THE $22 billion National Disability Insurance Scheme will transform the lives of many Australians. This special report reveals how the system works for people with disabilities and their carers.

Key points

|

THE idea of a universal funding scheme for people with disabilities has long been embraced across the political spectrum.

But the struggle over how to pay for the National Disability Insurance Scheme stretches back to mid-2011 and an agenda-setting Productivity Commission report advocating the concept.

The financial wrestle continues today, following Treasurer Scott Morrison’s May Federal Budget unveiling a 0.5 per cent increase in the Medicare Levy for all taxpayers to fully fund the NDIS.

This was swiftly opposed by Opposition Leader Bill Shorten, who accused the government of trying to bully Labor into backing an unfair hike while giving away $65 billion in corporate tax cuts.

The move to a NDIS was triggered by the aim of meeting the substantial costs of lifetime disability care by pooling risks and costs.

“Most families and individuals cannot adequately prepare for the risk and financial impact of significant disability,” said the 2011 Productivity Commission inquiry report into disability care and support.

“The current disability support system is underfunded, unfair, fragmented and inefficient, and gives people with disability little choice and no certainty of access to appropriate supports.

“The stresses on the system are growing, with rising costs for all governments.

“There should be a new national scheme – the National Disability Insurance Scheme (NDIS) – that provides insurance cover for all Australians in the even of significant disability.

Funding this should be a core function of government.

“Funding of the scheme should be a core function of government (just like Medicare).”

The scheme’s main function, the report urged, would be to fund long-term, high-quality care and support – but not income replacement – for people with significant disabilities.

About 410,000 people would receive funding support.

Benefits of the scheme would significantly outweigh the costs, the report predicted. People would have more choice and support packages could be tailored to individual needs.

However, the Productivity Commission estimated the amount needed to provide people with necessary support would be about double the-then current spending, or an extra $6.5 billion per year.

Fast-forward to May, 2013 and the-then Labor prime minister Julia Gillard announced a Medicare levy increase from 1.5 to 2 per cent to pay for the NDIS. Ms Gillard had ruled out a levy in 2012, then changed her mind.

“This is the right thing for the nation. This is the choice I’ve made. I know I am asking Australians in their millions to step up and pay an increase in the Medicare levy,” Ms Gillard said at the time.

A month before, South Australia had become the second state to sign up for the full NDIS. At the time, it was estimated that about 33,000 South Australians with a disability would benefit by the end of 2018-19, giving them more choice in their care as well as more cash.

State funding of services of $345 million this year would rise to $723 million by 2018, matched by the Commonwealth for total funding of $1.4 billion.

``People will get funding for all the services they need and will be empowered to choose for themselves the services they want,’’ Premier Jay Weatherill said at the time.

But, by mid-2015, respected Disability Speaks lobby group chairman David Holst said a stand-off between state and federal governments over eligibility and funding for the scheme was becoming “chronically unhealthy” for affected families and children.

Almost six years after the Productivity Commission report, however, debate continues about how to fully fund the NDIS.

In his May Budget speech, Mr Morrison vowed to “close the funding gap for our National Disability Insurance Scheme once and for all”.

“The funding gap is currently $55.7 billion over the next 10 years. We have previously sought to close this gap with budget savings that we have not been able to get through the Parliament,” he said.

“To ensure the NDIS is fully funded we will legislate to increase the Medicare levy by 0.5 percentage points in two years’ time, when the extra bills start coming in.

“This will also provide further time to explain to Australians what the NDIS will deliver.

“Even if we are not impacted directly, this is all our responsibility. Our decision to increase the levy reflects the fact that all Australians have a role to play.”

But Mr Shorten then declared he would not compromise on increasing the Medicare levy for all taxpayers, saying there would be plenty of money if the Coalition abandoned its $65 billion company tax cut plan. Instead, Labor insisted it would back the Medicare levy increase only for Australians in the top two tax brackets.

“Let me be clear about the National Disability Insurance Scheme. Labor didn’t just create the NDIS – we fully funded it, we budgeted for it – and Treasury confirmed it,” Mr Shorten said in his May Budget reply speech.

“And, after three years of Liberal Cabinet leaks questioning the cost and the value of the NDIS, we will not have our commitment challenged by those opposite.

