Huge number of Cairns homes under mortgage stress

Cairns suburbs are in the 10 worst areas in the state affected by mortgage stress, new figures show, as one mum shares how she’s making ends meet.

Cairns

Don't miss out on the headlines from Cairns. Followed categories will be added to My News.

Cairns suburbs are in the 10 worst areas in the state affected by mortgage stress, new figures show, as interest rates look set to rise again on Tuesday.

Consumer group CHOICE has released data showing Cairns comes ninth on the list with 3542 homes suffering mortage stress.

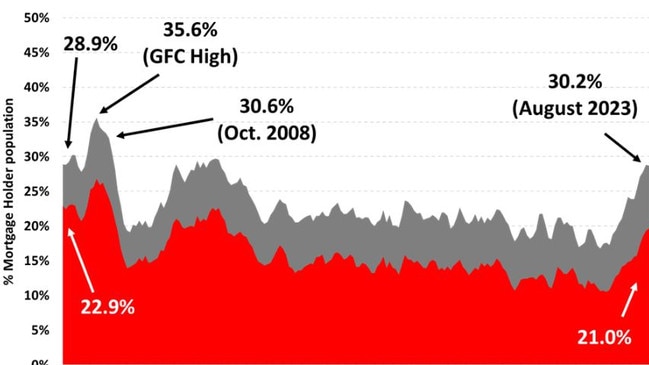

The data, revealed by Martin North from Digital Financial Analytics, shows a whopping 43.5 per cent of Queensland households were believed to be “mortgage stressed” at the end of October, with that number tipped to increase to 49 per cent if the central bank increases the official cash rate to 4.35 per cent on Tuesday.

Mount Sheridan mother Katy White said the over the last twelve months more than 50 per cent of her family’s income went on her mortgage.

“It’s become a huge juggling act, we cut back on everything and I still got up to 20 calls a day from people I owed money to,” Ms White said.

“It got to the point that we applied for hardship through the bank so we could have a temporary mortgage freeze for three months.

“The bank were actually really good. The three months that we had the mortgage frozen we were able to catch up with the other due bills.”

This week Reserve Bank governor Michele Bullock was noncommittal at a Senate Estimates Committee about whether the RBA would raise interest rates, but most financial analysts are predicting a rate rise of 25 basis points – bringing the cash rate to 4.35 per cent.

It would be the 13th rate rise since May last year.

This comes as Australia’s inflation rate rose again in the September quarter, boosted by higher petrol prices and increased property rents.

The headline consumer price index rose 1.2 per cent in July-September, up from 0.8 per cent in the June quarter.

“Many households across Queensland are doing it tough,“ CHOICE banking policy expert Patrick Veyret said.

Mortgage stress is defined as a mortgage-holding household with a negative cash flow, so they are not able to keep up with mortgage payments and other essential spending through income alone.

“Across Queensland, households are struggling with their mortgage repayments. In particular, families in rural and regional Queensland are struggling. Toowoomba, Ipswich, Mackay, and Cairns feature in the top 10 hardest hit postcodes in Queensland”.

He said that while there are “promising signs of economic recovery in Queensland, many people have been left behind”.

Mr Veyret said high levels of underemployment, stagnant wages growth, and government support as well as the impacts of international and state travel restrictions in Cairns “have placed a serious strain on household finances”.

For Ms White the prospect of an interest rate rise makes her “feel nervous”.

“It’s hard to budget and make commitments when you don’t know what your accommodation expenses will be in the future,” Ms White said.

More Coverage

Originally published as Huge number of Cairns homes under mortgage stress