Commodity Insights report says QLD coal royalties put billions at risk

The sound and fury around the government’s new coal royalties continues to escalate with a new report from an independent commodities consultant stating Queensland is now the world’s ‘rank outlier’ on rates.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Bowen Coking Coal’s Bluff mine is once again shipping coal, but executive chairman Nick Jorss says the government’s new royalty regime means his company will think twice about restarting a mothballed mine.

“This (the royalty increase) raises substantial risks to further investment in Queensland mining and regional Queensland jobs,” he said.

Mr Jorss’ remarks are part of a new report from Commodity Insights, which argues the government’s new rates could put at risk $57bn in coal projects at the announced or feasibility stage.

“The new royalty regime will impact the economics of all this potential coal sector investment, particularly the $41.5bn in the feasibility stage,” the report states.

The report, commissioned by the Queensland Resources Council, calculates the new rates add an extra $28/t on average to metallurgical coal production and $27/t for thermal coal.

In comparison with other coal producing nations, the report notes Queensland now has the highest maximum coal royalty rate in the world at 40 per cent.

Indonesia comes in at second place with a maximum rate of 28 per cent and among developed nations, Canada follows Australia with a rate of 15 per cent.

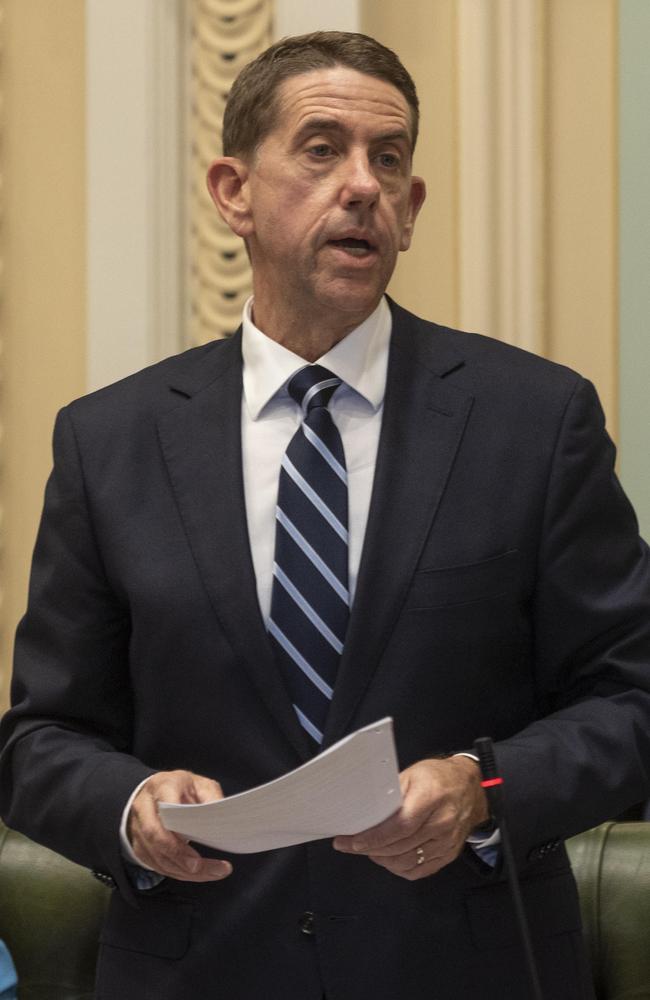

The new royalty regime, announced by Treasurer Cameron Dick in June, added three tiers to the existing tiered structure, with companies now paying 20 per cent on the dollar when coal prices exceed $175 per tonne, 30 per cent on the dollar when prices climb beyond $225 per tonne and 40 per cent when they exceed $300.

“This maximum rate is also nearly four times higher than the global average of maximum rates (10.2 per cent), making Queensland the rank outlier regarding coal royalty rates,” the report states.

“It is also noteworthy that the second highest royalty rate under the new Queensland regime (30 per cent) is still higher than any of the global maximum rates in their jurisdictions.”

The report also claims the government has underestimated the revenue it will collect from the royalties by using excessively conservative coal price forecasts.

“The Queensland Budget estimate of $800m revenue raised under the new regime for 2022-23 compares to a range of $2.9-7.5bn revenue from other forecasters,” the report states.

A spokesman for the Treasurer said forecast returns were based on coal price modelling by Queensland Treasury and aligned with forecasts used by coal companies when planning investments.

“If prices perform higher than forecast, any additional royalties generated would only be a fraction of the windfall profits that coal companies would be making from the resources owned by the people of Queensland,” the spokesman said.

“Regional Queenslanders deserve to see the benefit of high prices.

“All of the additional royalty revenue announced in the budget is being allocated to regional hospitals, including a new hospital for Moranbah.”

The royalties came into effect on July 1 and there are already signs Central Queensland’s $29bn resources sector could be affected.

Whitehaven Coal is looking to pump $1bn into the Winchester South project near Moranbah but CEO Paul Flynn has signalled the new rates made Queensland a more risky bet.

“The unpredictable nature of what has occurred in Queensland does not foster the confidence necessary to commit billions of dollars in capital,” he said.

Bowen Basin Mining Club director Jodie Currie has also raised concerns about the flow-on effect to the Basin’s small businesses.

“The small business owners of the Bowen Basin are put at long-term risk by changes to royalty schemes, particularly unpredictable ones,” she said.

“It is not news that ours is an unpredictable industry, but it is also known that the good years are meant to offset the tougher times.

“When those tougher times come, small businesses are the first ones to feel the impact, as they do not always have economies of scale or big profit margins to fall back on.

“If mining companies are wary of long-term investments, this is bad news for suppliers throughout the industry’s supply chain, but particularly small business.”

Originally published as Commodity Insights report says QLD coal royalties put billions at risk