“For our party, the National Disability Insurance Scheme is an article of faith. Labor fully funded it in government, we will fight for it in opposition – and we will never see the people who rely on it go without the money they need.”

For both major parties, there is a will to fully fund the NDIS. But they differ on the means, resulting in an impasse.

People with disabilities and their families will hope a solution to the long-running logjam can be found, turning political will into reality.

To watch this video in Auslan, click here

FREQUENTLY ASKED QUESTIONS

What is the NDIS?

The National Disability Insurance Scheme has been hailed as the most significant bipartisan economic and social reform since the introduction of Medicare in the 1970s.

The initiative provides funding for Australians who have a disability and require long-term support. The aim is to improve the quality of life for people with disability and their carers, increase their economic and social participation with improved care and support services, and stop the increasing costs for all governments.

Block-funding from state governments will shift to individuals to choose which public or private service providers can best respond to their needs.

Why change?

The Productivity Commission report in 2011 found the support for people with disabilities and their families and carers was “underfunded, unfair, fragmented and inefficient”, especially at times of crisis. In addition, the number of people needing support is rising but the number of voluntary carers is declining.

The report found the NDIS would add 1 per cent to the country’s gross domestic product. “From an economic perspective, the benefits of the NDIS will exceed the costs,” the report says.

Who is affected by the scheme?

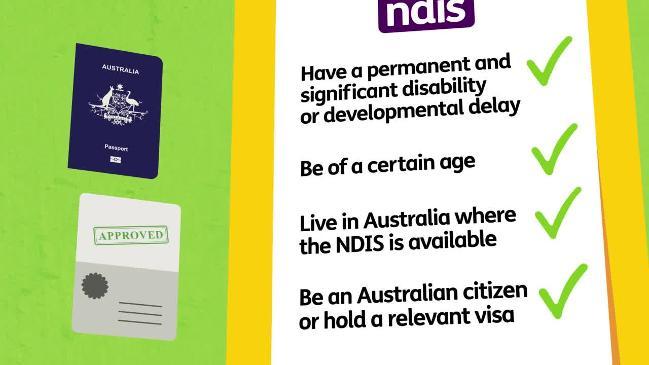

There are about 2.5 million people in Australia who have a disability, according to the 2015 Survey of Disability, Ageing & Carers. But not all will be eligible for the NDIS.

The number receiving an NDIS package is expected to grow to about 460,000 when the scheme becomes fully operational in 2019.

The NDIS looks after Australians who have a permanent impairment that substantially reduces their intellectual, cognitive, neurological, sensory, physical, psychological or social functioning.

The person must be under 65 at the time of entering the NDIS and will remain on the scheme even as they turn older. People who develop a disability later in life are covered by the aged care system.

Family and friends who care for people with disabilities are also affected by the changes, with some saying the scheme would put more pressure on them. However, others believe the scheme, if implemented properly, could actually help them return to work.

Jobseekers will be affected by the scheme, with the NDIS expected to create thousands of jobs in a sector that already struggles with skills shortages. Service providers will face major restructure to respond to the changes.

How does the NDIS work?

The National Disability Insurance Agency is an independent statutory agency, responsible for implementing the NDIS.

Once signed up for the scheme, an NDIA representative meets with the participant to discuss the person’s life situation, current supports and hopes for the future.

An individual plan and funding is allocated for “reasonable and necessary supports to live a life as ordinary as possible”.

Once a person has a plan, they can choose the service providers. Alternatively, they can nominate a service provider or an agent to manage the funds.

Plans are reviewed annually and can be adjusted when circumstances change.

What kinds of services and support are available?

NDIS funding for each individual is divided into three different budgets:

Core supports, which look after day-to-day living support, so people with disabilities can better take part in the community;

Capital supports, which help participants buy resources or equipment, including wheelchairs, assistive technology or car modifications; and

Capacity-building supports, which help build life skills.

What does the NDIS mean for people who currently receive disability support?

They will continue to receive any existing supports until their transition to the NDIS.

What if I’m over 65?

The Commonwealth will provide support to older people with disability through the Continuity of Support Programme, starting on October 1. For more info, visit health.gov.au. People who are not eligible for the program should contact My Aged Care on 1800 200 422.

How is it funded?

