Negative equity is likely to become more prominent in Australia

Negative equity is becoming a reality for some borrowers and it’s only going to get worse, the nation’s central bank has warned.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

Negative equity is a frightening situation that homeowners never want to face.

For those of you who are not sure what this means, it’s when the amount owing on a mortgage is bigger than the value of the property.

For years now borrowers in many capital cities including Sydney and Melbourne have revelled in soaring housing prices.

They’ve watched the value of their homes continues to go up and up while in many cases their mortgages have gotten smaller.

MORE: How this family slashed their mortgage rate in half

MORE: What potential tax changes mean for your hip pocket

But the nation’s central bank, the Reserve Bank of Australia, this month issued a stern warning to mortgage customers, informing them if the slide in the housing market continues it’s likely to impact them.

Nationally house prices have fallen by 7 per cent over the year to March.

But some of the hardest hit in recent years is in Perth where prices have fallen by 18 per cent and Darwin 27 per cent since their respective peaks in 2014.

That’s frightening stuff.

When I drive through some of Melbourne’s blue chip suburbs including Brighton, Albert Park and Toorak, it often crosses my mind how people afford such palatial homes.

Old wealth perhaps, or high-paying jobs.

Or maybe they’re just the average Joe who is hooked up to their eyeballs in debt.

I often wonder how many homes have a mortgage and for those who do have one how fat is it?

The RBA said its in biannual financial stability review this month that it’s an unusual economic time in Australia and globally, “for property prices to be falling while interest rates and unemployment are low.”

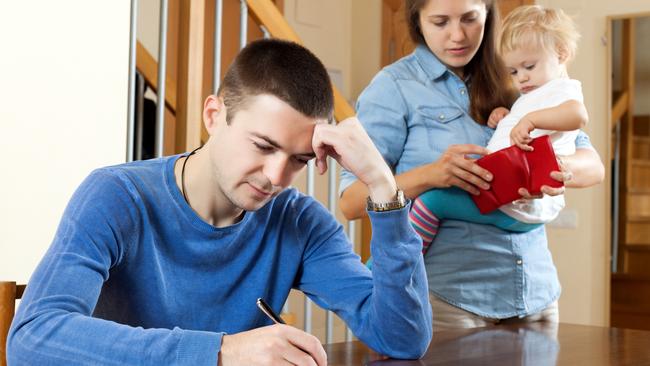

Borrowers need to get smart and try as hard as they can to get ahead on their loans while interest rates are at record lows.

Owner occupiers can easily snare a mortgage rate starting with a “3” and if they not they’re only hurting themselves.

For a borrower with a $300,000 30-year home loan, if they get a good rate of 3.8 per cent and pump an extra $200 a month into the loan the difference they can make is mammoth.

The borrower could shave six years and 3 months off their loan and save a huge $47,000 in interest charges off their loan.

If you can’t chuck this much extra on your loan try for a smaller amount, every extra cent counts.

When I signed up to my first mortgage back in 2012 I felt like I was treading water, the amount owing wasn’t going anywhere.

But I was able to tip in a bit more money and the difference it made was noticeable.

Here’s fact from the RBA that also needs to be taken notice of: nearly 30 per cent of home loans have little or no buffer.

Now this may well be fixed loans where buffers are usually not permitted or for those paying interest-only and perhaps keeping excess cash elsewhere.

But whatever the case may be if you’re an owner occupier with a home loan now’s the time to make some serious headway into your loan because one things for sure, rates won’t stay this low forever.

Originally published as Negative equity is likely to become more prominent in Australia