Property owners object to valuations, and more complaints are expected under revaluation project

MORE than 2600 people objected to their property valuations in the past financial year, resulting in nearly half of them having the house value reduced.

MORE than 2600 people objected to their property valuations in the past financial year, resulting in nearly half of them having the house value reduced.

But complaints are expected to significantly rise as a result of a controversial statewide revaluation project that critics say could rapidly increase CBD property values, cripple the state’s property sector and hurt mum-and-dad investors.

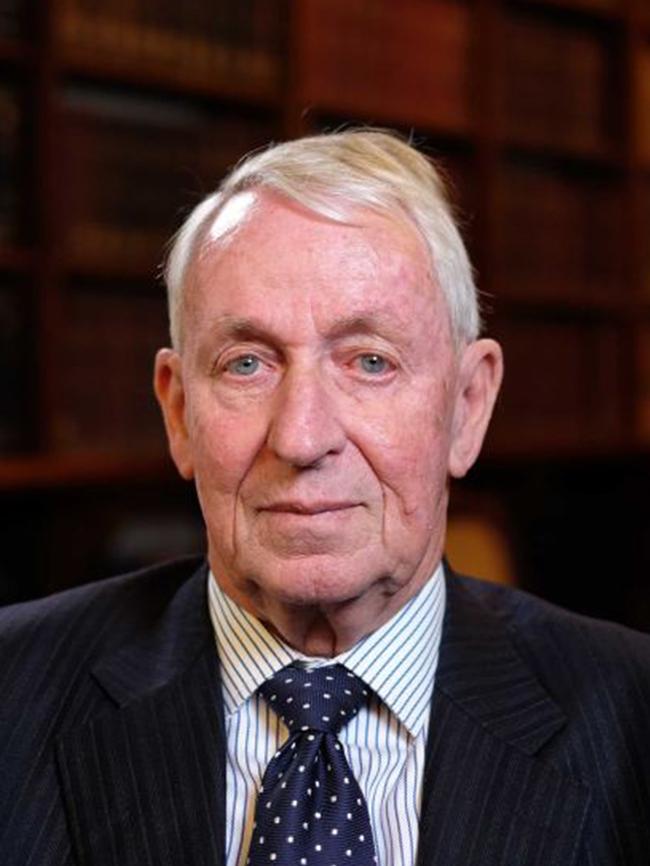

The figures obtained through Freedom of Information laws by Upper House MP John Darley reveal that for the 2017-18 financial year, 2612 objections were lodged with the Office of the Valuer-General. Of these objections, 1240 were successful, including 651 who had their valuations slashed by more than $50,000.

Land tax, council rates and SA Water sewerage costs are all pegged against property values set by the Valuer-General.

Mr Darley, himself a former Valuer-General, told The Advertiser he was surprised that only 2600 people had applied for a revaluation of their properties.

But he warned it was the calm before a coming storm, as a five-year rolling revaluation project by the Valuer-General kicks in.

The project, which is now under way, is based on applying “market values” over the five-year period, which Mr Darley said would unfairly hurt those whose properties were evaluated first.

“That’s why we ditched that system in 1979,” Mr Darley said.

In the State Budget on Tuesday, the revaluation project was predicted to increase underlying land tax revenue by about $19 million by 2021-22.

Property Council SA executive director Daniel Gannon said unless land tax was brought down — or the project was put on hold — these rises could “cripple” the state’s property sector.

“If valuations significantly rise and land tax at the top end stays high, the property sector could fall to its knees,” he said.

From July 1, 2020, the State Government will increase the land tax-free threshold to $450,000, up from the current level of $369,000, and has also flagged a new top tier rate of 2.9 per cent for property worth between $1.2 million and $5 million, down from 3.7 per cent.

Mr Gannon said despite this, investors through super funds could still be seriously hurt if property valuations significantly rose and there was not reforms to land tax.

The Advertiser contacted Treasury, which the Office of the Valuer-General now falls under, for comment.