It is estimated that the NDIS will cost up to $22 billion annually by the time the scheme is fully operational in 2019.

In his Budget speech in May, Treasurer Scott Morrison said the permanent increase to the Medicare levy of 0.5 per cent, to apply from July 1, 2019, would deliver the Commonwealth’s share of the NDIS. The rest will be committed by the State Government. At full rollout, the State Government will contribute $723 million annually to the NDIS. The total value of the scheme in South Australia is estimated to be $1.5 billion.

What does it mean for jobs?

The Department of Communities and Social Inclusion estimates, by the time the scheme is fully operational in SA, there will be 12,000 full-time equivalent roles – double the number of jobs pre-scheme. In proposing the introduction of the NDIS, the Productivity Commission warned the shortage of allied health professionals, particularly in regional areas, could hamper the delivery of the NDIS. The increasing demand in the sector means further training opportunities will have to be provided in the area.

Jobs range from carers to IT workers, occupational therapists, physiotherapists, drivers and managers. Disability Workforce Hub connects jobseekers in northern Adelaide with local

employers, training providers and employment agencies.

For more info, phone 1800 619 933.

To watch this video in Auslan, click here

HOW TO MANAGE YOUR PLAN

There are different ways to pay your disability help with your NDIS money.

Agency-managed means the NDIS pays your bills for you and you don’t have to worry about it. You don’t have to keep paperwork or open special bank accounts but can only buy from registered providers.

Self-managed means that you look after your own bills and keep records. You can choose anyone to provide your support and services but you have to be good at maths and budgeting.

Plan-managed means the NDIS will pay someone you choose from the NDIS list to help you manage the money and pay your bills. You don’t have to keep any paperwork or open a special bank account but your bill might be paid late with some plan managers.

1. AGENCY-MANAGED

When a participant chooses their plan to be “agency-managed”, this means your funds are paid directly by the NDIS (the “agency”) to your registered service providers after services are provided. With agency management, you can ONLY choose NDIS registered providers to give you supports and service with your NDIS funds. Those registered providers have a direct portal link to the NDIS online and electronically send their bills (and those rates are capped by the NDIS) directly to the NDIS after they have provided you a service. Then the NDIS pays them directly.

You, the participant or nominee, can check in on the MyPlace NDIS web portal (when it is working) at any time to see how you’re tracking with your funds, what has been claimed, and what is left. This option offers the least choice and control but is good for people who aren’t looking for much flexibility, and want the security of all registered providers.

Pros: no bookkeeping, no upfront costs, no separate bank account, audits easy.

Cons: can only choose registered disability providers, less control and creativity over how to spend your funds, and no spontaneity (for example, most registered support worker agencies will have minimum shift lengths that may not suit your needs, and you won’t be able to buy smaller assistive technology items from regular shops).

2. SELF-MANAGED

This means the money effectively (but not actually) goes to you, the participant, to spend to meet you or your child’s goals. You can use any providers or mainstream supports and services – they do not have to be disability specific, nor registered providers.

An example might be that you want to learn to surf, but need two instructors to assist. With self-managed funds, you could pay the fee for the extra second instructor from your self-managed funds – as surf schools are not likely to be agency registered providers you could not do this if your plan was agency-managed, and will have to pay from your own pocket.

When your plan is self-managed, it’s important to know that no provider is obligated to stick to the NDIS fee schedule — they can set their own fees and charges (this might be good if you want to pay an especially valued support worker more than the scheduled fee, or bad if the provider is the only one in town and charges ridiculously high fees).

You’ll want to open a separate bank account just for your NDIS funds (for nominees of children, a student account in your child’s name or an offset account of your own are both fine, and if you have more than one participant in your family, each of them will need their own account). You can then go out and purchase services and supports yourself.

You can either pay upfront for services as you use them or put in claims after you are invoiced, and then pay (very easy on the portal) – your reimbursement will be deposited into your account, usually within a few days. You will need to keep decent records and all of your receipts for auditing purposes. In some circumstances, you may be able to claim a few weeks in advance – you’ll need to talk to your LAC or the NDIS for approval for advance claims.

Pros: complete control of funds, choose any provider or company to help meet your goals (which means you can be more spontaneous), and you can pay higher rates for valued services and/or be able to negotiate lower prices for supports and maybe stretch your funds further.

