Anthony Albanese, Jim Chalmers’ ‘dumb’ decisions that are set to add extra $40bn to our ballooning debt

With Treasurer Jim Chalmers adamant Labor will deliver a budget next month, Aussie experts have revealed the “dumb” policies that need to be fixed in addressing the bottom-line decline.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Exclusive: Australia’s top independent economists have urged Anthony Albanese and Jim Chalmers to fix two “outstandingly dumb” policies – one on the GST and another on cigarettes – to take tens of billions of dollars off ballooning forecast deficits.

With the Treasurer adamant Labor will deliver a budget next month, rather than be in the midst of an election campaign, Saul Eslake and Chris Richardson say the best option for addressing the bottom-line decline is to end a Goods and Services Tax deal with Western Australia set to cost about $32 billion between now and the end of the decade.

“Money is being shovelled over to the government of the richest state in the country,” Mr Eslake, formerly the chief economist of ANZ Bank and Merrill Lynch, told this masthead.

“By not spending that $32bn you could have lower deficits.”

Mr Richardson, who is regarded as the nation’s leading expert on the federal budget, said there was “no economic argument” for the GST deal with WA, which he described as a “travesty”.

“It is just an outstandingly stupid policy,” he said. “It exists because of politics. WA has been very central to federal election outcomes in recent years.

“The rest of Australia would be just as well off if we got $100 notes and smoked them,” Mr Richardson said.

“I don’t see much prospect of a change, but there will be even less prospect if people don’t know about it, and the vast bulk of Australians don’t know.”

For 20 years from its introduction in 2000, revenue from the GST was distributed to equalise the capacity of the states and territories.

So as WA’s wealth rose due to mining royalties, its share of the GST fell, which triggered an outcry in the west.

Fearing an electoral backlash, the former Coalition federal government changed the rules to deliver vastly more GST revenue than it was entitled to under capacity equalisation.

The Coalition retained all its WA seats at the 2019 election. But the record-breaking popularity of the WA state Labor government during the Covid pandemic helped Anthony Albanese win four extra seats in the west at the 2022 federal poll to hold nine of the 15 electorates.

To shore up those seats, Mr Albanese extended the GST deal. The Prime Minister even signed “No change to WA GST” on the arm of a journalist from Perth’s main news outlet last year to demonstrate his commitment.

A poll of 38 economists by the Economic Society of Australia found 28 believed the WA deal should be scrapped. Just four wanted it kept.

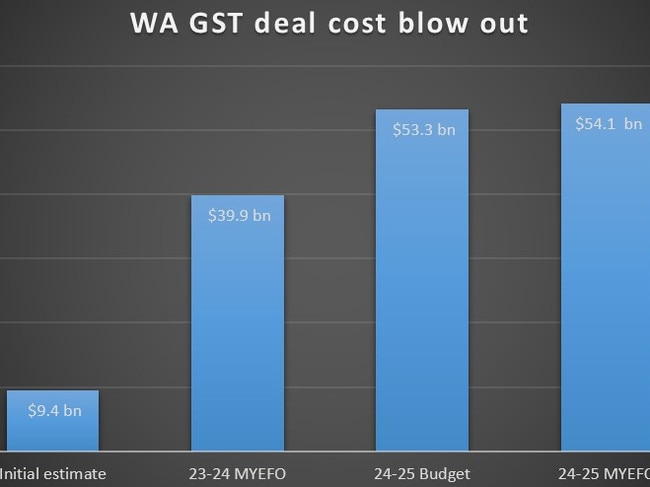

Mr Eslake said the deal was originally meant to cost Canberra about $9bn over a decade.

But that has blown out to more than $54bn through 2030, mainly because of even higher than expected mining royalties for WA.

Nearly $22bn has already gone out the door under the deal, which now guarantees WA 75 per cent of what it would get if GST revenue was split by population.

“You certainly don’t have to spend what’s been left … placating the greed of the richest state in the country,” Mr Eslake said, noting WA was the only jurisdiction in the nation running surpluses.

Under the capacity equalisation model, this financial year the west would have received 12 per cent of what it would have received if GST was split by population.

Still, both sides of politics told this masthead they have no intention of altering the GST deal with WA.

Mr Eslake noted there is a legislative requirement for funding to the states and territories to be investigated by the Productivity Commission before 2027.

“Whoever is the Treasurer after the next election should task the Productivity Commission with … coming up with system that is simple, efficient, predictable and understandable,” Mr Eslake said.

The office of Treasurer Jim Chalmers declined to comment on what the outcomes of the PC review should be.

A government spokesman said Labor had delivered surpluses in its first two years and found more than $90bn in savings, most of which had been banked.

However, the recent mid-year economic and fiscal outlook laid out four years of deficits totalling $144bn – $22bn more than forecast in last year’s budget.

The other way to drastically improve the budget position is to arrest the slide in tobacco excise by cracking down on crime gangs behind the sale of black-market cigarettes, Mr Richardson said.

According to his calculations, this could increase government revenue by even more than unwinding the WA GST deal — potentially as much as $10bn a year.

“Line up the enforcement with the taxing,” Mr Richardson said. “People will smoke less and we’ll get a lot more tax.”

Mr Eslake said: “There is now an enormous incentive for people within Australia to create what is known as chop chop – illegally grown tobacco – and lots of incentive for people to smuggle in cigarettes from overseas and sell them for $25 or $30” a pack.

Mr Richardson said: “For organised crime, it’s got all the profits of heroin and a tiny fraction of the downside.

“If you get caught you get fined. Come in spinner.

“We have created an enormous black market and financed much of the rest of organised crime by just being outstandingly dumb,” Mr Richardson added.

The battle for control of the black market is causing chaos on the streets. In Victoria alone, there have been over 130 arson attacks on tobacco stores in the past two years, as crime gangs attempt to pressure owners into selling their products.

A government spokesman said Labor was “taking decisive action to end the trade of illicit tobacco with $188.5 million to the Australian Border Force.

“Record levels of illicit tobacco are being targeted and seized … and prosecutions are taking place,” the spokesman said.

The Coalition has promised $250m to combat illegal tobacco.

At a conference in London this week, former federal treasurer Peter Costello urged western governments to pay down debt instead of “punting the problems to our kids and their generation.”

Australia was debt-free by the time Mr Costello’s 11 year-stint ended in 2007. Federal net debt is now forecast to breach $700bn by 2027-28.

More Coverage

Originally published as Anthony Albanese, Jim Chalmers’ ‘dumb’ decisions that are set to add extra $40bn to our ballooning debt

Read related topics:Anthony Albanese