sky News revealed Tuesday’s budget forecast will be based on the assumption a coronavirus vaccine will be discovered by next year.

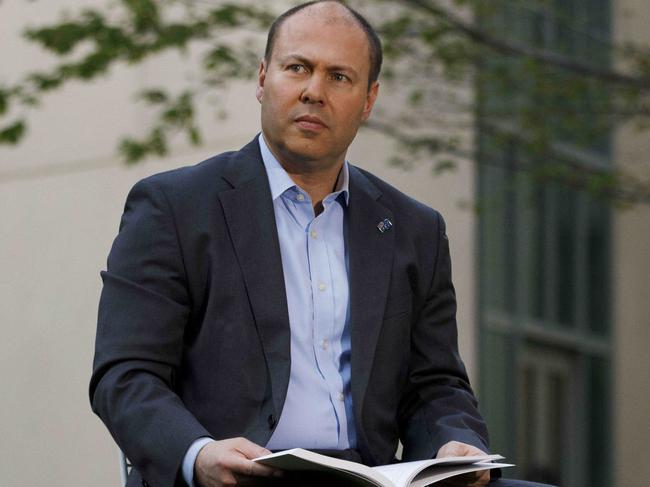

In an exclusive interview with Sky News Political Editor Andrew Clennell to be aired today, Treasurer Josh Frydenberg confirmed the budget will “take into account” the possibility that Australia will have a COVID-19 vaccine next year.

“We have factored in those issues related to the vaccine,” the Treasurer said.

When asked whether the budget will be predicated on the assumption that a vaccine will be secured and readily available, Treasurer Josh Frydenberg said “the budget takes into account the possibility that is the case”.

It comes as Andrew Clennell confirmed the budget will include a extension of the low-to-middle income tax offset which aims to put more cash in the hands of Australians and therefore back into the economy.

The budget will reportedly also flag the end of JobKeeper with a replacement subsidy for businesses who hire new employees, according to Mr Clennell.

$1.2B JOBS BONANZA TO SUBSIDISE APPRENTICES, TRAINEES

Half the salary of new apprentices and trainees in any industry will be paid for by the Federal government for one year under a wage subsidy scheme to drive jobs growth.

Flagged as the single biggest investment in a trainee commencement scheme, the Morrison government has set aside $1.2 billion for Australian businesses to employ 100,000 new workers as part of its COVID-19 economic recovery plan.

Starting on Monday, businesses who take on a new apprentice or trainee will be eligible for a 50 per cent wage subsidy, regardless of geographic location, occupation, industry or business size.

The move has been welcomed by the construction and hospitality sectors, where thousands of laid off trainee staff now have an opportunity to resume paid work.

Prime Minister Scott Morrison said apprenticeships and traineeships were an important pathway to get young people into jobs while also ensuring a “skills pipeline” to meet the future needs of employers.

“During this pandemic the Federal Government has been focused on supporting and creating jobs as well as identifying the skills we need in the economic rebuild,” he said.

INCOME TAX CUTS COMING

Treasurer Josh Frydenberg has confirmed the budget will deliver income tax cuts “right now” in a move that all but confirms tax relief will be backdated in the budget.

News.com.au exclusively revealed on Friday that senior government sources had confirmed the budget backdates the tax relief to ensure workers can secure tax relief this financial year.

“We believe people should keep more of what they earn. We also believe more people having more money in their pockets right now will help economic activity across the economy,’’ Mr Frydenberg told the Today Show.

“More spending will mean more jobs.”

The personal income tax cuts for middle income earners are worth up to $2565 a year for workers earning more than $120,000 or $50 a week and $1080 a year or $20 a week for anyone earning more than $50,000, but are not scheduled to start until 2022.

$100M LURE TO BACK TOURISM INDUSTRY

Tourist hot spots in regional Australia hard hit by the coronavirus will receive a multimillion-dollar boost as part of a Federal Government plan to entice Aussies to holiday at home.

As state borders begin to reopen, News Corp Australia can reveal next month’s Budget will include $100 million to upgrade campgrounds, visitors centres and tourist attractions such as walking tracks in an effort to boost jobs in regional areas and prop-up struggling economies.

Nine tourism regions heavily reliant on international tourists will also share $50 million to spend on marketing and festivals to entice would-be international travellers to holiday at home.

The areas earmarked for cash including the NSW North Coast, Tropical North Queensland, the Whitsundays, Phillip Island in Victoria and Kangaroo Island in South Australia.

CHILDCARE SUPPORT ON THE WAY

The Federal Government has offered $305 million towards childcare. The support package would see the activity test, which determines how many hours of subsidised care parents receive, relaxed until 4 April next year.

It also includes a fee freeze for Victorian families until January 31, and a continuation of the employment guarantee.

MORE CASH FOR PENSIONERS

Australian pensioners are set to score a cash boost in the budget, Minister for Social Services Anne Ruston has said.

“Further support around our pensions is something that is contained in the budget,” Ruston told Nine Newspapers, although she declined to say what form the increase will take.

Mr Morrison has also flagged further support for pensioners, after the Council on the Ageing (COTA) for an extra $750 stimulus payment for Australia’s age pensioners. Pensioners have received two $750 stimulus payments this year.

“We urge the Government to provide an additional $750 stimulus payment as part of your economic stimulus measures, for the benefit of both pensioners and the economy,” COTA chief executive Ian Yates said.

Originally published as Federal Budget 2020: Debt ceiling to be lifted to $1.1 trillion