South Australia’s $330 million bill you can’t see

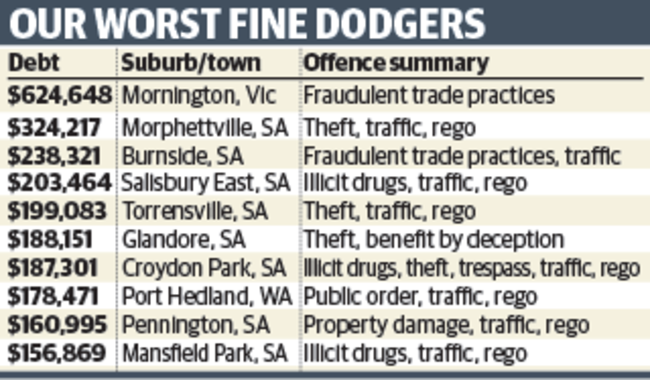

There are more than 100,000 fine dodgers who owe hundreds of millions of dollars to the State Government — but a name-and-shame database designed put pressure on our worst debtors has been suspended. SEE OUR WORST OFFENDERS.

Law and Order

Don't miss out on the headlines from Law and Order. Followed categories will be added to My News.

- Driving with phones: SA motorists risk $200 fine increase

- Traffic fines South Australia: Weird offences

Fine evaders owe almost $330 million to the State Government, which has suspended its online name-and-shame file over fears it could inadvertently identify vulnerable people.

The Advertiser can reveal about 109,000 people have outstanding fines worth $328.2 million in traffic and registration infringements and penalties for various criminal offences.

But the identities of SA’s worst debtors – including a Victorian who owes $624,648 in unpaid fines and compensation for fraudulent trade practices – is now not publicly known.

The name-and-shame file was introduced in December 2014 by the former Labor government, which described it as the latest weapon in the arsenal to crack down on fine defaulters.

More than $260 million was owed at the time, when then attorney-general John Rau said: “It is unacceptable that so many people are finding ways to beat the system.”

But the list, which included people owing hundreds of thousands of dollars, no longer appears on the State Government’s Fines Enforcement and Recovery Unit website.

A fines unit spokesman said the public register of names was suspended by the chief recovery officer earlier this year after a review assessing its effectiveness uncovered potential risks.

“The fines unit identified there was a high risk of inappropriately publishing the name of a debtor who was a youth, a protected person or person subject to a suppression order,” he said.

The spokesman said that, while no one had been inappropriately identified, resources required to mitigate the risk outweighed any potential benefits.

Attorney-General Vickie Chapman told The Advertiser the fines unit was now considering publishing names of companies “as this is an effective way to recover those debts”.

She said the State Government was “working through inter-agency information sharing” to avoid disclosing information about vulnerable people, including domestic violence victims.

“People who owe money to the State Government for unpaid fines need to realise there are serious consequences if they try to avoid addressing their debts,” Ms Chapman said.

“Pretending the debt doesn’t exist is not going to solve the problem. People could end up facing far worse sanctions than just an unpaid fine.”

The fines unit has the power to recover unpaid debts through suspending driver’s licences, garnisheeing income from bank accounts and seizing assets.

It has recovered $657.8 million and suspended 257,182 licences since its February 2014 establishment. There have been 59,000 garnishments worth $14 million since May 2016.

Garnishments are for 25 per cent of the account balance or the total debt, whichever is lower, but Centrelink benefits are generally protected under legislation.

The fines unit spokesman said suspending a licence or garnisheeing income prompted debtors to enter some form of payment arrangement.

He said there were more than 70,000 active payment arrangements currently in place and about 650 were established or varied each day – the majority pending a licence suspension.