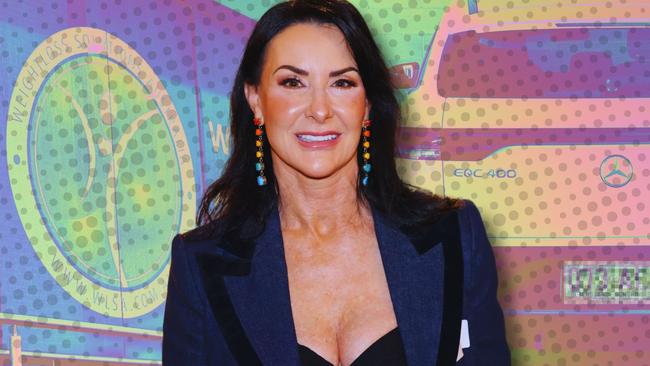

She gets around town in a luxury Mercedes, is a staple on the Gold Coast’s lunching scene and has shaped a reputation as a top businesswoman and “wellness warrior”.

But behind the accolades and designer wardrobe, Felicity Jane Cohen has overseen a series of devastating company collapses which have left creditors millions of dollars out of pocket.

Ms Cohen, 59, is head of Weight Loss Solutions Australia, which facilitates bariatric surgeries and other procedures from its headquarters at Varsity Lakes.

But two companies associated with the business have gone into liquidation in recent months, with debts of almost $3 million between them.

Reports lodged by the liquidator of one of the companies, Bariatric Patient Management Australia (BPMA), said Ms Cohen “advised me that she owes $1.98 million to the company in relation to a loan account”.

A report in August from liquidator Matthew Bookless of SV Partners said the company owed individuals and businesses more than $2.2 million, including almost $370,000 in unpaid staff superannuation.

It has unknown total assets and the liquidator’s report said Ms Cohen had told him she owed $1.98 million to the company.

“She has not advised whether the loan will be recoverable in full or at all,” the report said.

“I will conduct my own assessment of the recoverability of the loan and issue a demand for repayment. I will also investigate the purpose of the loan account and how the funds were used.”

Ms Cohen has since denied owing the money and Mr Bookless, who has not lodged further information about the $1.98 million since August, did not respond to the Bulletin’s questions.

Ms Cohen is sole director and shareholder of BPMA, although the shares are held in her married name, Felicity Layani.

The report said Ms Cohen had told liquidators the company owned a 2020 electric Mercedes wagon, used as her regular drive, on which was owed more than $73,000.

Mr Bookless’ report said if it was valued at less than the loan payout amount, owed to Macquarie Leasing, he would exclude it from the liquidation.

A 2020 electric Mercedes wagon was parked in a bay marked “CEO WLSA parking only”, at WLSA’s headquarters last week.

An extension cord connected to the wagon trailed across the carpark into the door of the business’s front office.

Ms Cohen declined the opportunity to answer questions at the office, saying she had contacted her lawyers.

“There’s so much in (the Bulletin’s questions) that’s just, not just damaging, but misinformation and a whole host of other stuff,” she said.

Addressing the questions on Ms Cohen’s behalf, solicitor Callum Viel of Hickey Lawyers said she “no longer owns the vehicle” and “denies that she personally owes the amount alleged”.

“Our client and her financial advisers are currently working with the liquidators to

resolve various complex accounting issues,” Mr Viel wrote.

“Our client is currently working seven days a week in the effort to achieve an outcome which is favourable to all involved.

“Our client intends to comply with any legal obligation that she has.”

Mr Bookless’ report said BPMA had received $230,000 from the Queensland Government via the Rural and Industry Development Authority, which was listed as a secured creditor. Almost $350,000 is owed in tax.

Another of Ms Cohen’s companies, WLSA Pty Ltd, was wound up in the Brisbane Supreme Court in April with debts of almost $700,000. Ms Cohen is sole director and shareholder of WLSA, which is described in the report as a “non-trading entity” which held the intellectual property of the weight loss business.

A report by liquidator Steven Staatz of Vincents said the company was wound up by Big Green Surgical Company, which supplies Allurion “balloons” which are inserted into the stomachs of patients seeking to lose weight.

According to Mr Staatz’s report, an affidavit sworn by Ms Cohen during the wind-up proceeding said she was unsure which of her companies, BPMA or WLSA, was supposed to pay the invoices.

Ms Cohen’s affidavit said the confusion arose because a trade credit application with Big Green was made by WLSA but BPMA received the products.

