These stocks can help you start a share portfolio

The traditional rules around starting a share portfolio have changed, with former sure things tanking and new technologies opening up fresh ways to invest. Here’s what the experts say.

After a terrible December, sharemarkets have bounced back in early to mid January with the US market having its best start to a calendar year in 30 years.

That’s great news for Australian investors who will reap the benefits through their superannuation funds and general share portfolios.

Exposure to the sharemarket is a component to any wealth-building strategy. In the past we’ve written about the different options for first time investors to get into the markets — from managed funds and listed investment trusts through to exchange traded funds and private syndicates.

MORE: Lessons learnt from a life of investing

MORE: Kochie examines why the bitcoin bubble burst

But over the past couple of months we’ve received emails from parents and grandparents wanting guidance to put together a “first portfolio” for their adult children … and from 20-something young Australians wanting ideas for the type of stocks they should look at to form the foundation of their investment portfolio.

In essence, a portfolio on which they can build in the future.

It’s an interesting exercise. In the past the natural instincts would be to follow the traditional thinking around the big four banks, Telstra and major resource stocks like BHP and Rio. But business, technology and markets have dramatically changed over recent years and there are now a whole new range of diverse opportunities.

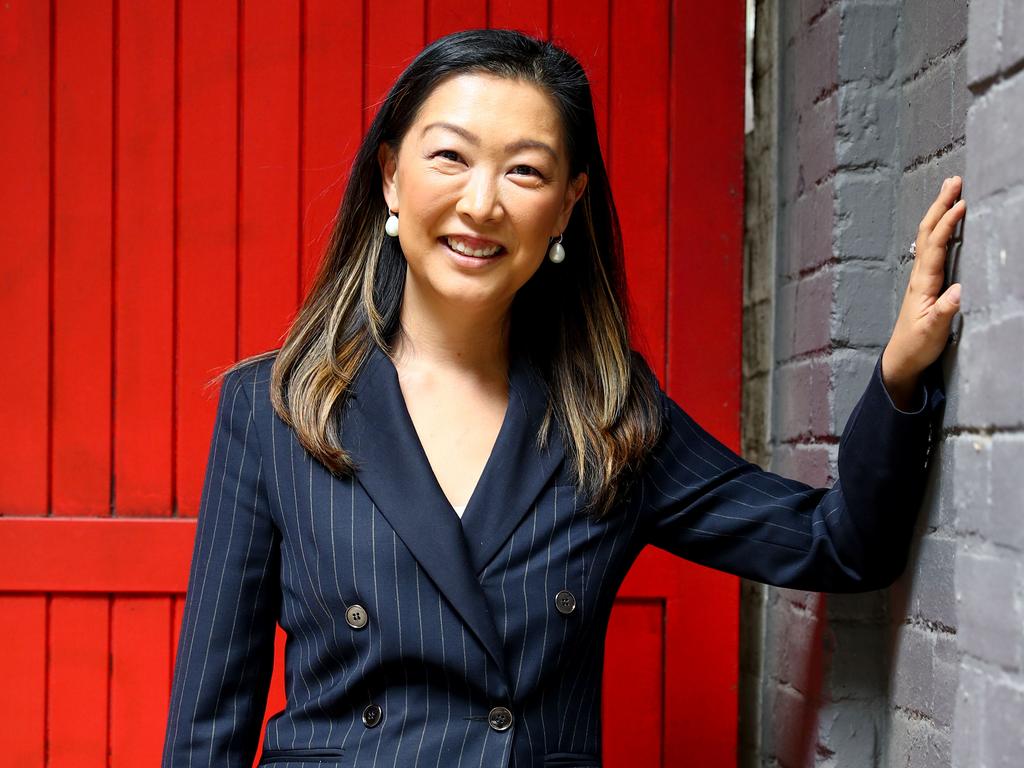

We put the challenge out to Bell Direct equities strategist Julia Lee and Lincoln Indicators executive director Elio D’Amato. Both warned that a “first portfolio” runs the risk of lacking diversity across industries and markets.

As a solution, Lee recommends investing in the iShares Global 100 ETF. “This ETF invests in 100 of the largest global stocks and yet is traded on the ASX,” she says. “It offers diversification at a low cost with the convenience of being traded on the ASX like an Australian listed company.”

D’Amato advises: “The other factor that will lead to long term success for those starting out is an ongoing commitment to topping up their investments periodically”.

“That is why superannuation offers a great opportunity for those gainfully employed to accumulate real wealth if they proactively manage their money.”

In terms of specific Australian stocks to form part of a first portfolio, Lee and D’Amato both suggest considering:

BHP

This company is a global energy, iron ore and copper mining giant.

“When the world grows, it consumes commodities, says Julia. “There will be ups, there will be downs as this stock is cyclical but if global growth is accelerating, this stock should as well.”

Appen

The business provides language technology data and services to government and companies around the world.

“The company tends to trade at high valuation multiples due to its solid track record of revenue growth, high margins, and longstanding relationships with its key customers,” says D’Amato.

CSL

It’s a health company with blood products at its core but also produces vaccines and antivenene.

“The world is getting older, health is a growing area,” says Lee. And $10,000 invested when the company floated in 1995 is worth $2.5 million today.

“This is one of the best at managing the life-cycle of a medical product and balancing that with its research and development.”

Macquarie Group

The diversified financial group is in 59 locations around the world and 60 per cent of its income is earned outside Australia.

“Often called the smartest guys in the room, Macquarie Group has a great track record of under-promising and over-delivering as well as reinventing itself as times change”, says Lee.

D’Amato says: “The company is well-capitalised and with a dividend of 4.5 per cent, younger investors may choose to reinvest the dividend to benefit from compounding returns”.

Afterpay

This fintech offers retailers a buy-now-pay-later facility to customers.

“Investing should be fun,” in Lee’s eyes. “I like Afterpay because the US has 300 million consumers, it is a much bigger market than Australia and Afterpay appears to be making impressive strides in the biggest market in the world.”

Hub24

The company delivers an award-winning investment platform, advisory licensing as well as data, reporting and software services to the Australian stockbroking and wealth management industry.

With the recent royal commission highlighting major conflicts between advisers and investment product manufacturers, the HUB offers an independent platform.

“The shift in wealth management towards innovative platforms continues with more advisers jumping on-board (+40% over last year) yet it still only commands a small proportion of the total market size giving more room to grow,” D’Amato says.

REA Group

The number one property classified business in Australia also has strong roots internationally

“Although there are concerns regarding the slowdown in the Australian property market, investors should note that REA's revenue is dependent on listing volumes and advertising yields rather than property prices,” says D’Amato. “Internationally the business is showing some green shoots and is leading several markets for site visits and time on site.”

Wisetech Global

This is a market-leading supply chain execution software company and 19 of the 20 largest global logistics service providers use its software.

“The investment thesis for WTC is driven by the need for manufacturers and distribution services to have more efficient warehouse, trade and transportation management systems, the pressure to reduce costs and maintain compliance with regulation,” according to D’Amato.

“The stock trades on a significant valuation multiple, but we believe this premium is justified given the company's market position, strong growth prospects, high proportion of recurring revenue, and intellectual property.”

Originally published as These stocks can help you start a share portfolio