Climate change business to boom as riches are about to flow

Stopping climate change is tipped to deliver huge wealth to those taking advantage of business opportunities.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Elon Musk has been a shining star showing the billions – and soon to be trillions – of dollars being generated by businesses that combat climate change.

The founder of Tesla, which produces electric cars along with solar energy generation and storage, rocketed up the global rich list last year as the value of Tesla shares surged ten-fold.

He briefly became the world’s richest man last month and currently sits at number two behind Amazon founder Jeff Bezos.

Economists and finance specialists say Mr Musk’s rise is just the start of a global mega-trend bringing huge wealth for climate-focused businesses, and the countries that support them.

Australia – with its vast space, sunshine and expanding renewable energy industry – is one of the best-placed countries to benefit.

Billionaire businessman and philanthropist Andrew Forrest has thrown his financial weight behind making Australia the world leader in green hydrogen: “the cleanest source of energy in the world” that emits only water vapour.

“The question isn’t whether or not green hydrogen will become the next global energy form, it’s who will be the first to mass-produce it,” Dr Forrest told an ABC Boyer lecture in late January.

“The journey to replace fossil fuels with green energy, which has been moving at glacial speed, has suddenly slipped into high gear,” he said.

Businesses, governments and everyday Australians can benefit from the multi-decade boom in climate-focused innovation as much of the world aims to emit no carbon by 2050.

HOW MUCH WILL BE SPENT?

Munro Partners chief investment officer Nick Griffin said big players including Europe and China – and the US soon – were joining the push to zero carbon.

“Multiple corporations, including Amazon and BHP, are saying they want to get to zero carbon emissions,” he said.

“We think conservatively that it will cost $30 trillion over the next 30 years, and it could cost as much as $50 trillion.”

And it’s only early days. Mr Griffin said renewables currently produced just 10 per cent of all power, while electric cars comprised just 2 per cent of all cars sold.

“Investors are quite close to the start of this,” he said.

Tesla was one company doing well “and there will be lots of others”, Mr Griffin said.

“There’s just too much money that has to be spent.”

GROWTH POTENTIAL

KPMG Australia chief economist Brendan Rynne said the pandemic had turbocharged the public’s acceptance of science, just as the new Biden administration in the US was putting climate back on the primary political agenda.

“Communities have lived experience of more climate severe climate variations, and it matches the warnings from the scientific community over the last couple of decades,” he said.

Dr Rynne said Australia could capitalise on climate-related spending trends.

“Because of our natural advantages we should be world leaders in solar energy,” he said.

“What we have been able to show before is that Australia can be a dominant player in energy industries, in agriculture, and in areas requiring innovation and technology advancement,” he said.

KEY PLAYERS

Dr Forrest’s Fortescue Metals Group, the iron ore giant that made him Australia’s richest man, is taking a lead in lowering carbon emissions through renewable energy power stations, trucks, trains and steel in Western Australia.

“We aim to start building Australia’s first green steel project in the Pilbara, powered entirely by green hydrogen from local wind and solar, in the next few years,” he said.

“Australia is in an absolutely unique position to scale green steel. If we do it, the immediate and multiply impact on the Australian economy will be nothing short of nation-building on a grand scale.”

Energy giants such as AGL and Origin have significant renewable businesses, along with their traditional energy production assets that may see them walk a financial tightrope in coming years.

Federal Government policies will have a huge impact, and Prime Minister Scott Morrison has been talking about moving Australia into the net zero emissions camp.

Consumers will also play a key role, voting with feet and wallets for more climate-friendly products and technologies.

Electricity and gas retailer Simply Energy’s CEO, Shannon Hyde, said a low-carbon future would flow from “technology that works with consumers”.

“We can’t lose sight of what the destination will look like: we will have energy that’s sustainable, affordable, reliable and ideally abundant,” he said.

Simply Energy is a subsidiary of French low-carbon energy company Engie, which Mr Hyde said “intends to be a leading player in Australia”.

“Engie closed down coal early and converted to renewables,” he said.

GRABBING A SLICE

Individuals wanting to buy into the climate boom should search offshore, as there are few large climate change-related businesses in Australia.

“The climate policies in Australia haven’t really fostered innovation in this area,” Mr Griffin said.

Successful local renewable energy businesses are often snapped up by European giants.

4D Infrastructure global portfolio manager Sarah Shaw said everyone should be looking at how to capitalise on climate-related opportunities, including infrastructure that was vital to produce and transport renewable energy.

“Whether you’re a believer or not, the investment opportunity is phenomenal,” she said.

“But in terms of mums and dads wanting to invest in the Australian equities market, opportunities are limited.”

Ms Shaw said investors could consider mining companies that produced minerals used in battery technology, such as lithium. Pilbara Minerals shares have climbed three-fold in past year, while Galaxy Resources is up 150 per cent.

Many renewable energy stocks listed in Australia are actually New Zealand companies, while others have had poor-performing share prices, so do some research before buying.

An alternative is managed funds and exchange traded funds (ETFs) that focus on global growth or renewables.

ETF Securities head of distribution Kanish Chugh said it was witnessing a surge of investors buying into its Battery Tech & Lithium fund.

“This high performing ETF offers exposure to global companies developing electrochemical storage technology, mining companies producing battery-grade lithium and manufacturers of electric vehicles,” he said.

“There is a clear-cut case for investing in the themes driving the future.”

And as this gigantic global trend gathers momentum, many more opportunities will emerge.

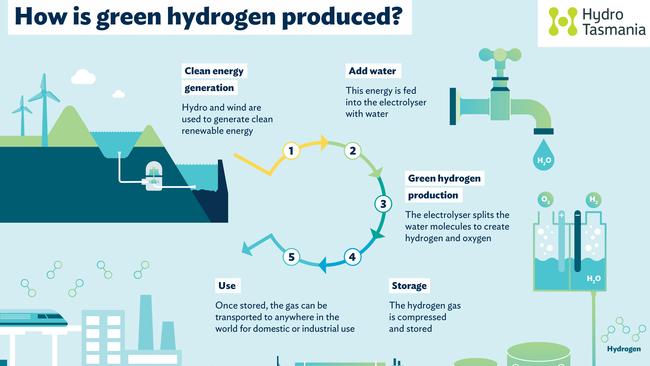

HOW GREEN HYDROGEN IS MADE

• Hydrogen powered vehicles are popping up across the world, and UNSW Sydney researchers say large-scale hydrogen energy plants could become cheaper than fossil fuel plants in the next two decades.

• Hydrogen power can be produced by pumping water into an electrolyser, which uses electricity to split away the valuable hydrogen gas (H2) to leave oxygen (O2) as a benign waste.

• The process only creates greenhouse gas emissions if it’s powered by electricity supplied from fossil fuels. But if that electricity comes from renewable energy such as solar or wind, it’s much cleaner and is know as green hydrogen.

CARBON CAPTURE IN A NUTSHELL

• Carbon capture and storage is one of the necessary tools available to fight climate

change, says asset management group Schroders.

• “It is the process of capturing carbon dioxide, transporting it and permanently depositing it underground,” Schroders says in its Sustainable Investment Report released this month.

• It says the process can capture up to 90 per cent of CO2 emitted by a factory.

• The most widely-adopted technique involves compressing emissions into liquid form and injecting them underground, such as into depleted oil and gas fields. “Over hundreds of years, these carbon emissions will be absorbed by the surrounding rocks,” Schroders says.