No money for you! It’s a tough battle for borrowers

Getting a property loan was much easier back in the olden days of just 12 months ago. Now banks — stung by the royal commission — are cracking down hard on loan applicants.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

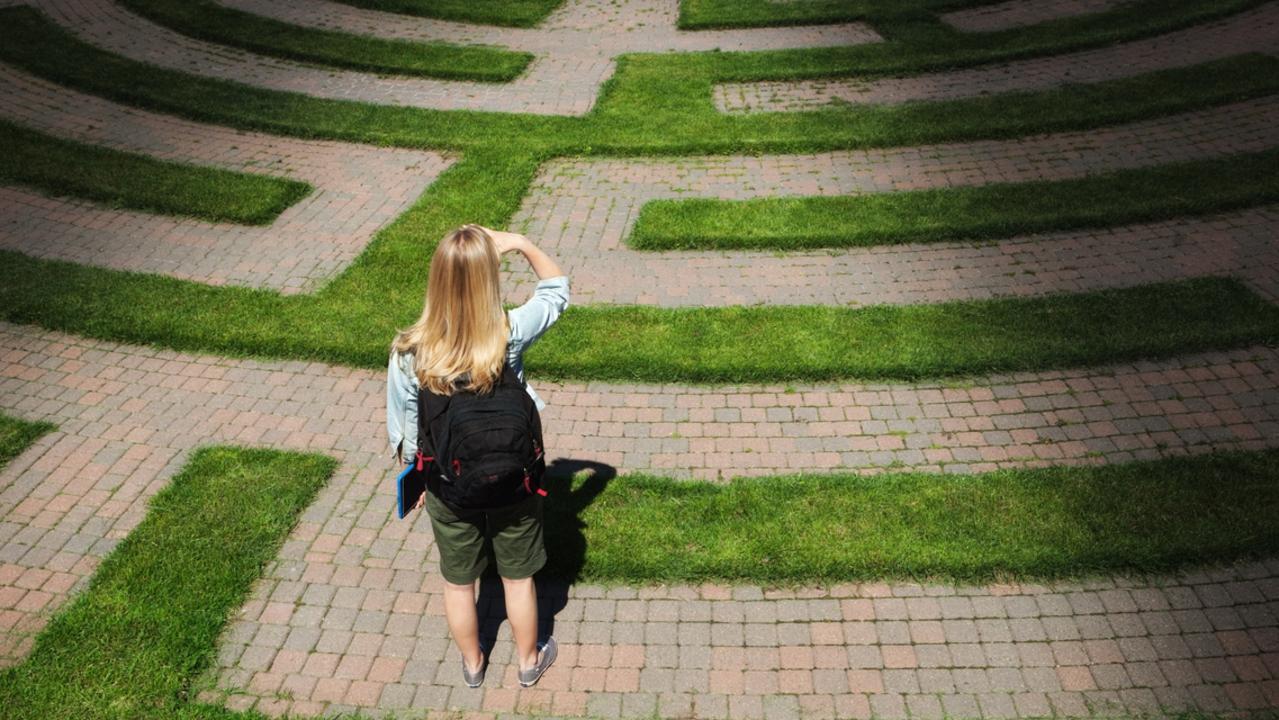

Property owners and investors wanting a new mortgage or to refinance their existing loan this year should prepare for a bruising encounter.

Many will feel like they’ve gone three rounds with Mike Tyson, some will feel like he’s bitten off their ear, while others will simply wave a white flag and give up.

Lenders have become super-conservative in the past 12 months and next week’s release of the banking royal commission’s final report looks likely to send them further into their shells.

Not even a perfect repayment record can save borrowers from being smacked around by punishing loan approvals processes.

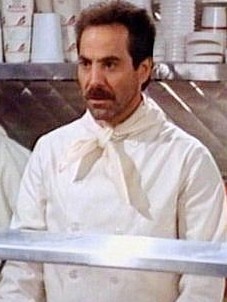

I recently tested the water with my long-term lender for a potential new property purchase, and felt like I was up against the infamous Soup Nazi from 1990s TV hit Seinfeld.

“No money for you!” was the blunt answer.

Investors looking to expand their property portfolios are being hardest hit. That’s because any existing loans they have are being assessed as if their repayments are at a much higher interest rate — 7 or 8 per cent — rather than the 4.5 per cent many are paying.

And if they’re paying interest only, which most investors should do for tax purposes if they also have an owner-occupier home loan, their repayments are assessed at the higher principal and interest levels.

Those two measures alone mean a lender probably assesses you to be paying thousands of dollars a year more than you actually are.

Lenders are also scouring people’s spending habits, right down to their Netflix accounts, gym memberships, coffees, lunches and lawn mowing.

One potential borrower who had low transport expenses was forced to show their bank that they walked to work, using Google Maps as evidence.

The Big Brother approach to bank borrowing could intensify this year if the royal commission report calls for more scrutiny of banks and their lending practices.

Spitting the dummy and switching to another lender is also going to be harder this year, because chances are they too will have the Mike Tyson-Soup Nazi approach to borrowers.

The best thing you can do to dodge the punches is to prepare well in advance if you’re planning to borrow.

Go through your latest bank statements and examine every small expense now. Try to cut some costs to free up cash flow.

Being able to show a regular habit of saving money will also help, so set up automatic deductions into a separate savings or investment account.

If you’re an investor with at least a couple of properties, it’s going to be tough to get past those tricky income assessments. Perhaps it may be time to look at other options, such as focusing more on your superannuation — which after all is still your money.

And don’t feel dejected if your bank makes you feel like a pauper after years of being a good customer. Most borrowers are copping the same punishment.

Anthony Keane is editor of Money Saver HQ, which appears in News Corp papers on Mondays.