Experts share their buy, hold and sell tips amid stockmarket turmoil

This week our Share Tips columnists have chosen large, quality companies as turmoil strikes Aussie and global stockmarkets.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

It’s a tough job analysing share prices and company performance, especially in the middle of a sharp share market downturn, but somebody’s got to do it.

As Aussie, US and other global stock markets sink, this week our share tips columnists have focused their buy recommendations on big companies, with proven track records, and largely operating in the resources sector.

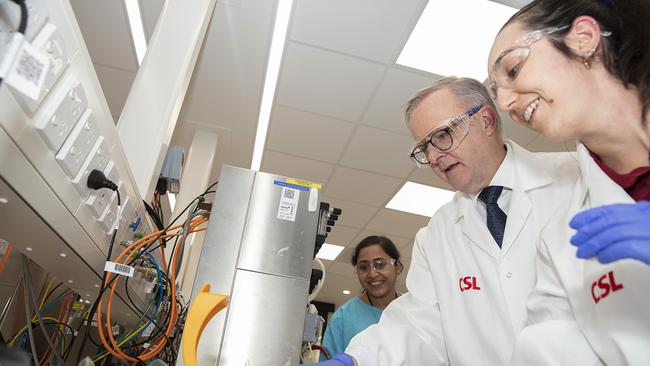

Health and biotech giant CSL also got a mention for offering value after its shares have slumped 20 per cent in the past nine months. CSL shares are trading below where they were five years ago, but since 2010 they have still climbed more than eight-fold in value.

If the current share market slump deepens, we can expect more broker “buy” recommendations as good companies dip into good-value territory.

Shaw & Partners senior investment adviser Jed Richards

BUY

BHP

BHP demonstrates strong financial performance with consistent dividends and a diversified portfolio in commodities like copper, iron ore, and coal. With iron ore prices exceeding expectations and export volumes at record highs, the company is well-positioned for continued growth. The low share price makes BHP a compelling buy recommendation

CSL

CSL presents an excellent buy recommendation due to its current low share price and strong double-digit growth potential. With consistent revenue increases and robust performance in its plasma and vaccine divisions, CSL is a global leader and is well-positioned for long-term growth.

HOLD

Polynovo (PNV)

Polynovo is now a healthcare supplier rather than a biotech innovation company. The Novosorb product is the world leading treatment for burns and global sales continue to grow monthly. Recently, the shares have fallen due to senior executive and board member disruption. The lack of unity and staff changes deter investors from supporting the stock. Once the management issues are solved, we expect sales to grow more than 30 per cent per annum. Hold as they navigate the refreshed management.

Treasury Wine Estates (TWE)

Treasury Wine Estates faces challenges such as declining earnings per share and unstable dividends. Excess Australian wine is still an issue but storage volumes are slowly reducing. However, its luxury wine segment, including Penfolds, shows resilience, offering potential for long-term growth. Hold as the share price is now excessively low.

SELL

Qantas (QAN)

Qantas share price has both recovered and exceeded the pre-covid 2019 share price by more than 23 per cent. Our view is that investor enthusiasm is excessive. With the current global conflicts and geopolitical uncertainty, travel numbers could reduce. The share price is unlikely to be sustained as it is now above most price analyst targets. Sell and lock in gains.

Elders (ELD)

Elders faces challenges in Australian agriculture, including high capital expenditure, rising land prices, and drought conditions. Historically, management has struggled to deliver shareholder value, making it a sell consideration for investors.

Equity Trustees head of equities Chris Haynes:

BUY

Santos (STO)

Santos engages in the exploration, development, transportation, and marketing of natural gas in Australia, Papua New Guinea, and Alaska. Over the next 12-24 months STO will complete projects in Alaska and Australia which will provide very strong free cash flow growth. This growing cash flow does not appear to be factored into the current share price.

Orica (ORI)

The company is the global leader in manufacturing and distribution of commercial explosives and blasting systems to the mining and infrastructure markets. There is strong growth in both the Australian and US markets across the mineral spectrum, including gold. Investment in technology and systems and the repricing of some end products sees very good growth in earnings over the near term. Not a fashionable business but absolutely vital to mining and trading cheaply with a solid yield of 3.5 per cent.

HOLD

Northern Star (NST)

This major gold producer has operations in Australia and North America. Its share price has run very hard tracking the rise of the gold price, and the recent result was also excellent. Northern Star is currently in the process of acquiring De Grey Mining and this should result in some indigestion and potentially a pullback in the share price.

Life360 (360)

Life360 sells and distributes location-sharing mobile applications globally (similar to find a friend on Apple phones but better). It has more than 80m active users. The 2024 result showed revenue growing at 22 per cent with profit insignificant still. The business model continues to evolve and there is some uncertainty around how it monetises its user base over the next 24 months.

SELL

Reece (REH)

Reece supplies plumbing, bathroom, heating, ventilation, airconditioning, waterworks and refrigeration products to customers in the trade, retail and commercial markets. It stepped out to the US some years ago but that is not working too well. In the recent result, earnings were down 19 per cent with the US being the key negative. Even though the price has fallen 30 per cent this year, the stock remains expensive on 28 times earnings.

Netwealth (NWL)

Netwealth is one of the best wealth management platforms for financial advisers in Australia. With a very full valuation of 56 times FY2025 earnings and a market correction, it is not too late to take some profits.

More Coverage

Originally published as Experts share their buy, hold and sell tips amid stockmarket turmoil