Mr Staatz’s report said BPMA owed $416,171 to WLSA, which Ms Cohen had told him could not be repaid.

Ms Cohen personally owes WLSA $16,500, while she was also joint guarantor for more than $90,000 in loans from Bizcap, under the name Felicity Layani, according to the liquidator’s report.

On Friday, Mr Staatz said he was “still pursuing the recovery of funds from the director, Felicity Cohen, and from the related entity Bariatric Patient Management Australia”.

Mr Bookless’ report said BPMA’s business had been licensed to Brilliant Bariatrics, “a related party”, for $550 a month.

“The appropriateness of the licence arrangement will form a primary focus of my investigations,” the July report said.

Company records show Ms Cohen created Brilliant Bariatrics in May 2024, and its current registered address is in her name and at her home address.

The directorship and shareholding was transferred to Dimitri Fedorov in August, after BPMA went into liquidation and after it struck a “licensing agreement” to run the business.

Dr Fedorov, an anaesthetist with Brisbane Obesity Surgery, did not respond to the Bulletin’s questions, which found their way to Ms Cohen.

A surgeon for Brisbane Obesity Surgery, Dr Reza Adib, has a decade-long history with WLSA, having performed countless surgeries on clients of the business.

Questions sent to Dr Adib – the partner of ex-Premier Annastacia Palaszczuk – also ended up with Ms Cohen.

Ms Cohen’s solicitor said there were “various inaccuracies” in the questions to the doctors but did not specify what they were or attempt to answer them.

Mr Staatz’s report said the operations of WLSA were licensed to another of Ms Cohen’s companies, FJC Invest, also for $550 a month.

“The director, through her representative, has indicated her intention to purchase the Company-owned IP with a verbal offer,” the report said.

“Despite follow-ups, I have not received a formal written offer or any funds/payment.”

On Friday, Mr Staatz said the $550 licensing fee had not been paid by FJC Invest since July.

Mr Viel’s letter said his client Ms Cohen “does not operate the WLSA business, she is an employee of the business”.

However, the letter also said she was “driving a rebuild of the business in consultation with her advisers and the liquidators”.

“It is more important for our client that she spend her time achieving an outcome for those affected by the appointment of the liquidator rather than responding to your email,” it said.

Ms Cohen was winner of the Gold Coast Woman in Business of the Year at the 2021 Gold Coast Women in Business Awards.

In 2022, she won the Wellness Warriors category of the Gold Coast Bulletin Women of the Year Awards.

Ms Cohen’s website describes her as a “CEO, speaker and changemaker” and “one of Australia’s leading pioneers in the movement to end obesity and weight-related disease and illness in children and adults”.

Her home address, as per ASIC records, is a Tugun home which sold for $1.1m in 2023.

The property is registered in the name of Felicity Jane Layani, and is jointly owned by chef Ehoud Uzan, co-founder of shuttered Palm Beach restaurant Avvia and successful Italian venue Balboa.

Balboa is now solely operated by Mr Uzan’s ex-wife Cherie Uzan.

Ms Cohen was previously a practice manager at Weight Loss Solutions Australia, which was founded by gastric surgeon Laurence Layani, who she subsequently married.

The pair parted ways and social posts suggest he currently lives in the United Arab Emirates, where he continues to work in the sector.

It’s not the first time a company directed by Ms Cohen has been wound up by a court – Lapsurg Innovations, which she co-directed under the name Felicity Layani with her former husband Dr Layani, went into liquidation in 2013.

Liquidator reports lodged with ASIC show that company owed more than $195,000 to creditors including the tax office.

Mr Viel’s letter said Ms Cohen was “a passionate businesswoman” who had built a career while “sole carer of two young children”.

“Our client has always set out to achieve the best result for her patients and to

ensure that her staff are satisfied within their roles,” it said.

“The appointment of a liquidator to the business, as well as the following process has

taken a physical and mental toll on our client.”

WLSA liquidator Mr Staatz said he believed Ms Cohen “may have committed offences” in the management of the company and that he’d reported his suspicions to ASIC.

But, the report said, “ASIC has advised that they do not intend to take any further action in relation to my reported findings”.

Pay to dump: Council’s big move on tip fees

Gold Coast residents will in future have to pay fees to access tips if City bosses get their way, with a crunch vote looming at council chambers.

$900k dance-off: Dreamworld performer sues over injury

A dancer is suing Dreamworld for almost $900,000, claiming she injured her foot after not being given enough time to rest on a double shift.