Should you invest in bank shares after royal commission crunch?

The stockmarket welcomed the banking royal commission report with a surge in share prices for the big four banks. The big question is whether they are still worth buying.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

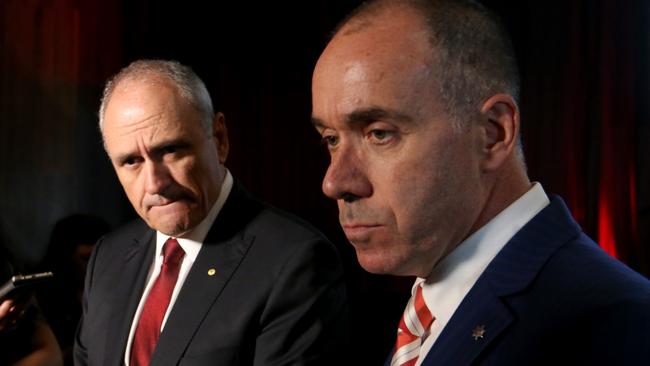

They were savaged by banking royal commissioner Kenneth Hayne in his final report handed down last week.

One of them, NAB, has lost its chairman and CEO who both are stepping down after copping especially harsh criticism from Mr Hayne over NAB’s response to a history of ripping off customers.

However, shares in Australia’s big four banks have been on a roll in recent days, climbing sharply as investors realised that the royal commission didn’t dish up anything that will severely dent their profits.

• Why you must think about tax now

• Royal commissioner’s stern words to bank bosses

Some analysts think Mr Hayne went too soft on them. Others think he had to be careful because Australia’s outlook is already uncertain amid a shaky economy and falling house prices.

So, for an investor, are the big banks now a buy, or a bye bye?

THE CASE FOR

The Commonwealth Bank, Westpac, ANZ and NAB are profit machines and the royal commission has done nothing to stop that.

Even after last week’s surge and strong share price rises since Christmas, banks are still trading at valuations well below their long-term history.

The Reserve Bank’s signal last week that interest rates may fall further will make banks and their big dividends even more attractive for people seeking yield. Why invest in bank deposits paying less than 2 per cent from cash in the bank when you can buy the bank itself and receive a dividend return of 6-7 per cent per cent a year?

There were no recommended changes to responsible lending laws in the royal commission’s report, which is good news for banks — and also for investors who have had the screws tightened on their borrowing activities in recent times.

THE CASE AGAINST

Investors buying banks now have missed the boat to some extent, compared with buying them back in December. It’s likely that bank share prices will trade sideways over the next year or two, and possibly fall.

The royal commission has called for tougher regulation and this will increase costs and put a lid on bank profits.

And there’s still a pile of economic uncertainty surrounding the banks. House price falls may continue, which will stop households spending, which will restrain growth. The global economy is looking wobbly too, and the US share market boom of recent times looks less likely to continue.

THE VERDICT

For long-term shareholders, many analysts believe banks still look like a solid investment. High dividends, huge profits and market dominance give them a solid future, but investors should expect some wild swings in price along the way. A good strategy may be to wait for the next dip, then buy then.

However, while some stockbrokers still think bank shares are undervalued, don’t expect them to boom any time soon.

And be prepared look past the royal commission revelations that they charged financial advice fees to dead people, charged fees without delivering any service and coldly forced people out of their homes.

BANK SHARES SINCE CHRISTMAS

• ANZ up 15 per cent

• Westpac up 13 per cent

• CBA up 9 per cent

• NAB up 6` per cent