Cons: you will probably have to pay for stuff upfront at times and wait for reimbursement, you’ll need to keep good records and your receipts for years, and you will likely be audited at some stage.

3. PLAN-MANAGED

This offers pretty much the same advantages as self-managed, without the disadvantages, and the NDIS adds extra funds in your plan specifically to cover the cost of someone else to do the paperwork and pay providers for you – it’s a bit like having your own NDIS-funded accountant. Your NDIS funds are reimbursed directly to a Registered Plan Manager of your choice when they claim, who then pays the bills that you send them, or your providers can send the bills directly to the plan manager. You can use registered or unregistered providers to provide supports and services through a plan manager, but all plan managers are registered (you can’t use your own regular bookkeeper or accountant). The money to fund a plan manager is an added extra in the plan, and does not eat into your therapy or any other plan funds. Make sure to ask, if you choose a plan manager, that they have a system that lets you login and see all your claims anytime.

Pros: choose any provider or company to help meet your goals (which means you can be more spontaneous and flexible), you might be able to negotiate lower prices and maybe stretch your funds further, audit paperwork is taken care of by the plan manager, and you don’t have to worry about record keeping.

Cons: your plan manager might not pay your providers as quickly as they’d like (but they might – depends on the plan manager you choose).

4. A MIX

Plans can be part self-managed and part agency-managed, so, for example, you might want your capacity building therapy funds agency managed, but self-manage your consumables/continence supplies funds, so you can buy continence aids on sale and stretch your funds further.

How do you find a plan manager?

The NDIS website has a provider search function, which lists registered plan managers — I suggest you call a few and interview them BEFORE your planning meeting so you can tell your NDIS planner you want plan management and who you’ve chosen. When you interview these plan managers, ask them how long they take to pay bills, how flexible are they, and whether they have their own online system you can check into anytime to track your claims and balances.

— By Sam Paior, a disability advocate and consultant who founded and runs The Growing Space and provides support co-ordination for NDIS plans. For more info, visit thegrowingspace.com.au

WHY I CHOSE TO SELF-MANAGE MY DAUGHTER’S NDIS FUNDS

MIA Perrie has always been a happy child. She is caring and enjoys the company of others. But mother-of-three Peta knew from the beginning something was “not quite right” with her youngest child.

“She wasn’t meeting any of her milestones,” Ms Perrie, 42, says. “She wasn’t sleeping, gaining weight. She didn’t walk until her third birthday.”

Mia, now 10, was diagnosed with Angelman Syndrome – a rare neurological disorder affecting one in 20,000 children. The syndrome affects her speech, movement and balance, sleep and some people will experience seizures.

Mia is one of thousands of South Australian children who has been part of the NDIS trial since 2013. She receives speech therapy, uses speech software to communicate, takes part in children’s clubs that teach her how to be independent and takes part in the Rapidswim Aquatic Therapy, thanks to the disability scheme.

“Recently we have had a pool installed at home so I was really keen to start swimming lessons with Mia,” Ms Perrie, of Mile End, says. “I found Rapidswim’s Learn to Swim program but we’ve since realised that the Rapidswim Aquatic Therapy option that we started only a month ago is far better suited for Mia.

“It was important for me to find an opportunity for Mia to become familiar with water so that she could be more safe and we can soon enjoy family time together at home in the pool.”

Ms Perrie, who is a pharmacy assistant, decided to self-manage her daughter’s plan. She says it helps her maintain choice and control. She says she receives advice from other mums and Angelman Syndrome networks.

“You know what works best for your child and I am able to research, modify and change to ensure everything that Mia is doing is working toward her goals,” Ms Perrie says.

“The NDIS has been a good thing for our family and has given us the flexibility to trial different options like Rapidswim. We started with support from Mia’s speech therapist to manage our NDIS planning in the first year because to start with I was overwhelmed. But over that year I learnt a lot and realised it was relatively easy in our situation so we started to self-manage Mia’s plan.”

Harry’s chance at self expression

INNOVATIVE speech technologies help little Harry not only talk, but open up a world of literacy and friendships.

Kelly’s crusade goes beyond cross benches

SHE may not have been re-elected to Parliament in March, but after eight years Kelly Vincent still has plenty of wisdom to impart on life, the NDIS universe, and everything.