CFD class action: Sydney law firm investigating trading risky contracts

A Sydney law firm is investigating a potential class action on behalf of a growing group of people including hairdressers, Uber drivers, construction workers and shop owners who have lost their life savings by trading risky CFDs.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

A Sydney law firm is investigating a potential class action on behalf of a growing group of people who have lost their life savings by trading risky “contracts for difference”, or CFDs.

The Daily Telegraph can also reveal that within weeks the corporate regulator will belatedly crack down on CFDs, finally bringing Australia into line with other developed countries.

But the move will come too late for many. Since 2017, the number of people using local operators to make these highly leveraged wagers has more than doubled to one million-plus.

They are betting on whether a stock, currency or commodity will rise or fall and nearly three-quarters end up in the red. Some not only do their dough, they end up owing money to CFD companies.

The industry’s growth has sped up during the pandemic, according to the firm contemplating the class action, Mayweathers. Figures show soaring revenues for companies offering CFD trading.

Mayweathers partner Steve Vrtkovski told The Telegraph the firm is now being contacted every second or third day by hairdressers, Uber drivers, construction workers and shop owners who have squandered money on derivatives, despite having little or no experience.

“People like that should go nowhere near this sort of stuff but they do, with significant consequences,” Mr Vrtkovski said. “We are getting a large number of inquiries from people who have lost sizeable sums of money — quite often their entire life savings.”

A potential class action would involve alleging breaches of corporations law and licensing conditions.

Mr Vrtkovski said the firm currently had four CFD cases before the Australian Financial Complaints Authority.

At AFCA, it has previously succeeded in arguing some platforms failed to follow ASIC guidelines that accounts should only be opened by skilled and experienced clients.

CFD companies’ revenues have ballooned in the coronavirus era. Israeli-headquartered Plus500’s Australian income leapt by 180 per cent to $90m in the six months to June 30 compared to 2019. It is also the most-complained-about CFD business in Australia. Mr Vrtkovski did not point the finger at Plus500 specifically.

Plus500’s Australian CEO Sean Murphy said: “The bulk of the complaints that go to AFCA are frivolous. Unfortunately there’s not a lot of accountability on behalf of people who open accounts.”

Mr Murphy said Plus500 had “quite a thorough due diligence process”, including posting risk warnings across its website, trading platform and promotions. “People have to be responsible for their own actions,” he said.

A Sydney woman told The Telegraph she lost $100,000 by trading CFDs.

“It was too easy and too good to be true,” the woman, who works in the bridal industry and asked to remain anonymous, said.

She got her money back after Mayweathers took her case to AFCA and successfully argued the CFD provider hadn’t discharged its duty of care.

A third of people who trade CFDs with Australian platforms have an annual income of less than $37,000.

The Telegraph understands ASIC is preparing to press go on a crackdown on CFDs that will substantially curtail the degree of permitted leverage – currently as much as 400 times what a client has in capital – plus prevent people from ending up owing more than they have in their account.

The US, Singapore and other nations took such action at least five years ago.

REGULATOR SHUTTERS DERIVATIVE COMPANY

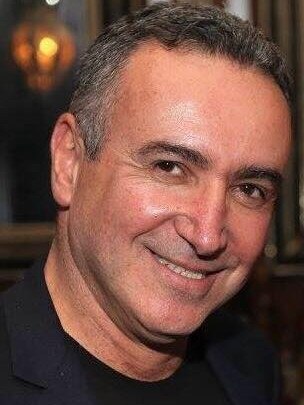

Yossi Ashkenazi’s LinkedIn profile contains a long list of roles but omits his being CEO of arguably the worst CFD-spruikingbusiness Australia has seen – AGM Markets.

Mr Ashkenazi was AGM’s only Australian director and until now has been exposed to very little media attention. For example, before today, no picture of him has been published.

Israeli-controlled AGM was shut down by the Australian Securities and Investments Commission in 2018 after it found the business provided financial product advice without a licence, made misleading or deceptive representations and engaged in unconscionable conduct.

The regulator also launched civil proceedings against AGM, with the Federal Court earlier this year determining that both the Corporations Act and ASIC Act had been breached.

AGM is now in liquidation, with business creditors likely to get no more than 11 cents in the dollar owed.

Meanwhile, scores of clients turned to the Australian Financial Complaints Authority, with $3.7 million in compensation paid since November 2018.

But more than $620,000 is still due to clients.

The Telegraph has seen a determination by AFCA against AGM which says the business failed to meet its duty of care by ensuring the complaining client was suitable to open an account.

The client, who had been upfront about having no experience in trading, was told he would earn 10 to 15 per cent on his investments while taking a ‘safer path’.

But he ended up losing $90,000.

AFCA ordered AGM to repay the money.

In 2018, ASIC banned Mr Ashkenazi from providing financial services for eight years, saying he had “a key role regarding AGM’s financial services business and had been involved in the contravention of a financial services law, namely AGM’s contravention of engaging in unconscionable conduct”, was “likely to contravene a financial services law” and was “not adequately trained, or is not competent, to provide a financial service”.

When contacted by The Daily Telegraph, Mr Ashkenazi said: “It’s very traumatic for me. I can’t respond. It puts my mental health at risk.”

Another director of AGM was Israeli Kobi Cohen, who is being sued by the US government over an alleged $US103 million ($145 million) global derivatives fraud in which a company called Yukom is said to have “targeted and victimised US residents”.

Mr Cohen, who does not live in Australia, has filed a motion to dismiss the US government action against him.

Mr Ashkenazi wasn’t involved with Yukom and isn’t in the US government’s crosshairs.

Got a story to tell? Email john.rolfe@news.com.au

Originally published as CFD class action: Sydney law firm investigating trading risky contracts